If you thought there was a significant amount of media attention on self managed super funds in the last year you would be right. SMSFs have definitely become a hot topic – and it seems everyone has an opinion. In this article I will share my views on why SMSFs have now become mainstream, and whether it’s time to set up an SMSF.

Navigate to Key Sections

How many people have SMSFs?

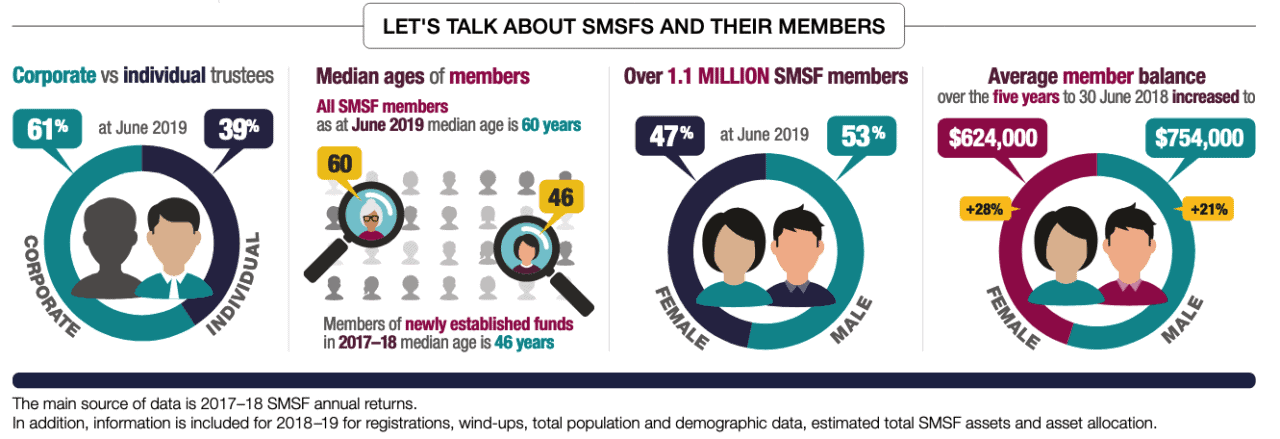

As at March 2020 the nearly 600,000 SMSFs in Australia had a combined total of 1.119 million members. Although this represents less than 5% of Australia’s population, they accounted for $676 billion, or about 25% of the $2.7 trillion invested in superannuation. This is less than the $717 billion invested in industry funds, but more than the $524 billion in public sector funds and the $558 billion invested in retail funds (that is, those run by financial institutions).

SMSFs have been steadily growing for the last decade, however is recent years the growth rate has slowed down as the SMSF segment has matured. The number of SMSFs is still growing at a very sustainable rate and there is no indication it will decline as new, younger entrants begin decide it’s time to set up an SMSF.

Another item that will ensure SMSFs continue to grow is choice of super. In August 2020 a new law giving more than 800,000 additional employees superannuation choice has was passed by Government week removing limitations that forced them into a super fund dictated by their employer. Many of these 800,000 people work in high paying jobs and although they could open an SMSF prior to these changes coming into effect (January 2021) as strong disincentive was that they would still need to maintain the fund nominated under their workplace agreement to receive contributions.

Younger Australians setting up more SMSFs

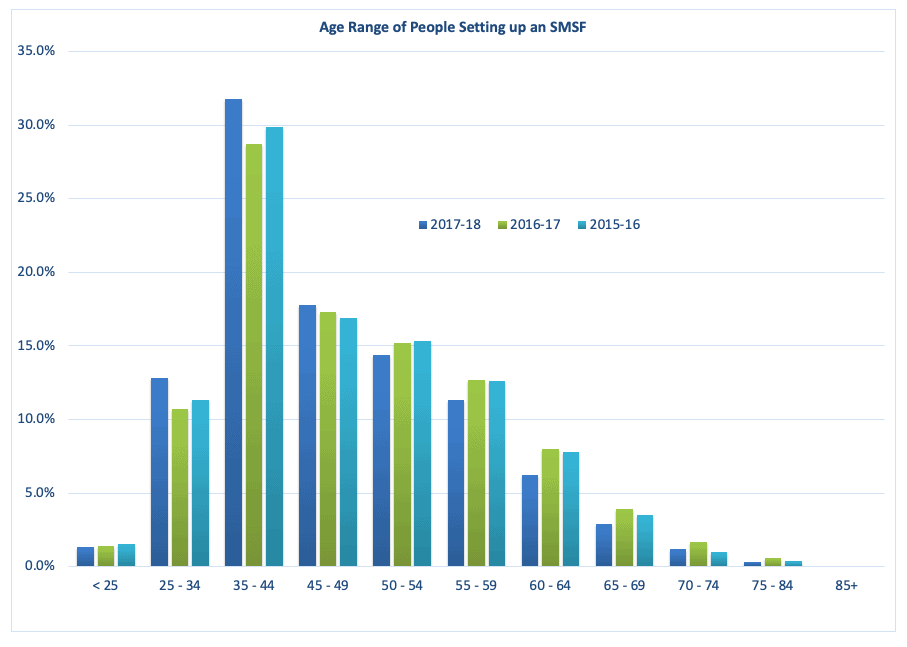

Both the annual statistics and the quarterly SMSF statistics from the ATO show that SMSFs are continuing to attract younger members, with 63.7% of new members under the age of 50. When looking at the overall SMSF population, only 25% of member of under 50 years of age.

The dominant age range of people who’ve decided it’s time to set up an SMSF is 35-44 years old and the median age is 46 Although typically SMSF members are much older – 60 was the median age as at 30 June 2018, many younger members are joining SMSFs as showing by the chart below.

Average income of SMSF members

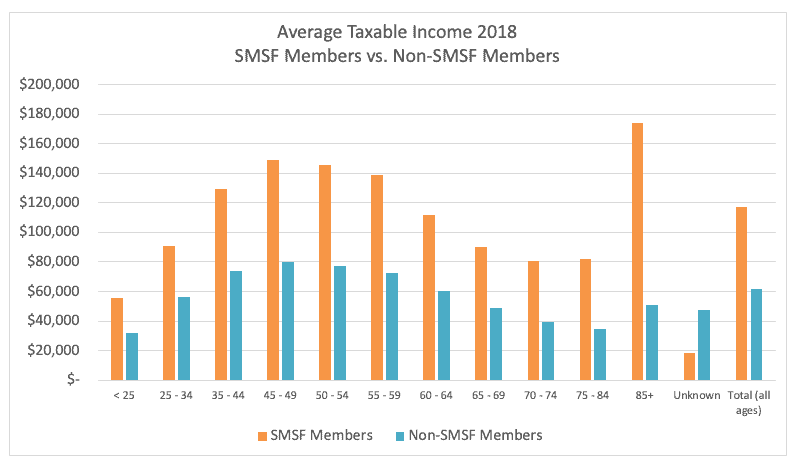

Compulsory super was introduced more than 20 years ago, which means virtually all of Gen-Y has had a portion of their wages paid into superannuation for their entire workings lives. In additional Gen-X has also had the benefit of compulsory super for most of their working lives and with the power of compound growth over the last few decades many people, especially with higher than average incomes are at their prime time to set up an SMSF.

For many of us in these generations, we are starting to see a significant amount of our wealth being held in super – so once again big dollars attract our attention. It is not unusual for a couple in their 30’s to have combined super savings of well over $200,000 – which again makes an SMSF an attractive choice when compared to other super funds when you consider the high level of control and direct ownership some people desire when it comes to their investments.

For many of us in these generations, we are starting to see a significant amount of our wealth being held in super – so once again big dollars attract our attention. It is not unusual for a couple in their 30’s to have combined super savings of well over $200,000 – which again makes an SMSF an attractive choice when compared to other super funds when you consider the high level of control and direct ownership some people desire when it comes to their investments.

Similarly, with an ever increasing number of baby boomers starting to retire, that generation are also becoming extremely focused on their retirement savings, and are seeking the control and transparency SMSFs can provide.

Time to set up an SMSF to buy property?

Although SMSFs have been able to utilise borrowings to purchase property since 2007, it wasn’t until the 2013-14 financial year that borrowing to buy property through super using an SMSF really started to take off. Even so, geared property is still a relatively small portion of the overall SMSF investment make up.

It’s also important to distinguish between commercial property investment made by SMSFs and residential investments. Unfortunately a portion of people who decided that it was time to set up an SMSF were sold low quality poor performing property investments from one-stop-shop providers who were more interested in their commissions than actually empowering their clients to take control of their super.

Many business owners have used their super to purchase business premise so they effectively pay themselves rent. This can be a very tax effective strategy and gives the business owners security of tenancy, however COVID has shown that it does concentrate risk – i.e. it works well when the business is flourishing and has strong cash flow, however it becomes tricky when the related business can’t pay rent. Fortunately with COVID the ATO has enabled SMSF rental deferrals and discounts to help trustees and business owners.

Another item which has slowed the growth of geared property in super has been the exit of the big four banks (and Macquarie) from the SMSF loan market. This has reduced competition in the SMSF loan space, and have given a handful of dominant players room to keep their SMSF loan interests high while interest rates are at a record low. As of September 2020, the lowest SMSF loan rate around is just over 5.00% however there are numerous owner-occupier loans available (provided you have a lower LVR) for 2.50% or less.

There is a strategy available however for people to finance an SMSF borrowing using existing equity outside of super through a related party LRBA.

Read: Buying property with super – SMSF property investment FAQs (2020 version)

How much super do you need to set up an SMSF?

I discuss this subject in a lot more detail in this article: How much is needed to set up an SMSF? Although the article was one of the first I published way back in 2010, the information is still extremely relevant.

The exact amount you need to set up an SMSF is a matter of debate among accountants and advisers. There is no mandated minimum from the ATO who regulate SMSFs.

Based on the ATOs SMSF: A statistical overview 2017-18 the average SMSF costs per year are $3,934. This is based on a median (mid-point) of operating expenses which an SMSF would incur including SMSF auditor fees, SMSF accounting fees, SMSF administration costs, ATO SMSF Supervisory Levy and other deductions relating to the annual running of an SMSF.

If you use a 1% rule of thumb, then based on the above, having a balance of around $400,000 (combined with all members – typically a couple) makes having an SMSF cost effective compared to other superannuation options.

The above amounts however assume that the annual administration costs (i.e. the accounting and audit fees) equate to approximately $3,300 per annum. If you use a lower cost solution, and were only paying half that amount, then a combined super balance of $200,000 to $300,000 makes an SMSF comparable from a cost perspective.

If you don’t think you have enough in super to justify an SMSF you should read: 5 strategies to grow your super balance

Don’t have time for an SMSF? Think again….

When you establish and run an SMSF you take on responsibilities to ensure the SMSF complied with all the relevant laws, lodges it’s returns, pays its taxes etc. This aspect however is frequently blown out of proportion in terms of the time required to actually manage an SMSF ongoing once it is set up.

The wording typically published brings to mind images of a frustrated looking middle-aged man being overwhelmed by piles of investment research and paperwork with the big bad ATO looking over his shoulder. This couldn’t be further from the truth – provided you work with professionals who know what they are doing.

Historically that professional would be your friendly suburban accountant; however this is changing as technology streamlines virtually every aspect of operating an SMSF. Less and less time should be spent on ‘paperwork’ and compliance related activities, with more on education, research and implementation of an appropriate investment strategy – which is the most important, and probably the most interesting aspect of running an SMSF.

Many SMSF trustees I work with have an entirely paperless solution: Banking and investing is all handled online, communication with us as their administrators and strategic advisors is electronic (when not in person), all the accounting and tax returns are completed electronically (in Australia) and anything that needs to be signed can typically be securely signed electronically as well.

There are also law changes underway that effectively enable an SMSF trust deed to be signed electronically (where is has a company as trustee) for people who’ve decided it’s time to set up an SMSF, although some banks and institutions may not accept an electronically signed SMSF trust deed (they will catch up eventually).

The ATO has some very good quality, well written publications on what you need to think about and what your responsibilities are when setting up and operating a SMSF: http://www.ato.gov.au/Super/Self-managed-super-funds/

Summary

Control is definitely a key motivating factor, but it’s more about having a deeper engagement with your overall savings and wealth creation – both inside and outside of the super environment.

The SMSF trustees I work with have taken responsibility of their personal finances. They are not going to rely on the Government, their employer or their family / spouse to secure their future lifestyle.

And this to me is the key question when deciding whether an SMSF is right for you: Do you want to actively take control of your overall personal wealth creation?

If the answer is YES, then it may be time to set up an SMSF.

If the answer is no, then there is nothing wrong with leaving it in an industry or retail super provided.

SMSFs can be a great enabler when it comes to personal wealth creation provided you do your research, trust your instincts and work with professionals who are there to help you.

Related Articles

You may also like the following articles: