SMSF insurance is an essential component of any successful wealth building strategy and more importantly it ensures that you and your family will be looked after in the event of serious illness, accident or death.

Often when investors establish a SMSF they overlook the need for insurance cover and can lose any existing cover they had within an industry or retail super fund and are unable to obtain replacement insurance cover within their SMSF. For this reason it’s very important that when you set up an SMSF that you don’t transfer or rollover 100% of your superannuation benefits out of your existing super account before seeking advice from a licensed financial adviser.

Please note the information below is high-level general information only and should not be relied upon as personalised advice. Refer to the Grow SMSF advice disclaimer for further information.

Types of SMSF insurance available

The following are types of SMSF insurance you can utilise:

- Life insurance cover can help your family cope financially in the event of your death.

- Total and permanent disability (TPD) cover provides a level of financial security to and your family if you are unable to work due to long term illness or injury.

- Trauma cover will provide you with funds to assist in meeting medical and other costs that can arise should you suffer a specific trauma.

- Income protection cover will provide you with regular income should you be unable to work temporarily because of illness or injury.

Chances are you have heard about the above types of insurances and you may even have some of the above policies yourself – which is great. The key thing we need to do is ensure that the policies are held in such a way that you and your family are looked after in the most tax effective way possible. Not all insurances can or should be owned by your SMSF. Some insurances are more suitable to be held in your personal name.

Tax deductions for insurance in an SMSF

The following table reviews the above insurances and compares the tax deductibility of policies owned in your personal name and by an SMSF and provides a recommendation in regards to who should own the policy:

| Type of Insurance | Deductible in Own Name? | Deductible in SMSF? | Recommended Owner |

| Life Insurance | No | Yes | SMSF |

| TPD Insurance | No | Yes* | SMSF |

| Trauma Insurance | No | No | Individual |

| Income Protection Insurance | Yes | No | Individual** |

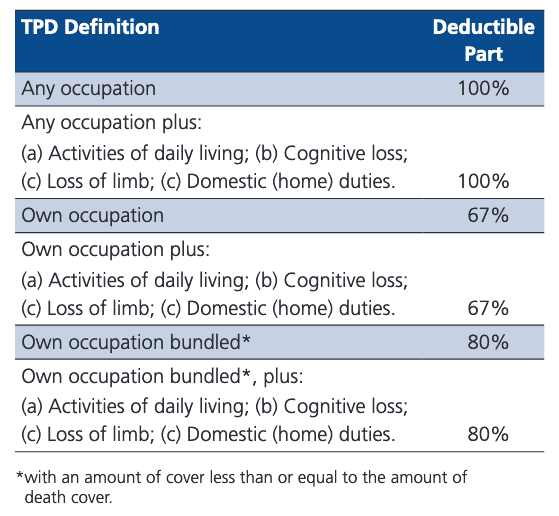

* TPD insurance tax deductions can be less than 100% depending on the type of policy held by the SMSF.

**It is possible to hold income protection insurance policies in the name of a SMSF, however due to a person’s marginal tax rates typically being higher than the 15% tax paid within a SMSF it is more tax effective to hold the policy in an individual’s name.

As you can see by the above table, the only way to obtain a tax deduction for the payment of life and TPD insurance premiums is to hold them via a superannuation fund such as a SMSF.

Importance of insurance with SMSF property investment

With the advent of SMSFs being able to borrow to invest in residential and commercial property via an limited recourse borrowing arrangement (bare trust structure), there is an increased need for SMSF insurance due to a significant portion of the funds assets invested in one large asset.

This lack of liquidity will become a huge problem if one of the members becomes disabled, dies or is unable to work for an extended period of time.

The following case study demonstrates how important it is to have correct insurances:

Case Study

- Husband and wife in their late thirties with a combined before tax income of $180k (husband $90k / wife $90k)

- SMSF Assets:

| SMSF Assets | Value |

| Cash | $20,000 |

| Shares and ETFs | $50,000 |

| Investment Property | $500,000 |

| SMSF Loan (LRBA) | ($250,000) |

| Net SMSF Assets | $320,000 |

- The net assets (or member balances) are split approximately husband $180k / wife $140k

- The net cash flow generated from the investment property before annual administration costs is around $4,000 per annum

- The SMSF holds no insurance policies

Now, let’s assume that the husband becomes permanently disabled and it no longer able to work. In this situation he would have met a ‘condition of release’ meaning he can access 100% of his superannuation balance as either a lump sum or have it drip feed via a pension.

If he decides to take a pension to make up for his lost employment income of $90k per year, the SMSF is going to quickly run into liquidity problems as the only cash it will be receiving is the $4,000 per year from the property (after expenses such as interest and rates) and $7,267 from his wife’s 9.5% super contributions ($90k x 9.5% less 15% tax).

For the SMSF to continue funding a pension or for the husband to take his $180k of benefits as a lump sum they would need to sell the property and pay back the loan. This is not ideal because they would not be selling the property on their terms – they have to take whatever price they can get for a quick sale.

This may mean the property that is ‘worth’ $500k might only be able to be sold with proceeds of $450k, which after paying out the loan would leave the SMSF with no more than $220k in cash as well as $50k in other liquid assets (shares and ETFs). In this scenario the husbands superannuation balance within the SMSF would quickly be depleted and put the family in significant financial strife.

If the above case study was changed and instead of a property with a loan the SMSF had a diversified portfolio of shares and ETFs, its likely there would still be a need for SMSF insurance policies such as life and TPD insurance, however the trustees would have more flexibility in regards to how and when they sold investments to pay out benefits to the disabled member.

A better alternative

The above case study illustrates the importance of SMSF insurance. If the SMSF was able to receive an insurance payment for total and permanent disability, the proceeds would be paid to the SMSF as cash and the disabled member could have then either taken a lump sum, commenced a pension or a combination of both.

The SMSF insurance proceeds could be used to pay out the SMSF loan on the property, which would provide additional ongoing cash flow from the rental income which could also be used to fund an income to the member.

Setting up insurance policies in your super fund

Whether you already have a SMSF or are looking to establish one shortly, it is essential that you get your insurance needs assessed and have your SMSF acquire appropriate insurance policies on behalf of the members.

Although you can shop around by yourself for a policy you may thinks suits the needs of yourself and your family, you are better seeking advice from an experienced insurance adviser. It will cost you nothing are you are more likely to get better cover at a better price compared to if you organised it yourself.

Alternatively, if there are specialist online SMSF insurance providers such as Mortgage Protect who are a step above the online comparison websites.

It’s also very important to understand that if you set up an SMSF and transfer 100% of your member balance from your existing industry or retail super fund, you will lose any attached insurance cover. This means you can either leave a minimum amount (specified by the super fund) in your existing account to ensure the insurance is kept active or obtain SMSF insurance prior to transferring your existing super account(s) to your SMSF.

If you have any questions feel free to get in touch.

2 comments

Kris_Evolved

January 12, 2011 at 9:04 pm

The Government plans to ensure that all trustees are required to consider life and total and permanent disability insurance is included as part of their investment strategy. This has not been a requirement for Trustees in the past and may be one reason why the current level of insurance in SMSFs is statistically much lower than other retail or industry funds.

Pingback: SMSF Setup Advice - Grow SMSF

Comments are closed.