SMSF Administration Services

SMSF Accounting + SMSF Tax Returns

SMSF Audit Services

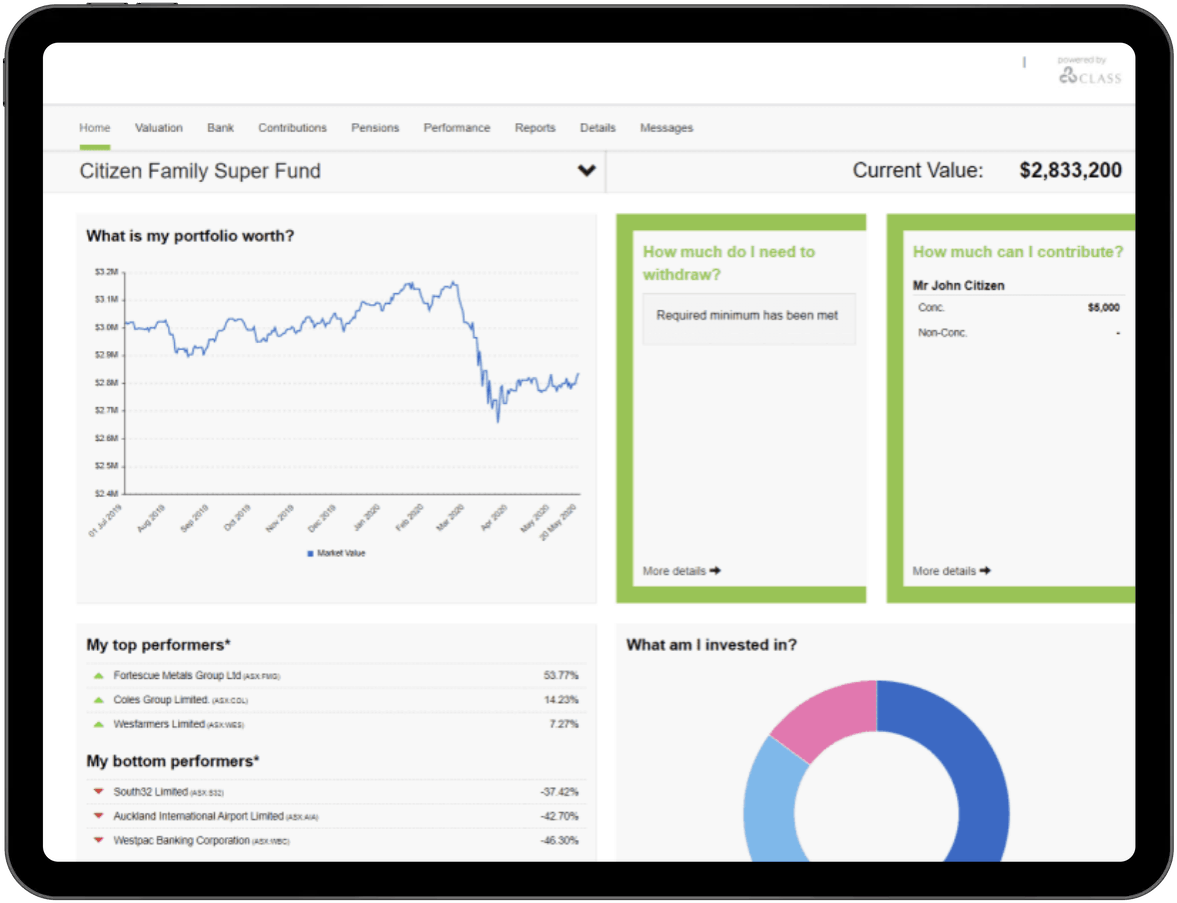

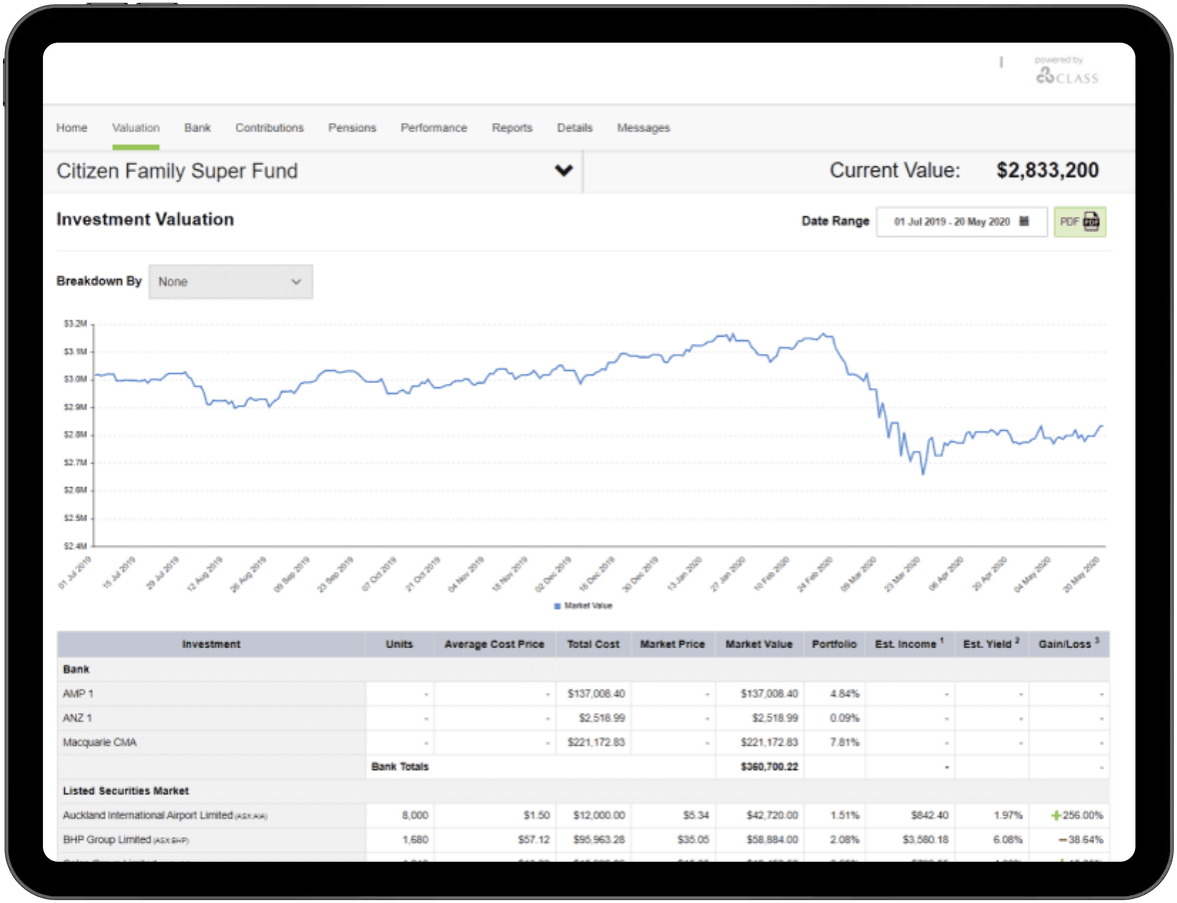

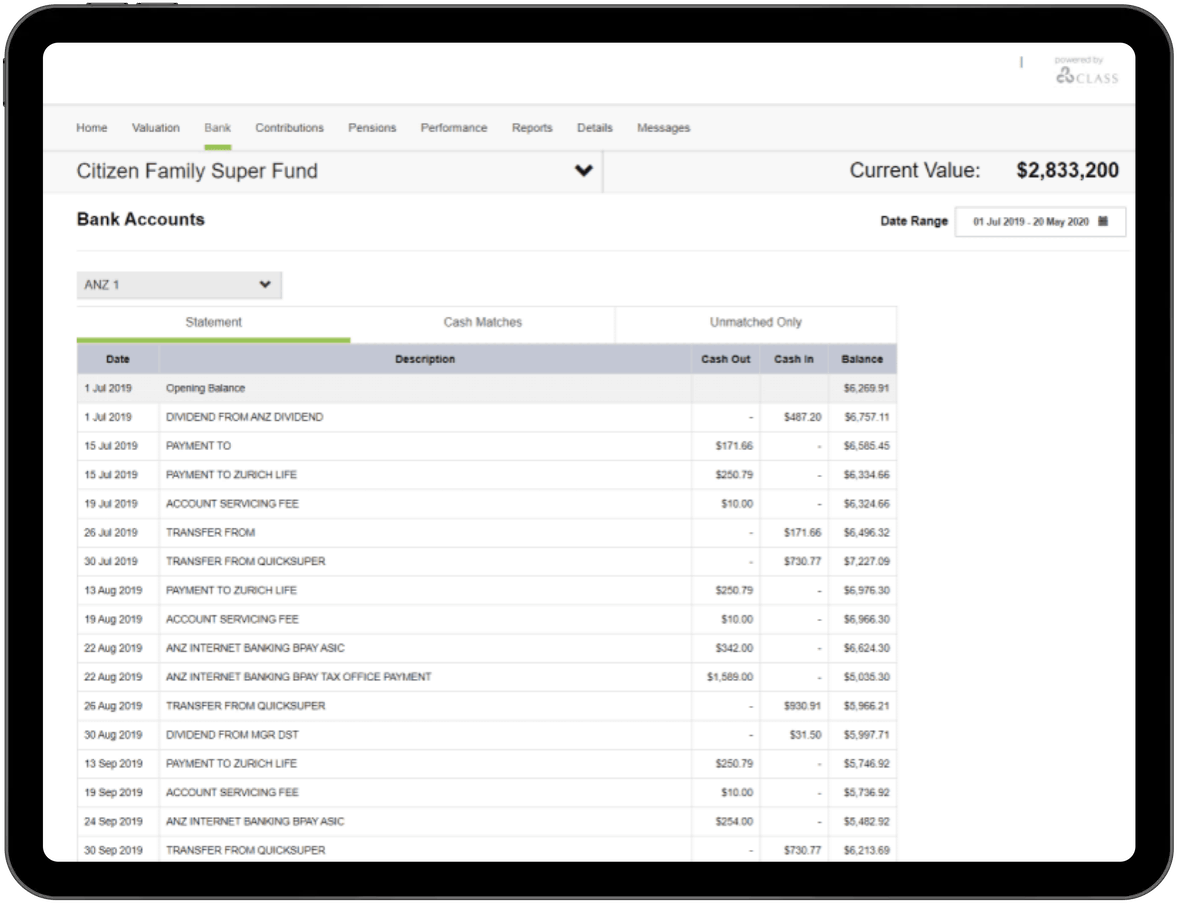

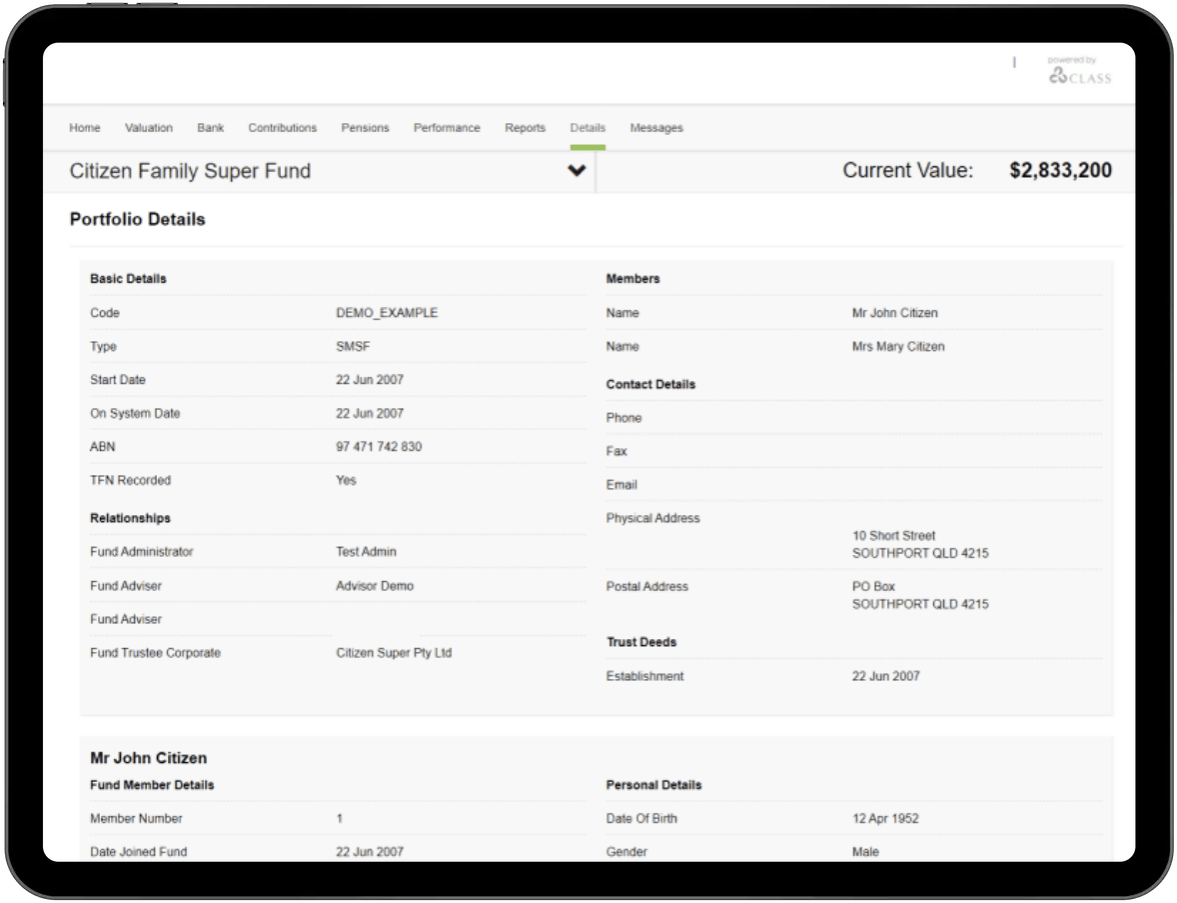

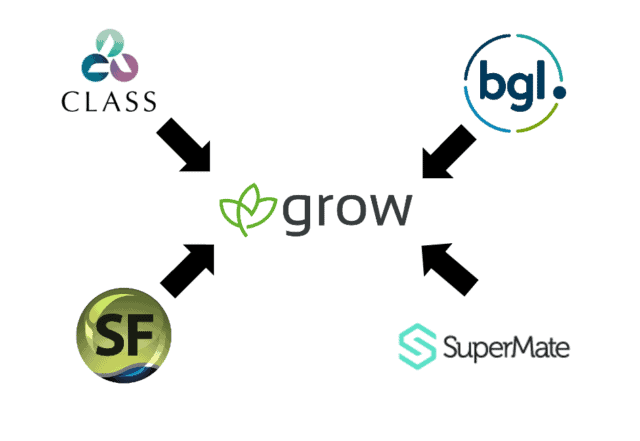

SMSF administration for trustees.

SMSF accountants providing comprehensive self managed super fund administration and compliance advice services.

Why work with Grow as your

SMSF accountant?

SMSF administration

letting you focus on the more important things!

As an SMSF accountant I’ve gained not just strong technical knowledge on self managed super funds, but also a solid understanding of what those of us with an SMSF want. We want the freedom, transparency and control of a self managed fund, but we also want to reduce the compliance burden (both actual and perceived) that can sometimes come with an SMSF. I’ve designed the Grow SMSF administration solution based on that principal: We handle the compliance so you can focus on the important. Grow your wealth. Grow your lifestyle. Grow your legacy. Kris Kitto Founder & Director | Grow SMSF Pty Ltd

SMSF administration

to make looking after your self managed super fund easy

Let's talk.

Book a call or meeting.

Taking the first step can be hard. Let’s make it easy!

Arrange a phone call, Zoom or Google Hangouts chat to discuss how me and Grow can help you with your SMSF. When deciding on someone to looks after your SMSF administration, having a conversation with a real human is the best way to start.

A quick chat to ask a question or learn more.

More detailed chat to dive deeper into SMSFs.