Every self-managed superannuation fund needs a bank account. So which is the best SMSF bank account?

Important: This opinion piece should be read together with our Advice Disclaimer. The information contained within this article is my opinion as an SMSF trustee and factual information only. This article should not be considered a financial product recommendation. Readers need to research and decide on the best SMSF bank account for their needs.

Macquarie Bank: NOT CRYPTO FRIENDLY

UPDATED: 11/11/2024

In late October 2024, Macquarie started to block all transfers to all known Australian cryptocurrency platforms and exchanges.

They’ve blocked the specific BSBs. There is no way around this.

If you plan to invest a portion of your SMSF money in cryptocurrency, DO NOT USE MACQUARIE BANK.

The following support article contains an up-to-date list of all the BSBs from common Australian-based cryptocurrency platforms that Macquarie has blocked:

https://support.growsmsf.com.au/en/articles/10093722-macquarie-blocked-bsbs

If the above doesn’t apply to you, please read on…

Considerations when looking for the best SMSF bank account

A self-managed super fund needs a bank account purposely designed for SMSFs. The needs of an SMSF and those who work with them are different compared to a personal transaction account or a business account.

It’s also important to understand that an SMSF isn’t restricted to one bank account; it can have multiple bank accounts for different purposes (i.e. regular income and expenses, savings and investing / trading).

Best SMSF bank account: Macquarie CMA?

The Macquarie Cash Management Account, in my opinion, as a trustee of an SMSF, is the best SMSF bank account available for self-managed super funds.

Some of the key features that make Macquarie a winner for me include the following:

- Easy online set-up;

- Fast inward transfers (deposits) on the New Payments Platform (OSKO/SCT)*;

- No monthly account fees;

- No adviser commissions (or commissions rebated);

- Links with the stockbroking and investment platforms;

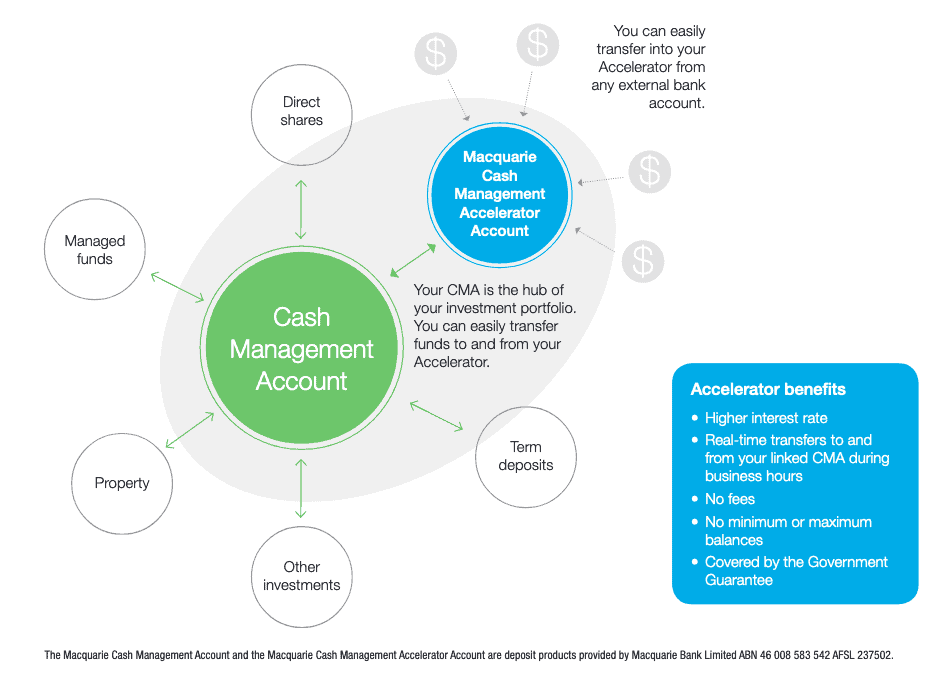

- Optional linked high-interest Accelerator Account**;

- Easy to set up term deposits;

- Seamless integration with SMSF accounting software;

- Reliable data feeds;

- Great accountant and adviser read-only access (under the control of the SMSF trustees);

- Great Macquarie mobile banking app;

- MFA / 2FA using the Macquarie Authenticator App;

- Daily transfer limit of $100,000 using the Macquarie Authenticator App;

- Adviser Initiated Payments (AIP) of up to $500,000 per day;

- Australian customer support and call centres;

*Fast outward transfers on the NPP have been enabled since July 2023.

**There previously was a requirement for an advisor/accountant to be attached to the account to get the linked Accelerator Account. This is no longer true for NEW applications; however still applies to existing CMAs.

Most popular SMSF bank account

According to data from Macquarie themselves and data from the ATO, 1 in 3 SMSFs use the Macquarie CMA.

That is approximately 200,000 SMSFs across the country using the Macquarie CMA. This is unsurprising as Macquarie has always worked closely with intermediaries such as accountants, financial advisers and stockbrokers. These professionals historically have determined what bank account an SMSF trustee should use. Again, this article is not intended to influence your decision on this financial product; I am simply acknowledging the historical role professionals (including advisers, brokers and accountants) have had in making the Macquarie CMA a popular choice for SMSFs.

In addition, Macquarie has put a lot of effort into ensuring their bank account integrates easily into the systems of these professionals, including through data feeds and the Macquarie ESI (External Systems Interface) – which provides many ‘open banking’ features many years before open banking and the new payments platform was a thing.

Making SMSF administration easier

With an SMSF, less is often more. An SMSF needs a good bank account to act as the cash hub. With Macquarie, the administration, accounting and audit of an SMSF become very easy. At any time, an accountant or SMSF administrator like Grow SMSF can pull through up to 3 years worth of transactions, and any new transactions come through daily. This helps make the SMSF accounting process quick and easy with no manual data entry.

In addition, Macquarie also enables powerful but flexible third-party access to advisers and accountants. The amount of access (e.g. read-only versus transaction authority) is controlled by the SMSF trustees as the account owners. For example, an SMSF administrator could be granted read-only access to the account, which enables transactions to be fed through into the SMSF accounting platform and online access to download statements or reports for the SMSF auditor when needed, all without the ability to transact on the account.

Some SMSF auditors, including the ones used by Grow SMSF, have even undertaken independent audit testing on the Macquarie CMA and its data feeds into SMSF accounting platforms like Class Super to enable them to place reliance on the data feeds. This means less paperwork each year, and SMSF accounts are completed faster and more seamlessly.

Setting up an SMSF account

Another reason the Macquarie CMA is my pick for the best SMSF bank account is the ease of set-up. Even if you’re not an existing Macquarie bank customer (which you likely aren’t because they’ve never had an extensive retail bank branch network), setting up a new SMSF bank account with Macquarie is quickly completed online, an adviser or accountant can assist (on your request) by pre-filling most of the required information for you. You then receive an email to confirm a few details and authorise the account opening, and viola! A new account is opened.

Could the Macquarie CMA be improved for SMSFs?

There is always room for improvement, even with the best SMSF bank account. Although the setup process for new accounts is relatively fast, normally only taking a few business days, delays can sometimes occur.

The main drawback currently with the Macquarie CMA is that it’s not been moved onto Macquarie’s updated banking platform. In contrast, new transaction accounts and credit cards are already running on this platform. This means that, at this time, you cannot use some of the New Payments Platform services like Osko and PayID on the Macquarie CMA for outward payments. To my understanding, the functionality that enables adviser visibility and accounting system data feeds, and integrations are not yet available on their new SAP-based banking platform.

Macquarie has confirmed that it will enable outgoing payments on the NPP sometime in June 2023. This means near-instant transfers from the Macquarie CMA to third-party accounts (first-time transfers to a new account may still be delayed for security purposes).

In the interim, Macquarie undertakes ‘sweeps’ multiple times daily, meaning transactions often clear relatively fast between the CMA and other banks and between Macquarie accounts.

Can I bank with my regular bank for my SMSF?

Yes. If you are a trustee of an SMSF, you have complete control over what accounts your SMSF uses. There is no obligation to use the Macquarie CMA to use the services of Grow. This is clearly outlined in the Grow Advice Disclaimer.

Although most people like the convenience of having all their banking in one place, some bank products are not suitable for SMSFs. For example, Suncorp is popular with many customers (especially in Queensland); however, they don’t provide a data feed for transactions. Therefore, SMSF accounting fees need to increase to compensate for the additional time it takes to prepare the accounts each year.

Also, having the SMSF bank account with a different bank is good to ensure monies are not accidentally (or intentionally) intermingled with personal funds or business monies.

More information

Macquarie has lots of great information on its website regarding its Cash Management Account.

If you would like to know how Grow SMSF uses the Macquarie Cash Account and how it can help make the management of your SMSF cheaper and easier, Cash Management Account.

22 comments

Lynda Mynard

June 9, 2022 at 5:35 pm

Can I open a superannuation account online

Can I then open a term deposit online

How much interest on a term deposit at the moment

Kris Kitto

June 9, 2022 at 6:43 pm

Open a CMA here: https://www.macquarie.com.au/investing/cash-management-account.html

Term deposit rates are here (you can also apply online): https://www.macquarie.com.au/everyday-banking/term-deposits.html

Ensure you check with your SMSF accountant/provider because they may be able to set it up for you and obtain read-only access for statements and transactional data.

Tom Pankhurst

December 7, 2022 at 1:21 am

There seems to be little point in having a product such as the Accelerator if you are going to restrict SMSF’s from being able to open such accounts? We have had Macquarie CMA accounts since 2004 and wanted to add an Accelerator accounts. Told we can’t do it. Why?

Kris Kitto

December 7, 2022 at 7:51 am

Good question Tom.

I didn’t know this until recently, but for an SMSF the Accelerator Account can only be set up by an adviser or SMSF accountant that has authority on the Macquarie CMA. The authority includes ‘enquiry authority’ (read-only) that most accountants or SMSF administrators would have. I am sure if you instruct your SMSF provider they’d be happy to set up the Accelerator for you.

I have thought about changing the title of this article to “Least worst SMSF bank account” because that would be more accurate, however it’s not exactly something people would type into the Google.

Mark K

March 24, 2023 at 2:17 pm

How do we open an SMSF account with you as we’re ready to roll over funds?

Kris Kitto

March 27, 2023 at 2:29 pm

Hey Mark. Any clients of Grow SMSF have the option to set up a Cash Management Account with Macquarie. We assist you with this process (from your instructions).

If you’re not a client of Grow SMSF, then you will either have to speak to your SMSF provider/accountant or submit an application with Macquarie directly.

Warning: If you also want the option of accessing the Accelerator Account (higher interest) the application for the Cash Management Account should be submitted by an adviser/intermediary. You cannot access the Accelerator Account unless there is an adviser/intermediary attached to your account.

Disclaimer: The above response is answering your question and should not been seen as personal financial advice or inducement to use any specific financial product. Refer to our Disclaimer.

Pingback: esuperfund review 2023 - esuperfund SMSF problems

Shellie Harty

April 19, 2024 at 7:41 am

Hi. Now that cheques are being phased out, how can I pay for items etc for SMSF. I have in the past reimbursed myself with all documentation etc for items purchased for repairs etc. Will there be a change and allow a debit card to added do for example Macquarie’s CMA. Do the ATO allow a debit card to be attached ? Especially now with cheque books being phased out.

Thanks

Kris Kitto

April 20, 2024 at 1:33 pm

There are many ways to make payments out of an SMSF account including EFT transfer or BPAY. Things like PayTo and PayID will also become available in time.

Where neither of those options are available, then the trustee can pay for the items personally provided they immediately (as soon as possible) reimburse themselves for the expense they’ve incurred and wherever possible an invoice or receipt is issued in the name of the SMSF. An of course, the expense itself must be directly related to the operation of the SMSF to comply with the sole purpose test!

Neither the ATO or independent auditors have any problems whatsoever with SMSF expenses being reimbursed provided it happens promptly (i.e. within a few business days).

Will Macquarie (or other banks) roll out debit cards for SMSF accounts? This is something where there is definitely a demand for, and I have advocated directly with Macquarie about this. Although I’ve obtained no firm commitment that Macquarie will roll out a debit card for cash management accounts, they were interested in how it could work not just for SMSF trustees, but any entity that uses a their Cash Management Account.

Assuming they did roll out debit cards that would be linked to their Cash Management Accounts, they could either be physical or virtual cards. The biggest risk I see with a debit card linked to an SMSF is the accidental (or intentional) misuse of SMSF monies for non-SMSF expenditure. Virtual debit cards for online purchases and payments would be a very useful feature.

Steve L

July 19, 2024 at 8:54 am

Researching the best bank accounts for our SMSF. From online reviews, it appears that Macquarie CMA is the preferred bank account with most people for their SMSF, and I certainly can see the pros of Macquarie CMA from your review on this site. However, I am still keen to review other bank accounts before I commit to Macquarie. On this basis, are there any other bank accounts that are suitable for SMSF in your view? Eg CBA CDIA? Thanks.

Kris Kitto

July 19, 2024 at 9:03 am

I have no opinion.

The only reason I believe CBA has any level of popularity with SMSF trustees is simply because it’s the largest retail bank in the country. Same with account offerings from the other big 4 banks.

I will say that we get very few – if any – complaints from people who use Macquarie accounts for their SMSF.

Gregory Smith

May 10, 2025 at 6:59 pm

Thats interesting – no complaints about Macquarie Bank? Have you looked online lately for reviews – many bad reviews of this bank! I have complained and will not use Macquarie Bank for my SMSF for the simple reason that NPP or fast payments out from the Macquarie Bank CMA account only works 75% of the time in my experience. The withdrawal will arrive in the recipient account the same day but usually about 5 hours later. This also occurs in my personal account with Mq as well. Of course Macquarie denies this and says that the customer is always wrong stating that the recipient account must be not NPP enabled or it was done afterhours or on the weekend or the transaction was large, none of this being the case but its my fault and the bank is always right. If you push the point any further they then direct you to documentation somewhere where they cannot give any guarantees of NPP working as you would expect (and in my opinion not in the way that other banks operate their fast payment systems).

Kris Kitto

May 12, 2025 at 7:34 am

Thank you for your comments.

Yes, MANY complaints about Macquarie bank. This article is out of date and since it’s publication Macquarie service levels have dropped significantly.

Key complaint is the blocking of ANY TRANSFER to cryptocurrency exchanges from October/November 2024. Macquarie tells us its for ‘security’ and ‘fraud prevention’, which I find unconvincing as we’ve had SMSF trustees transferring large sums to cryptocurrency exchanges for over three years and Macquarie is just worrying about protecting people NOW after the fact? Sure. Just a bank acting in the banks own best interests as usual.

Yes, their participation in regards to NPP is questionable also. They don’t use OSKO for outgoing transfers, they use SCT as an alternate framework. More info here.

The other key area of complaint is in regards to their ill-configured ID verification process. In our experience about 1/3 individuals fail Macquarie’s overly stringent electronic ID verification. Especially if they have a non-Anglo name. This forces people to run around and obtain an independently certified ID from someone else, and again, this process is overly strict and burdensome with any minor discrepancy penalised with a rejection.

Overall Macquarie has turned the leading and best supported SMSF bank account into a joke. Do better Macquarie.

Petkus

September 17, 2024 at 9:32 pm

I am nervous about joining Macquarie Bank because reviews are very low. 1.7 stars most people complaining about service. When things hiccup and you need help online without people to talk to. Possibly feeling like a number. If there would at least be 1 branch in the city. I was told there are personal VIP Macquarie managers available but only for high-net people. And $600k in SMSF is not high enough for that. CBA only offers 3.2% on SMSF CDIA but at least I can pop to a branch.

Any advice on the best trading SMSF platform? I am using SAXO BANK PRO for SMSF but I wonder if people use others.

Kris Kitto

September 18, 2024 at 7:42 am

Thank you for your comment.

I am not going to tell you who you should or shouldn’t use. What I can say is out of the many hundreds of Grow SMSF customers who have chosen to use Macquarie for their SMSF cash accounts are very happy.

Yes, when it comes to service, most banks will get very low reviews. People only make reviews when they complain. If they’re happy, you don’t hear from them. Same with brokers.

Also correct that Macquarie doesn’t have a branch network, which is fine for 99% of people who would rather avoid branches all together. Macquarie has excellent Australia-based phone support.

With the trading platforms, there are many and it comes down to what works for you. If Saxo Pro works, that’s great. All I can say is that Saxo provides data feeds into the SMSF accounting software platform we use, so that’s a bonus, but so do many other trading platforms.

Ben

October 27, 2024 at 9:27 pm

Hi Kris,

Any update for us all on Macquaries CMA having a linked debit card? We opened a CMA (and CMAA) 4? months ago and no debit card has turned up. I didn’t persue actively as it has taken our employers that long to get their act together with our contributions etc. Recently started looking into this as ready to purchase property and alas have not been able to get a strraight answer re debit cards and CMA from either their FAQs or BOT. (Difficult for me to call during business hours due to work commitments.) Again tonight googling all over the place came across this thread…

This is a BIG deal in our situation as we have a rule: No-one does any financial stuff from any mobile device.

It’s just tooo risky (especially android)

Thanks & Regards Ben

Kris Kitto

October 28, 2024 at 7:29 am

No update. I don’t even think it’s on the radar for Macquarie. If that’s what you need, you should probably use a different bank. Also, if they did issue a debit card solution linked to the Macquarie CMA, it could be a virtual (not physical card).

We have many customers using Macquarie who have property and they get by fine without a debit card. Where there are situations when items need to be paid via debit/credit card, it’s perfectly fine to pay those items personally and then immediately reimburse from the SMSF cash account.

I make no comments around your decisions, but based on my experience, Macquarie’s security, especially in regards to their stand-alone Authenticator App is second to none. Much more secure than MFA via text message. Also, you can transaction via web via Macquarie online. No one is forcing you to use a mobile app.

Paddy

November 22, 2024 at 7:20 pm

Which banks are crypto friendly for SMSF account if Macquarie have now blocked it?

Kris Kitto

November 23, 2024 at 8:23 am

This will change all the time.

What we can say is that Macquarie, due to them deciding to block ALL TRANSFERS to almost all cryptocurrency exchanges, cannot be considered ‘crypto friendly’ and will lose customers because of it.

Some alternatives may include:

– BOQ Money Market Deposit Account via DDH Graham

– ANZ V2 Plus Account

The above cannot be considered a financial product recommendation, only accounts we’ve seen across the Grow SMSF customer base that are used by SMSF trustees and don’t seem to be blocking all transfers to crypto exchanges.

Alex

November 28, 2024 at 12:53 pm

“Macquarie Bank: NOT CRYPTO FRIENDLY”

This is not entirely true. I use Swytfx for Crypto purchases and transfers from my CMA go through almost immediately.

Same with my Commsec/CBA account. Never had an issue transfereing to Swyftx.

Just tried then and no problems.

Also Macquarie CMA doesn’t have a Debit Card attached. I just tried opening a Platinum Transaction Account for the SMSF and they set it up in my name and said you cant do it for SMSF. This is super frustrating because:

1. I dont like to reimburse from personal

2. I have investment tool subscriptions that only take debit/credit cards and not bank transferes.

It really is behind the times. SMSF will/should weed out any foul play with Debit cards if it takes place.

This is dark ages stuff.

Kris Kitto

November 28, 2024 at 1:18 pm

It’s inconsistent with Macquarie’s blocking of crypto exchanges.

As of today, you can’t add the 802-985 BSB which is used by the platforms you mention, however we’ve seen cases where certain people – such as yourself – have been able to transfer without issue provided the payer was already set up in Macquarie internet banking.

Also agree it’s annoying Macquarie hasn’t added a debit card to their CMA product. There is definitely a strong business case and I have pushed this with Macquarie on multiple occasions. I don’t understand why they wouldn’t do it because it would generate additional revenue for them. Even a virtual debit card via Mastercard or Visa would be useful and not have the same compliance issues as a physical card.

Alex

November 28, 2024 at 1:29 pm

If it came in during Oct 24 as you say then I wouldnt have been effected much. Been transferring for 3 years. Lets see what happens.