When you start asking yourself questions such as “How much super do I need?” or “How much super should I have?” you should give yourself a pat on the back as you’re becoming engaged with your long-term savings, which is something many Australians don’t do when it comes to their superannuation. Looking at the average super balance for your age group is one way to start answering this question.

The question about how much superannuation should you have, although prominent, is also somewhat irrelevant. A more important question is: How much super do I need?

Article Contents

- How much super should I have for my age?

- Average super by age

- Average super: Men versus Women

- Dangers of looking at average balances

- How much super do I need?

- How much super is needed for retirement?

- Using a superannuation calculator

- How to Grow your super

- Average super balance by age 2019

- How much super should I have at age….

How much super should I have for my age?

Since July 2014, employers have been required to contribute 9.5% into superannuation, however individuals are able to contribute further. The annual concessional contribution cap is $25,000 per person per year. This amount includes amounts paid under the 9.5% superannuation guarantee, as well as salary sacrificed contributions and personal contributions made where a tax deduction is claimed.

One way of helping determine how much super you need is to compare your current super balance to the average super balance. The table below provides the average super balance by age 2019:

Average Super by Age

| Age | Average (Mean) Super Balance | Median Super Balance |

|---|---|---|

| 15 - 24 years | $6,200 | $2,500 |

| 25 - 34 years | $36,800 | $25,000 |

| 35 - 44 years | $85,100 | $60,000 |

| 45 - 54 years | $162,200 | $100,00 |

| 55 - 64 years | $286,800 | $150,000 |

| 65 - 74 years | $402,600 | $225,700 |

| 75 years and over | $317,600 | $169,800 |

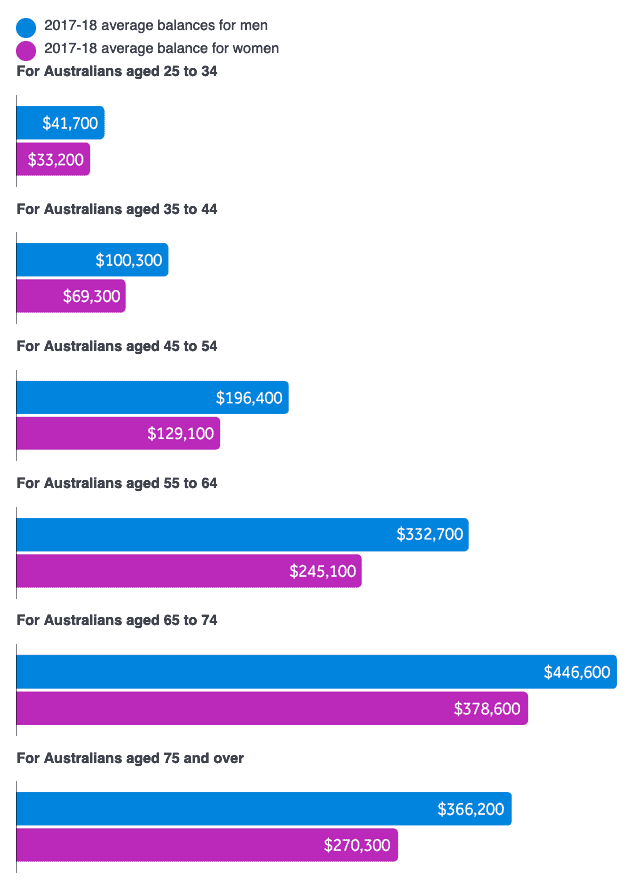

Average Super: Men versus Women

Dangers of looking at the average super balance

Although interesting for comparison purposes, looking at the average super balance by age can be dangerous.

Each person is different, with different earning patters across their lifetime as well as different lifestyle needs and wants. When looking at averages, it can hide the truth around how much super you need to fund the type of retirement you want.

In addition the average super balance does not take into account things like:

- Age pension entitlements that may be available in retirement;

- Income generating assets outside of super;

- Planned larger future contributions, for example from the sale of a business;

- Inheritances that may be received.

A better way to answer the question of “How much super should I have?” is to work out what income you will need when you stop working and from that figure determine how much super you need at retirement.

Once you have the “goal” figure, you can use a superannuation calculator to see whether there is going to be a gap and look at what you can do to boost your super balance to get it to your goal.

How much super do I need?

The easiest way to figure out how much super you need is to firstly answer the following:

- When are you planning on retiring and accessing your super?

- What type of lifestyle are you expecting in retirement? (e.g. “modest” versus “comfortable”)

People often overestimate the amount they actually need in superannuation savings in retirement as they don’t include capital they can draw down to supplement the income generated from their capital. This is natural – we are all living longer so running out of money is a reasonable thing to be afraid of.

How much super is needed for retirement?

The Association of Superannuation Funds of Australia (ASFA) has come up with a retirement standard which is a benchmark the ‘average’ Australian will need as income in retirement:

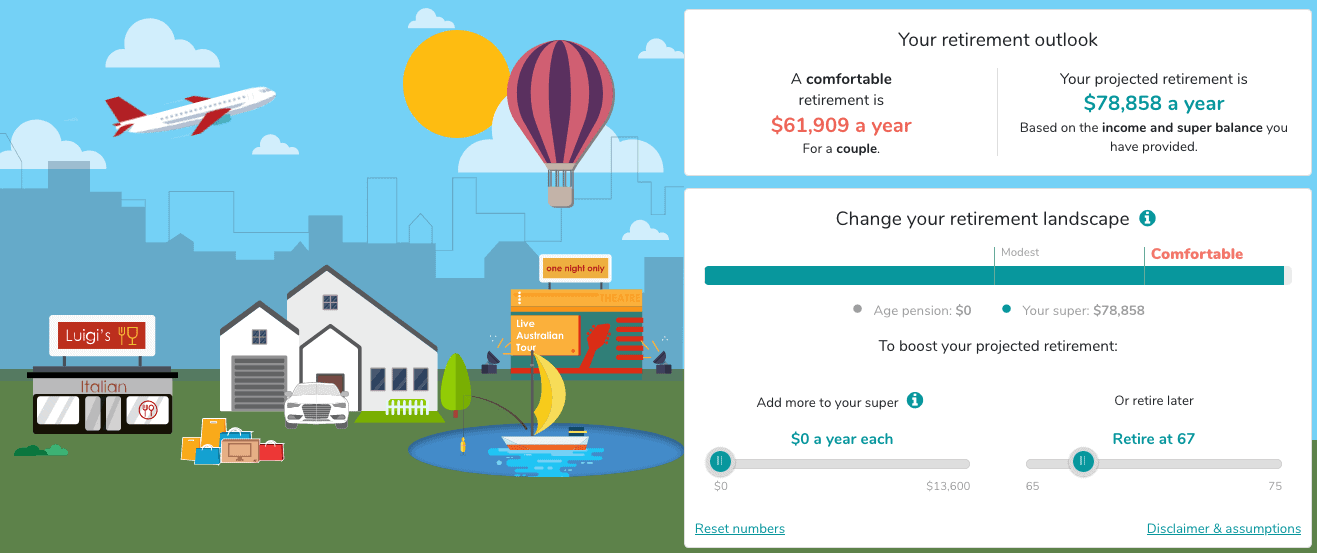

Modest Lifestyle

- Single – $27,902 per annum

- Couple – $40,380 per annum

Comfortable Lifestyle

- Single – $43,687

- Couple – $61,909

The above amounts are based on budgets for a 65 year old person or couple who own their own home outright and are relatively healthy.

The above are income amounts per year. To determine how much super your need to provide that income (i.e. the amount of capital), you need to take into account the following:

- How much per annum you need (i.e. is it higher or lower than the above)

- What the average annual return (income and grow) from your super investments will be

- Whether you will be eligible for any age pension benefits

- What other investments and financial resources you have outside of super

For example, if you require $70,000 per annum as a couple and believe your super will consistently provide you with a 5% return after retirement, then the calculation would be $70,000 divided by 5% = $1,400,000.

However, there is a few problems with the above calculation as it’s overly simplistic. Firstly, it assume you will not consume any of the underlying capital at retirement. So if you start with $1.4m at retirement age, that amount will still be there when you die.

Secondly, it does not take into account annual minimum pension drawdowns that are required from super. These minimum drawdowns start at 4% when you are between age 55 and 64, increase to 5% at age 65 to 74 and gradually increase to 14% if you are fortunate enough to live through to age 95 and above.

To put it another way, the superannuation system forces you to take money out of super and consume the capital, rather than preserve it. That said, the minimum super drawdown requirements only force the withdrawals – they don’t force the money taken out of super post retirement to be spent.

Using a superannuation calculator

Another good way to answer the question “How much super do I need?” is to use a superannuation calculator.

A very easy to use superannuation calculator is provided by SuperGuru. In fact, SuperGuru has two useful calculators that answer the following:

Superannuation calculator example

The Retirement Tracker Calculator is very useful as it will provide a estimate of how much super you will have at retirement and how much income it will provide.

You can also adjust key factors such as when you will retire (it defaults to age 67) to retire earlier or later and also the impact additional contributions to super make.

Unfortunately what this superannuation calculator does not show is how much your super balance will actually be at retirement.

This calculator is intended for illustrative purposes only. The figures provided for the Retirement Standard are current as at the quarter ending June 2020. Results are shown in today’s dollars. It is not a prediction of your superannuation benefit and should not be relied upon for making financial or product related decisions. This information is of a general nature only.

The Association of Superannuation Funds of Australia Limited (ASFA) ABN 29 002 786 290 does not accept any liability, either direct or indirect, arising from any person relying, either wholly or partially, upon any information provided by, resulting from, shown in, or omitted from, this calculator. Under no circumstances will ASFA be liable for any loss or damage caused by a user’s reliance on information obtained using this calculator.

Lifetime Superannuation Model – Calculation method and assumptions

Inflation

The model relies on both price inflation and wage inflation assumptions (see below for more details on where each is used within the model).

ASFA’s Retirement Tracker uses price inflation of 2.5% and wage inflation of 4.0%.

The assumptions of price inflation of 2.5% per year and wages growth of 4.0% per year have been adopted in the context of continuing low price and wage inflation in Australia, with recent annual figures actually below these assumed rates.

Using the edit assumptions tab, you can adjust the inflation rates within the permitted ranges.

Results are in today’s dollars

Results are shown in today’s dollars, which means they are adjusted for inflation.

The assumed rate of wage inflation has been used to discount future amounts to today’s dollars.

Personal income

The model enables you to enter your current salary. This is then assumed to increase in line with the wage inflation parameter.

Tax calculations allow for Personal Income Tax rates, the Medicare Levy, the Low Income Tax Offset and the Senior Australian Tax Offset. Threshold and Offset amounts in the first year are based on current rates. Thereafter they are indexed in line with wage inflation.

Employer contributions

By default you are assumed to receive superannuation guarantee contributions.

The assumed rates of superannuation guarantee contribution are:

Financial year

Rate

| 01/07/2020 | 9.50% |

| 01/07/2021 | 10.00% |

| 01/07/2022 | 10.50% |

| 01/07/2023 | 11.00% |

| 01/07/2024 | 11.50% |

| 01/07/2025 | 12.00% |

Superannuation guarantee contributions are subject to the maximum contribution base, which is currently $57,090 per quarter (for the 2020/21 financial year). This threshold is indexed annually in line with wage inflation.

Voluntary member contributions

You are able to enter regular voluntary concessional or non-concessional contributions. Contribution amounts you enter are assumed to increase in each year in line with your salary.

From 1 July 2017, non-concessional contributions are only permitted if the balance of an individual’s superannuation is below $1.6m. In a situation where the projected balance exceeds the (indexed) cap in the future, the calculator will not allow for any subsequent non-concessional contributions.

Where a Concessional or Non-concessional contribution exceeds the corresponding legislated contribution thresholds, the contributions are taxed accordingly. From 1 July 2015 concessional contributions are taxed at 15% in the superannuation environment. Concessional contributions in excess of the contribution threshold are subject to additional tax; however this is levied in the income tax environment (and so has no impact on the estimates in this model).

High income earners (from 1 July 2017, those who earn over $250,000 p.a.) are subject to additional tax on concessional contributions. These individuals will pay an additional 15% contributions tax on contributions relating to income above the $250,000 threshold. The calculator assumes that this additional tax is deducted from the superannuation balance; however there is also the option to pay this tax directly to the ATO.

The Concessional and Non-Concessional contribution thresholds are indexed in line with the assumed rate of wage inflation.

Co-contribution

In each projection year, your eligibility for a Government co-contribution is assessed based on your salary and non-concessional contributions. A co-contribution is made to the superannuation account if applicable.

The co-contribution thresholds and maximum amount are indexed in line with wage inflation.

Investment earnings

The default investment option For the ASFA Retirement Tracker is outlined below.

| Pension phase return (before tax) |

Accumulation phase return (after tax) |

Investment fee (%pa) | |

| ASFA Retirement Tracker Default | 6.00% | 5.520% | – |

Administration fees and insurance premiums

The assumed administration fees and insurance premiums are:.

| Administration Fee (per annum) | $100 per annum |

| Asset-based Administration Fee | 0.10% pa of the account balance |

| Insurance premiums | $100 per annum |

The dollar-based administration fee and the assumed annual insurance premium are assumed to increase in line with the assumed level of general wage inflation.

Age pension

Current Age pension rates of payment and income/asset test thresholds are allowed for based on your Single/Couple and Homeowner status. Rates of payment are indexed in line with wage inflation, and thresholds are indexed in line with price inflation.

The age pension is subject to an asset test and an income test.

The asset test is based on the accrued balance of superannuation assets and other assets.

For the purpose of this model no other assets have been included when assessing your eligibility for the Age Pension. Deemed income is calculated on superannuation and all assets outside of superannuation, and age pension eligibility is calculated based on this deemed income.

Transfer balance cap

The transfer balance cap restricts the amount that can be transferred into an account-based pension. At 1 July 2017 the cap is $1.6m and will increase in $100,000 increments in line with price inflation (CPI). If your projected account balance exceeds the transfer balance cap at the time of retirement, the maximum possible amount will be transferred into an account-based pension and any excess balance will be retained in an accumulation account.

Drawings

The drawings from superannuation in retirement are calculated as: Total income less other income (as entered by your) less any age pension amounts (as calculated by the model).

If your transfer balance cap is exceeded at the time of retirement, in retirement you will have both an accumulation account and a pension account. The minimum required amount will be drawn from the pension account and any further income required to attain your target income will be drawn from your accumulation account.

Minimum drawings

There are statutory minimum superannuation drawings in both the TTR phase and in retirement (once funds have been converted to the pension phase).

Minimum drawing requirements are ignored in the retirement phase. Though the minimum drawing amount would have to be withdrawn from superannuation, if they were not required to be spent to meet the your target income, they would still be available, say in a bank account. Seen from the perspective of retirement funding, and without the complication of including an account external to superannuation, it may be preferable then to ignore the minimum drawing levels.

Age limits

The model allows you to enter a current age between fifteen and seventy years old. Fifteen is the minimum working age in Australia, and the youngest that a person would reasonably expect to receive superannuation guarantee contributions. Although a person can receive superannuation guarantee contributions up to the age of seventy-five (assuming they satisfy the work test), the model is set at a maximum age of seventy because the model is designed to enable you to model your projected retirement income prior to retirement.

Legislative assumptions

A number of assumptions in this calculator are prescribed by legislation. These assumptions include: superannuation guarantee contribution rates; the tax arrangements on superannuation contributions, investment earnings and drawings; minimum draw down amounts; co-contributions; age pension payment rates and thresholds; and income tax rates.

Where there is relevant legislation, the assumptions made in this calculator reflect current legislative arrangements. One uncertainty regarding future superannuation entitlement relates to possible future legislative changes.

Although some future changes in the legislation relating to superannuation are likely, it is not possible to know what these changes may be. Where there is relevant legislation, current legislative arrangements therefore represent the most reasonable basis for estimating future superannuation entitlement.

Updates to legislative assumptions are made as soon as practicable after such changes are announced. The calculator is based on legislative arrangements as at July 2020.

How to GROW your super

For most people, its likely that when you run through the superannuation calculator and projections, there will be a ‘gap’ or shortfall between the income you want in retirement, and what you are likely to have in retirement. This is OK!

The most important thing is that you are now becoming engaged and taking the time to figure out what you should be doing when it comes to your long term investment assets i.e. your super. Also remember that how much super should I have is a very personal question and everyone has different work and income patterns as different lifestyle goals. Don’t let averages and other peoples situations make you feel unhappy about your own position.

The following are some common ways to Grow your super.

Please note the information below is high-level general information only and should not be relied upon as personalised advice. Refer to the Grow SMSF advice disclaimer for further information.

Ensure you’re getting paid the right amount of super

Having your compulsory superannuation from your employer either being underpaid or not paid at all, especially early in your working life, can have a significant and potentially devastating impact on your average super balance and impact how much super you should have later in life. Always check and ask yourself “How much super I should have in my pay?”

Regularly check your payslip and superannuation account to ensure the correct amount of super is getting paid. Employers must pay your super every quarter 28 days after the end of the quarter. They must pay 9.5% of your gross ordinary earnings, and this amount is set to gradually increase to 12% starting in 2021 (however may not happen due to COVID-19).

The ATO has some good information on what to do when your employer is not paying your super.

Make extra super contributions

One relatively obvious was to Grow your super balance is simply to put more money into super!

We all save and invest for different reasons. Superannuation should be thought of as long term savings that you will access in the later part of your life. Adding extra contributions to super, even when young should is not a replacement for saving, investing and wealth creation outside of the superannuation environment. You should try to do both as they work well side by side.

There are a number of different ways you can make additional contributions into super:

Salary sacrifice contributions

Salary sacrifice is where you elect to have a portion of your before-tax income paid into your super by your employer which is over and above the mandatory 9.5% they have to contribute on your behalf.

The amount contributed goes directly from your employer to your super fund account (including an SMSF) and is taxed at 15%. Salary sacrifice contributions are concessional contributions and the $25,000 annual contribution cap applies.

Tax deductible personal contributions

Tax deductible personal contributions are also voluntary contributions, which you can make using after-tax dollars (such as when you transfer funds from your bank account into your super) and then claim a tax deduction on when doing your tax return using a Notice of Intent to Claim form.

Like salary sacrifice these contributions are also taxed at 15% when they hit your superannuation account and they also count towards your $25,000 concessional contribution cap.

There types of contributions used to only be available for the self-employed (i.e. people where 10% or less of their income came from employment) however with the 10% rule for superannuation contributions being abolished, everyone regardless of being self-employed or receiving PAYG wages or salary can access these contributions and deductions.

These contributions are useful to claim an additional tax deduction in a financial year where your income is higher than normal – for example if you’ve received a bonus or had a capital gain on the sale of an investment or asset (shares, property etc.).

In addition, where your total superannuation balance is under $500,000 the amount unused of your $25,000 annual cap on a rolling five year basis.

After tax contributions (non-concessional)

In addition to tax deductible concessional contributions, each individual (under the age of 67) can make an annual after tax contribution of $100,000 per year, or by triggering the bring-forward rule, $300,000 at one time.

There are special rules if you are over age 65 in regards to the bring-forward rule (this hasn’t been increased to age 67 at this time – but should be come November 2020). The ability to make non-concessional contributions is also impacted where a persons total super balance is over $1.4m – although if your super balance is at this level, it’s a good problem to have.

After tax contributions are useful where a windfall amount of cash has been received, for example form an inheritance and the money is not immediately needed – i.e. you are close to retirement age.

Co-contributions

Co-contributions are available when you make an after-tax contribution to super and don’t claim a tax deduction. Where you income is $37,697 or less the Government will automatically credit your super account $500 when you make a contribution of $1000.

These types of contributions are especially useful for younger workers. Think about making these contributions on behalf of teenage children / young adults when they first start earning an income from a part time job or are early in their careers. An extra $5,000 for example generates $2,500 in Government co-contributions across 5 years and due to the power of compounding can have a significant impact come age 60.

Co-contributions as well as the catch-up concessional contributions provisions and spouse contribution splitting are useful ways to boost the super balance of women (and men) who’ve taken time out of the workforce to have and look after children.

Downsizer contributions

A person over age 65 can make a one-off non-concessional contribution of up to $300,000 from the proceeds of their principal residence (including part of their principal residence) provided that property has been their principal residence for at least 10 years prior to sale.

Both members of a couple can use the downsizer contributions on the sale of the same property and there are no restrictions in regards to total superannuation balance, the $1.6m transfer balance cap or requirement to meet the work test. Also there is no actual requirement to downsize!

Combine multiple super accounts

Half of Australian workers have more than one super fund but when it comes to super accounts, less is more. Extra accounts can attract more fees, confuse your employers, and crowd your letterbox at tax time.

You can save time, money and precious surface area by folding multiple balances into a single fund. Before consolidating, check for any insurance quibbles and exit fees, then head to MyGov again. The website can help you roll them into one with just a few clicks.

Ensure you’re in the right super fund with the right investment strategy

Fortunately, most Australians have full choice when it comes to the super fund account they choose. Although all employers have a default fund if you don’t provide super fund account details, you can chose to have your contributions paid into any super fund you like (including an SMSF).

There are some exceptions for people working under an enterprise bargaining agreement or registered agreement that came into place before 1 January 2021, however moving forward all workers have superannuation choice.

What is the right super fund for me?

The super fund with the highest returns and lowest fees of course is the best! However, how do you determine what fund that is?

You can’t control how your super fund performs year to year, however you can control fees as well as the investment strategy applicable – i.e. how and what your super is invested into.

A great resource to look at is the Stockpot Fat Cat Report. This report looks at over 600 superannuation funds and provides details on fees and investment returns.

What super investment strategy should I use?

A good rule of thumb is that typically the younger you are and the more years you are away from retirement, the more risk your superannuation investment strategy can handle and the higher growth option should be selected.

The logic with this is that many people sit in a default ‘Balanced’ option, however if they are younger they should be in a higher growth option as they can ‘whether the storm’ when it comes to fluctuations to their investments in the short term. As per approach retirement they typically would move into more conservative investments with lower risk and likely lower returns. In other words the investment strategy is based on life stages.

Taking control of your super investment strategy while in an larger industry or retail super fund will also assist you when you build your SMSF investment strategy.

Once again, this article cannot replace personalised financial advice and we again refer you to our advice disclaimer.

Investigate whether an SMSF is right for you

A self-managed super fund is one of many superannuation options that is available.

In terms of growing your super, an SMSF can be useful because:

- Fees can potentially be saved as you can combined multiple members into the one SMSF (typically members of a couple);

- You have full control over the investment strategy;

- You are likely to be more actively engaged in your superannuation investments;

- It may be easier to implement certain strategies compared to an industry or retail superannuation fund;

- There are many types of investments that are available through an SMSF that are not directly available via an APRA regulated superannuation fund (for example direct property, collectibles, investments into unlisted and private companies etc.

There are of course disadvantages and a number of other factors to be aware of and again, this article cannot replace personalised financial advice and we refer you to our advice disclaimer.

Average super balance by age 2019

- 15 to 19 years $485

- 20 to 24 years $5,501

- 25 to 29 years $21,372

- 30 to 34 years $38,386

- 35 to 39 years $56,715

- 40 to 44 years $80,899

- 45 to 49 years $114,616

- 50 to 54 years $135,290

- 55 to 59 years $180,689

- 60 to 64 years $214,897

- 65 to 69 years $207,105

- 70 to 74 years $161,974

- 75 to 79 years $76,049

- 80 to 84 years $42,912

How much super should I have at age...

| How much super should I have at 20? |

| How much super should I have at 21? |

| How much super should I have at 22? |

| How much super should I have at 23? |

| How much super should I have at 24? |

| How much super should I have at 25? |

| How much super should I have at 26? |

| How much super should I have at 27? |

| How much super should I have at 28? |

| How much super should I have at 29? |

| How much super should I have at 30? |

| How much super should I have at 31? |

| How much super should I have at 32? |

| How much super should I have at 33? |

| How much super should I have at 34? |

| How much super should I have at 35? |

| How much super should I have at 36? |

| How much super should I have at 37? |

| How much super should I have at 38? |

| How much super should I have at 39? |

| How much super should I have at 40? |

| How much super should I have at 41? |

| How much super should I have at 42? |

| How much super should I have at 43? |

| How much super should I have at 44? |

| How much super should I have at 45? |

| How much super should I have at 46? |

| How much super should I have at 47? |

| How much super should I have at 48? |

| How much super should I have at 49? |

| How much super should I have at 50? |

| How much super should I have at 51? |

| How much super should I have at 52? |

| How much super should I have at 53? |

| How much super should I have at 54? |

| How much super should I have at 55? |

| How much super should I have at 56? |

| How much super should I have at 57? |

| How much super should I have at 58? |

| How much super should I have at 59? |

| How much super should I have at 60? |

| How much super should I have at 61? |

| How much super should I have at 62? |

| How much super should I have at 63? |

| How much super should I have at 64? |

| How much super should I have at 65? |

| How much super should I have at 66? |

| How much super should I have at 67? |

How much super should I have at

- 20 – $0

- 21 – $5,000

- 22 – $10,000

- 23 – $17,000

- 24 – $24,000

- 25 – $31,000

- 26 – $38,000

- 27 – $46,000

- 28 – $54,000

- 29 – $61,000

How much super should I have at

- 30 – $68,000

- 31 – $76,000

- 32 – $85,000

- 33 – $93,000

- 34 – $102,000

- 35 – $112,000

- 36 – $122,000

- 37 – $132,000

- 38 – $143,000

- 39 – $154,000

How much super should I have at

- 40 – $164,000

- 41 – $174,000

- 42 – $184,000

- 43 – $195,000

- 44 – $207,000

- 45 – $219,000

- 46 – $231,000

- 47 – $244,000

- 48 – $257,000

- 49 – $271,000

How much super should I have at

- 50 – $285,000

- 51 – $300,000

- 52 – $315,000

- 53 – $330,000

- 54 – $345,000

- 55 – $360,000

- 56 – $380,000

- 57 – $395,000

- 58 – $415,000

- 59 – $430,000

Assumptions

Important information: The reported figure is the approximate amount a person should have in superannuation now to reach the ASFA Comfortable Standard balance by age 67, assuming a future pre-tax wage income of around $65,000 per annum (see below for other assumptions). The Comfortable Standard balance—which is the lump sum required for a comfortable retirement—is $545,000, in today’s dollars. The lump sum required for a comfortable retirement assumes that the retiree will draw down all their capital, and receive a part Age Pension.

The reported figure is intended for illustrative purposes only. It should not be relied upon for making financial or product related decisions.

This information is of a general nature only when asking the question: “How much super should I have?” or “How much super do I need?”.

Assumptions: Pre-tax wage income of just under $65,000 per annum. The Superannuation Guarantee contribution rate increases in line with current law, from 9.5% to 12% in 2025-26. Contributions tax is deducted at the rate of 15%. Investment returns (nominal), before investment fees and taxes, are 6.7% (investment fees are 0.7 per cent of assets, and the tax rate is 4.5 per cent). Administration fees are $100 per annum. Insurance premiums are $100 per annum.

The reported figure assumes that the person has a full year until his/her next birthday, and thus will receive a full year of Superannuation Guarantee contributions before his/her next birthday. Specifically, it is assumed that a person is born on 1 July (in a particular financial year), and the reported figure is the balance on the person’s birthday.