One common question in regard to the set-up of an SMSF is “How much super do you need to set up an SMSF?”. The answer is simple: It depends! Importantly, there is no SMSF minimum balance required by the ATO. Based on outdated information from ASIC, some industry and retail super funds will say that you need at least $500,000 for an SMSF. This is incorrect and not supported by independent research.

Navigate to Key Sections

Is $200,000 the SMSF minimum amount?

If you read the information on this subject, you will find that the recommended minimum amount to set up an SMSF is $200,000. This figure is based on one thing: The average SMSF costs and fees when compared to the management and administration fees charged by retail and industry superannuation funds.

Sounds good in theory. On average, a large APRA-regulated superannuation fund (industry fund retail super fund) fund will charge 1.10% of your balance. This is based on information collated by Canstar as of 14/04/2020, but obviously, there are higher and lower-cost options out there.

If you have a total of $200,000 in super (across all people who will be members of the SMSFs), the total super fees you will be paying is $2,200 per annum. That amount could also be used to cover the costs of the administration of an SMSF funds through a specialist provider like Grow SMSF, however you also need to take into account the statutory fees paid to the ATO and ASIC of $259 and $63 respectively.

Using the the same calculation, by reducing your annual fees, theoretically, the minimum amount needed to set up an SMSF should also reduce. For example, if you can the total of your SMSF accounting fees, audit fees, SMSF ATO levy and annual ASIC fees to $1,700 or less per year the the minimum needed for an SMSF would only be $170,000.

The flaw with the $200,000 SMSF minimum rule of thumb

However, the $200k SMSF minimum theory has a couple of flaws. Firstly, an SMSF is nothing like an industry or retail superannuation fund. An SMSF gives you complete control and freedom of choice regarding your investments, offers flexibility and you are able to more easily utilise advanced wealth building strategies that are simply not available (or too challenging) to be used with an industry or retail super fund.

The $200k minimum / percentage of fees approach does not compare ‘apples with apples’ if you’re trying to determine how much current super you need to set up an SMSF. Many people may decided the amount needed to set up an SMSF for them is less than $200,000 as they are willing initially to pay a premium in ongoing fees for a few years to give them that control.

For example if someone has the opportunity to invest in a pre-IPO company using their superannuation, they might be willing to incur fees that are higher that what they were paying in a larger superannuation fund to access that opportunity as part of their SMSF investment strategy.

A second flaw with the $200,000 amount as the minimum amount to set up an SMSF is that it focuses purely on administration costs. With larger industry or retail super funds, you pay fees for both administration and investment management. By comparison with an SMSF, you have to pay administration costs, but you can undertake investment management yourself.

It’s difficult, if not impossible, to prepare your own SMSF financial statements, member statements, tax return and trustee minutes without the help of a specialist SMSF accountant. You always need to pay for an independent audit. If you have an SMSF and also are paying for investment management (i.e. you’re also outsourcing this), that will add extra costs meaning the $200,000 rule of thumb minimum will not be enough.

How much super do you need to set up an SMSF that’s well diversified?

Another consideration when determining how much super do you need to set up an SMSF is the ability to diversify. Diversification is basically the splitting up of your investment monies over different asset ‘classes’ such as cash, Australian Shares, International Shares, Fixed Interest, Property etc.

As trustee of an SMSF, you have a responsibility to put together an investment strategy for your fund that takes into account diversification. Importantly, you don’t have to be diversified, however you do need to document why your are (or are not) diversified in your investment strategy. A really great solution to help you diversify your SMSF is to use a low-cost online investment solution like Stockspot. The Stockspot solution takes you through an online process and at the end will send you a personalised investment portfolio recommendation. This advice document is basically your recommended investment strategy.

The more money you have to invest, the easier it is to spread your monies over the different asset classes and in theory your returns will be more stable and consistent in terms of income and capital growth. You can’t control what investments markets do, however you can control the fees you pay and the amount of risk you take on via diversification.

With a smaller amount of funds, you may be able to achieve diversification through investing via a managed fund; however this simply adds another layer of fees – meaning you may as well have left your money in an industry or retail fund. This brings me to my next point – quality.

The quality of your investments is the key. Someone who investments $100,000 in high quality investments under a well considered and consistent investment strategy over the long run is going to better than someone who investments more money in poor quality investments or who chops and changes their investment strategy every year or so trying to chase ‘last years winners’.

How many members in your SMSF?

It’s important to remember that an SMSF may have up to four members, although the vast majority only have one or two members. When an SMSF has two members (typically a couple) they share and split the fees and costs associated with the SMSF making it more cost effective.

There is also talk of increasing the member limit on an SMSF to 6 members to cater for larger families groups to enable them to incorporate more people and reduce scenarios where a group of individuals (such as a family) have to spread their assets across two SMSFs.

Using the above $200,000 rule of thumb, this amount is the total amount across all members of the SMSF – it’s not the amount each individual member needs.

This doesn’t mean however you should find three friends and have four unrelated people in an SMSF simply to reduce the costs – that would be too risky and create too many practical challenges. In my opinion, your SMSF membership to be limited to you and your spouse, and maybe your children if they are young adults. Not your parents. Not your siblings. Not your friends or business partners.

So how much do you need to set up an SMSF?

The minimum amount to set up an SMSF is more likely to be based on the amount of fees that will be incurred per annum and whether you are comfortable paying those fees as a percentage of your total super. Work out how much as a percentage of your total superannuation savings will be eaten up every year, and if this percentage is acceptable to you in regards to what you are getting into return.

The table below shows the relationship between annual dollar value fees and total SMSF balance to give you a percentage based fee:

|

Total Super Balance |

||||||||

| $100,000 | $150,000 | $200,000 | $250,000 | $300,000 | $400,000 | $500,000 | ||

|

Annual Fees |

$ 1,500 | 1.50% | 1.00% | 0.75% | 0.60% | 0.50% | 0.38% | 0.30% |

| $ 2,000 | 2.00% | 1.33% | 1.00% | 0.80% | 0.67% | 0.50% | 0.40% | |

| $ 2,500 | 2.50% | 1.67% | 1.25% | 1.00% | 0.83% | 0.63% | 0.50% | |

| $ 3,500 | 3.50% | 2.33% | 1.75% | 1.40% | 1.17% | 0.88% | 0.70% | |

| $ 4,000 | 4.00% | 2.67% | 2.00% | 1.60% | 1.33% | 1.00% | 0.80% | |

When looking at fees your SMSF will incur to help you work out how much is needed to set up an SMSF, consider the following fees which are typically unavoidable:

- Accounting / Administration Fees

- Auditor Fees

- ASIC Annual Review Fee – $63 (where a trustee company is used which is recommended)

- ATO SMSF Levy – $259 (this fee is paid each year when the SMSF lodges its annual tax return)

Some providers include the auditor fee in their administration fees, while others charge it separately in addition, so always do your due diligence on providers.

Average balances for new SMSFs

Data from the ATO show that the average balance for a new SMSFs in its first year of establishment is $408,750 and the median balance is $259,588. This is based on the 2019-20 financial year and shows that many people believe the amount needed to set up an SMSF is somewhere between $200,000 and $500,000.

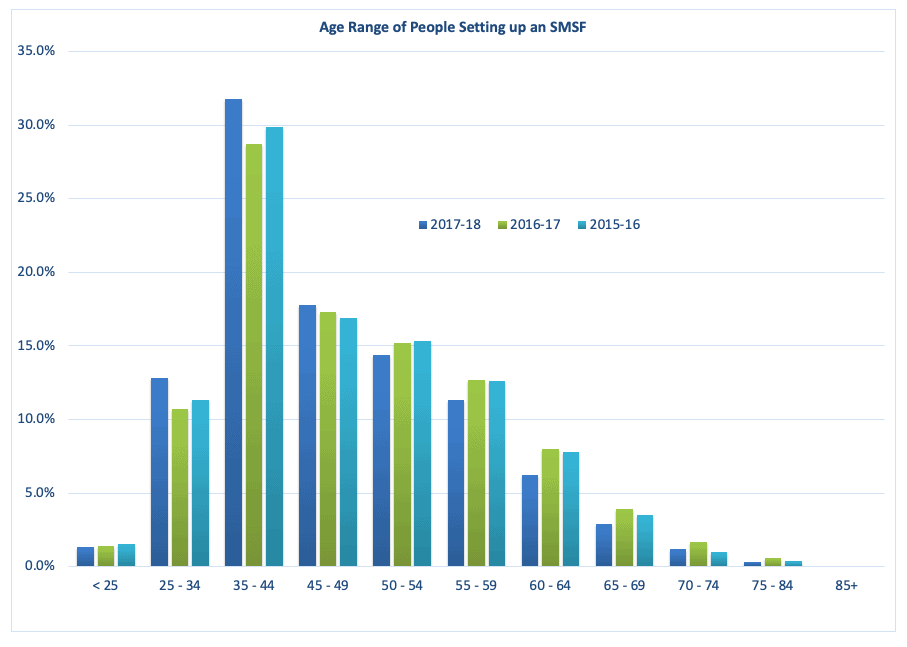

Also, the median age of people setting up an SMSF as at June 2020 was 46 years old. In recent years there has been an increase in the number of people under age 45 setting up SMSFs.

I discuss this trend in more detail in the following article: Is it time to set up an SMSF?

Summary

The amount needed to set up an SMSF in terms of total combined superannuation balances of all members will typically be somewhere between $100,000 and $400,000, however there is no minimum amount needed for an SMSF.

If you would like some simply strategies to help you grow your super balance, have a look at the following article: How much super should I have? I cover 5 easy to implement things you can do today that don’t require an SMSF, but if an SMSF is something you aspire to these strategies will put an SMSF within reach a lot sooner.

If you have any questions please get in touch or if you are ready to set up an SMSF you can do so online: Set up an SMSF

5 comments

Kimgr

September 26, 2010 at 6:29 am

We started off with just $50,000 in our SMSF, which we turned into $220,000 within 5 years by buying property back before you could borrow. Did a lot of research into the area beforehand, knew it would be a winner. We would never have reached the $220,000 in an industry super fund in that amount of time.

Kris_Evolved

September 26, 2010 at 9:22 am

That is fantastic Kimgr!

Thanks for sharing your experience.

Are you planning on taking advantage of the ability to borrow within your SMSF to leverage for further growth of your nest egg?

Tatiana

November 18, 2011 at 12:13 pm

I have $50,000 as well. Can you give some idea what is good place to by investment property?

Tatiana

Pingback: Is buying an investment property with your super better than negative gearing? | EvolveMySuper

Pingback: Is 2014 the year to set up an SMSF? | EvolveMySuper

Comments are closed.