A key drawback with an SMSF are the unavoidable costs involved. Is it possible to setup and operate an SMSF with friends to share the cost and bring a self managed super fund and all that control within reach? Yes – it’s possible and with the number of members allowed in an SMSF likely to increase from four to six, it could become even more affordable for those willing to self-manage with mates and join a “shared SMSF”.

Many younger Australians will move into a share house before either renting or buying a place of their own. This enables them live in a more conveniently located and desirable location than they likely could afford by themselves. A shared SMSF with friends works on the same concept: Putting something financially within reach that may not otherwise be.

Navigate to Key Sections

Fees

Self managed super fund fees are an unavoidable. Fees an SMSF must pay each year include:

- Accounting / administration fees

- Independent audit fee

- ATO SMSF Levy ($259 per year paid when the SMSF lodges its tax return)

- ASIC Annual Registration fee for the SMSF trustee company ($56 per year)

According to the ATO the average (median) SMSF costs and fees are $3,934 per annum although in some cases it could be half or even one-third the amount.

How a ‘shared SMSF’ could reduce SMSF fees

The table below compares a basic self managed super fund with all members in the accumulation phase, where the only investments held are cash and listed Australian or US shares.

The ASIC fee means a trustee company is used, and all SMSFs pay the ATO levy. The SMSF administration fee includes the accounting and independent audit. The segregation fee is the additional fee to account for the separate or ‘segregated’ accounts and investments of unrelated members of the SMSF (more on this below).

| No. Members | ASIC | ATO Levy | SMSF Administration | Segregation Fees | Total Annual Fees | Fees Per Member |

| 1 | $ 63 | $ 259 | $ 1,375 | $ – | $ 1,697 | $ 1,697.00 |

| 2 | $ 63 | $ 259 | $ 1,375 | $ 330 | $ 2,027 | $ 1,013.50 |

| 3 | $ 63 | $ 259 | $ 1,375 | $ 660 | $ 2,357 | $ 785..67 |

| 4 | $ 63 | $ 259 | $ 1,375 | $ 990 | $ 2,687 | $ 671.75 |

| 5 | $ 63 | $ 259 | $ 1,375 | $ 1,320 | $ 3,017 | $ 603.40 |

| 6 | $ 63 | $ 259 | $ 1,375 | $ 1,650 | $ 3,347 | $ 557.83 |

Based on the above, you can quickly see the difference adding additional members makes to the fees incurred per member. This is the key benefit of setting up and running an SMSF with friends and is somewhat obvious – but what are the drawbacks?

Risks when running an SMSF with friends

The reasons people set up an SMSF are clear:

- Control (both actual and perceived control);

- Choice of investments (the ability to make specific investments / buy particular stocks)

- Direct ownership (legal and/or beneficial ownership in the name of your SMSF)

Another way of looking at it is that people believe that by taking control of their superannuation investments, they can generate better returns as they’re looking after their interests first and foremost.

But all this control comes with responsibility and the more members who are added to the SMSF, the greater the chances that something will go wrong that will not just impact that member, but could seriously and permanently impact all members of the fund. This is because an SMSF requires all members to be a trustee (or directors of the SMSF trustee company), and the trustee is responsible for complying with the myriad of superannuation and tax rules applicable to SMSFs.

Penalties, disqualifications, fines and imprisonment

The primary danger when you have an SMSF with friends is that one of these super friends commits a serious breach, such as illegal early access or lending SMSF money to members or relatives. Breaches of this type are serious, and the applicable penalty (from 1 July 2023) is $18,780. This amount is either payable personally by every trustee (where the SMSF has individual trustees) or a single penalty is payable where a company trustee is used and all directors are jointly liable for the penalty.

In addition, the ATO could take actions including:

- Banning all trustees (even those not involved in the breach) from being trustees of an SMSF permanently;

- Removing the funds ‘complying’ status means there could be serious adverse tax consequences

Although the above measures are rarely applied, they’re not unheard of and the ATO is permanently banning people from being involved in SMSFs more often in recent years. You don’t want to be banned in say your twenties and never have the opportunity to be part of an SMSF in the future. In addition, the disqualification from being a trustee of an SMSF is published in a Government gazette and will show high in the search results when anyone searches your name – including potential employers or business associates.

So, what can you do to avoid these serious downsides of running an SMSF with friends?

Liquidity issues

When a member wants to leave a joint SMSF, regardless of whether the SMSF is run on a pooled or segregated basis, there needs to be cash available to transfer their benefits to an APRA (industry or retail) super fund of their choice. This is easy to accommodate when the SMSF is investing in liquid assets such as shares or ETFs, but can be problematic if the SMSF has invested in property or other illiquid assets.

SMSF company trustee essential

One of the certainties when setting up an SMSF with friends is that it’s guaranteed that sometime in the future (much like a shared house), someone will move out.

Using a special purpose company as trustee of the SMSF will add a little extra in setup costs ( + $605, for example), but it will massively reduce the work and costs when members are added and removed from the SMSF. With a company trustee, all investments and accounts must be in the name of the trustee (i.e. the company) on behalf of the SMSF.

By comparison, when individual trustees are used when the membership changes, so do the trustees. Therefore, all the accounts and investments need to be swapped over to the name of the new trustees. To get an idea of the work involved in switching trustees, you can read this article: Changing SMSF trustees

In addition to the administrative benefits of a company trustee, as described above in the worst-case scenario of fines and penalties being applied by the ATO, when a company trustee is used, there will only be one single penalty per breach – not up to 4 (or even 6) individual penalties.

If the above two reasons are not enough, the following article covers the reasons for an SMSF trustee company in more detail: Corporate trustee vs. individual trustees for SMSFs

Shared SMSF, separate investments

Just because you’ve set up an SMSF with friends to share costs doesn’t mean you share the same investments. Your super shared house has multiple bedrooms!

A shared SMSF needs to implement “segregated SMSF accounts”. Segregated SMSF accounts can best be described as ‘sub-accounts’ within a self-managed super fund where each member has their separate accounts and investments rather than having everything ‘pooled’ together with other fund members. Segregated accounts are uncommon because 93% of SMSFs have either one or two members and most with two members are couples so having all investments (and the subsequent returns on those investments) grouped together and shared is appropriate.

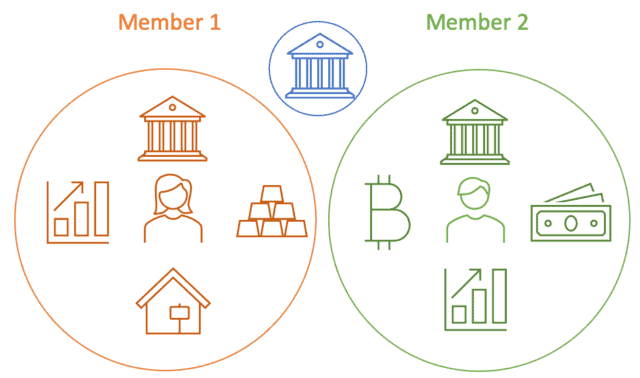

The following diagram illustrates what segregated SMSF accounts look like with two members, however, it can also be applied to an SMSF with three, four or even five or six members (if the membership limit is bumped up from four to six members):

The key benefit of using segregated accounts when running an SMSF with friends is that the investment performance and decision of any single member (both good and bad performance) don’t impact other members of the SMSF. Each member is responsible for their own investments, and the value of their benefits in the SMSF at any one time is the sum value of their investments less any tax liability.

For more information on how segregated SMSF accounts work, visit the following article: Segregated SMSF accounts

SMSF with friends – making it work

So if I was going to set up an SMSF with friends, how would I make it work? The following are my opinions based on close to two decades of providing advice and assistance to thousands of SMSF trustees and their advisers (please note this should not be considered personalised advice and like all content on this website and social media channels refer to the Grow SMSF advice disclaimer).

Leading member

Sometimes in a share house situation, there will be one individual who takes the lead and makes everything happen. They sign the lease and take responsibility for the property and ensuring the rent is paid and the place isn’t trashed.

A shared SMSF needs the same thing: One person who takes the lead and is involved in all decisions and although they work collaboratively with the other trustees, they have additional veto power. They are the person who breaks a deadlock where the votes between the directors of the company trustee are split 50/50.

The leading member may also need to be the person who rallies the other members / director of the company trustee to remove a member from the fund where their membership is no longer appropriate. For example of that member becomes a disqualified person (for example they become bankrupt).

The leading member is also the person who will likely stay in the SMSF in perpetuity when other members build high enough balances to justify their own SMSF with just themselves (or their partner / spouse) as members.

Investment restrictions

SMSFs are about choice. Although it seems counter-intuitive to restrict the investments a shared SMSF setup by a group of friends can make, its actually a very practical idea. By restricting investments the costs can be kept under control and there is less risk to other members.

For example if one member wants to enter a borrowing arrangement to obtain a loan to purchase property, they cannot do it by themselves and chances the other members wouldn’t want to sign personal guarantees of be in a situation where they need to pay the loan if the tenant can’t. Property itself should be a no-go investment for an SMSF with friends as property typically needs to be held for a long period to realise the benefits of capital growth, and the concept of a shared SMSF lends itself to being a stepping stone until the various members build their super balances enough to justify their own SMSF.

Cash control

Because the greatest threat to a shared SMSF is one member illegal lender money to themselves or withdrawing funds illegally, having tight controls over the SMSFs cash is essential.

A SMSF with friends should be setup with one central bank accounts for the fund which would be used for:

- Receiving rollovers from external super funds when a member enters the SMSF;

- Paying rollovers to external super funds when a member leaves the SMSF;

- Be the ONLY account of the SMSF where money can be transferred to any external account (i.e. it is the ‘gatekeeper’ account);

- Receive periodic amounts from the sub-accounts / other segregated bank accounts from each member to pay taxes, fees and any shared fund expenses;

- Receive any tax refunds;

If for example a shared SMSF had four members, it would have five bank accounts: One of each member and one shared account for the fund.

The leading member (as described above) would be a signatory on the shared bank account above, however each of the other four bank accounts for each member would only be able to be used for approved investment purposes – i.e. to settle buys and sells of their investments. Any one member would NOT have the ability to transfer money to an account external to the SMSF, the only linked account would be the central ‘gatekeeper’ bank account requiring the approval and authority of the leading member to transfer funds externally.

This tight cash flow restriction again seems counter-intuitive in SMSF land, however it protects all members as no one member can get their hands in the cookie jar.

Contributions and insurances

The trustee may also decide that the shared SMSF may not accept contributions or not hold insurances for members.

With a segregated SMSF its definitely possible for contributions as well as insurances to be accommodated, however some members may find it beneficial to retain their existing industry or retail super fund account to receive their employer contributions and for the (albeit sometimes very basic) group life and disability insurances available via a larger superannuation fund.

Tight administration

From an accounting and administration perspective, correctly operating a segregated SMSF with up to 6 unrelated members is in many ways more difficult than looking after a typical SMSF where there are one or two members and everything is pooled.

The additional complexity around things such as determining what member is liable for what portion of tax (both annually come tax time as well as with quarterly tax installments) doesn’t align to how a typical SMSF is administered by accountants and in some ways shares more with the larger APRA regulated funds that have thousands of members.

A correctly structured SMSF with friends arrangement is probably not something a generalist non-SMSF accountant could handle. A specialist SMSF accountant or administration using the right software is definitely needed.

It’s also important to consider that some of the above recommendations would require a very specific type of SMSF trust deed and to my knowledge, at the time of writing, although some good quality SMSF trust deeds may cater for some of the nuances required for a shared SMSF, no deed has specifically been drafted for an SMSF which has up to six unrelated parties.

Digital by default

The more people involved in a self managed super fund, the more practically challenging it becomes to manage common processes like signing trustee resolutions or getting the annual accounts signed off. A SMSF with friends needs to be completely digital from day one: Electronic signatures for all documentation including SMSF trust deeds, minutes, resolutions and of course the annual accounts and tax return of the fund.

Trust: Essential for an SMSF with friends

90% or more self-managed super funds are either run by a single member or two members who are likely each others spouse. Their interests are aligned and chances are (except for acrimonious relationship breakdowns) in most cases there is implicit trust and alignment of outcomes between the members.

A shared SMSF with friends is a lot more financially risky than a share house where you may loose your bond – it could scuttle a significant chunk of your retirement savings.

For this reason the only people invited into your shared SMSF should be people where there is a deep level of trust and alignment of goals. All members will have visibility over all the investments, returns and losses made by all other members, so all members need to be comfortable with that level of transparency.

Even if you think you know someone and trust them, how they handle their personal finances is something many people keep very close to their chest. How do you know your fellow SMSF member isn’t drowning in personal debit or has poor money habits or even serious gambling or drug habits. Should any potential member of your shared SMSF be willing to provide a credit check? Is this even practical or feasible?

An SMSF is about trust. Regardless of the controls and structures you can put in place with a shared SMSF, if you can’t trust someone they shouldn’t be in your SMSF!

Summary

When looking at whether a shared SMSF with friends might be suitable for your situation, the following summary will assist.

| Advantages | Disadvantages |

| Cost Savings

By sharing unavoidable costs across 4 or more people the annual cost of having an SMSF can reduce to less than $500 per individual. In many cases this is the same or lower than pseudo SMSF offerings provided by industry super funds (member directed options). |

Fines and Penalties

The more people in an SMSF the higher the chances on member will cause a compliance breach and the other members / directors will be jointly and severely liable for penalties of $18,780 per offense. These fines are personally payable by the directors of the trustee company. |

| Investment Control

An SMSF provides unrivaled investment choice across many asset classes not available via any other structure. |

Potential Complexity The wider the variety of investments the SMSF allows its members to invest in, the higher the ongoing fees and more administratively heavy the SMSF may become. |

| Transparency

Direct legal ownership of most assets in the name of the SMSF with few restrictions on how much can be invested into any one asset class or specific investment. Complete clarity on exactly what is owned and granular control over taxation aspect. |

Privacy

Each member of an SMSF can see all investments of the fund including those segregated or separated for other members. |

| Segregation Possible

Although in the same fund, each individual member can have ‘ownership’ and control over their own pool of accounts and investments. |

Single Return

Even though an SMSF can run separate investments under a segregated accounting method, the SMSF still only lodges one tax return so in some cases capital losses from one member might be gobbled up by gains of another member within the fund. |

| Common Goals

Assuming members within a shared SMSF have similar goals and are a similar life stage (wealth accumulation) there will be a level of comradery between members. There is an opportunity to share investment ideas and learnings and members will benefit from the collective wisdom within their SMSF. |

Exit Time

There will of course be a time in a shared SMSF where some members will need to exit. A shared SMSF is a stepping stone arrangement for those who want control without the costs until it becomes feasible to have their own fund. |

| Residency

A shared SMSF when structured correctly may enable members who move overseas and become non-residents from remaining members of the fund where the majority of benefits held are still by active Australian resident members. |

Management Complexity

Potential for one or two tardy members to cause issues with the administration of the fund where they don’t sign documents or provide information in a timely fashion. Mitigated somewhat by the fact a minimum of two directors must sign the SMSF accounts (s35b) however some documents and declarations need all members / directors to sign. |

There are alternatives to setting up an SMSF with unrelated parties. Some of the newer super wrap account providers enable direct purchase of both Australian and international equities, and some industry funds have ‘member direct’ options where individual Australian shares and ETFs can be purchased. To investigate these options you should always speak to an appropriately licensed financial adviser.

So would you set up an SMSF with friends to get yourself onto the self-managed super ladder?

If you have any questions or would like to know more, please get in touch.

Other content you may like

- How to set up an SMSF

- Stake SMSF – buy US stocks using your superannuation

- How much is needed to set up an SMSF

- Is it time to set up an SMSF

One comment

Rajiv Shukla

March 27, 2024 at 10:04 pm

Nice content on Self managed super funds, Explained in details. Nice information!