Yes – your SMSF can invest in gold and silver bullion and other precious metals as part of your investment strategy however there are a number of rules that you must comply with. Importantly, an SMSF investment in gold or silver bullion valued entirely on the spot price of the precious metal. Gold bullion is not a collectable therefore the strict rules around SMSF collectibles do not apply.

Important: This article should be read together with our Advice Disclaimer. The information in this article is factual information only and focuses on the superannuation law compliance aspects of these types of investments. This article should not be considered a financial product recommendation or an endorsement to invest (or not invest) in any particular asset or class of assets. For investment advice specific to you, please seek advice from a licensed financial adviser.

Gold and silver collectible coin investments versus physical gold

The value of gold and silver collectible coins is influenced not only by the weight of precious metals they contain but also the decorative art and the number of coins minted. You also need to be careful as gold coins described as “gold bullion coins” can also be considered collectibles. When your hold collectable gold coins inside your SMSF, you face strict regulation. You can’t, for instance, be stored to be shown off in your home or a private residence of a related party. Nor can you lease them to a related party. All decisions around storage of collectible coins must be recorded in writing by fund trustees and the asset must also be insured.

Also read: contact us to find out more

Audit evidence and record keeping for SMSF gold and silver bullion investments

With both bullion and collectables, there are still considerations for you as trustee of an SMSF. You need to keep appropriate records to prove the existence of the SMSF gold and silver investments to the independent auditor of your fund. Where you store the bullion with a reputable mint – such as The Perth Mint – you can get a June 30 holding statement to prove its existence.

Where you hold your SMSF investment in gold and silver bullion in a private vault, safe or a safety deposit box with a bank, it can be problematic for the auditor. This is because it is more difficult for you to prove the existence of your gold or silver bullion investment at 30 June. For this reason Grow SMSF recommends utilising a reputable gold and silver bullion investment provider like The Perth Mint or one of it’s approved distributors who are located across Australia. These distributors can take care of purchasing, sale, storage, insurance and valution of your SMSFs gold and silver bullion and provide all relevant documentation that will assist with the preparation of your SMSF accounts and independent audit.

SMSF investments into gold and silver bullion are attractive for investors as a protective asset during uncertain times, the barrier for SMSF trustees is that it does not provide you with any income while you own it. You don’t get dividends or distributions to help cover pension payments, for instance, but you will need to rely on appreciation in bullion prices at the time you want to sell to provide a return.

Traditionally the alternative to physical gold is to buy gold mining companies on the ASX, but this means you are also taking on the risks of how well managed they are.

Also read: Can an SMSF have a ‘pot of gold’ as an investment?

SMSF investments in gold and silver via ETFs

With the expansion of exchange traded funds (ETFs) on the ASX, SMSF trustees can also obtain exposure to bullion using an ETF without the complexity of storing and managing the physical asset.

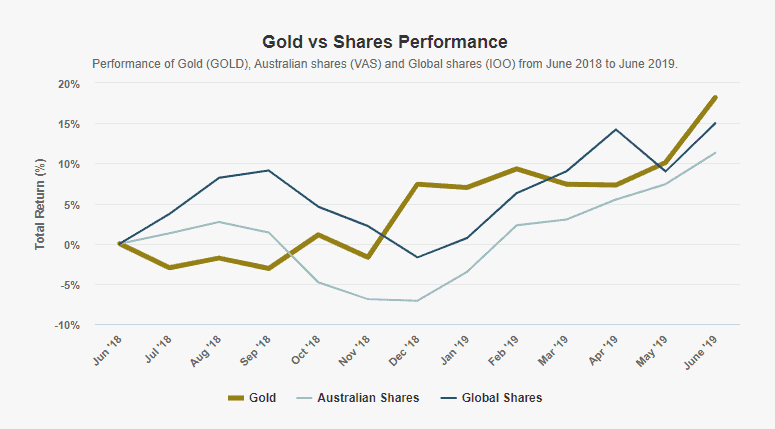

ETF Securities Physical Gold fund is one such ASX fund under the code ASX: GOLD. It gained 30-per cent plus in the past 12 months. This ETF is also used by robo-adviser Stockspot as part of it’s portfolios.

Find more about this here: Why to buy gold as a portfolio diversifier – three reasons we advise clients to buy gold to diversify their portfolios.

Another is BetaShares Gold Bullion ETF listed under ASX: QAU, which gained about 25 per cent over the past year.

Other questions about buying gold using an SMSF

Grow SMSF can also assist you in answering the following questions:

- How to set up an SMSF to buy gold?

- Can I buy gold with my SMSF?

- Can I invest my super in gold?

- How do I buy gold bullion in Australia?

- How is gold investment in an SMSF taxed?

- How to buy physical gold in my SMSF?

- Can my SMSF buy gold through the Perth Mint?

- Is physical gold owned by my SMSF guaranteed by the Government?

- What are the ATO rules on holding gold and other physical metals?

- Can I store my SMSFs gold in my house?

- Is gold bullion a collectible?

How we can help

Grow SMSF assists a sizable number of SMSF trustees with their investments into gold and silver bullion as well as other precious metals. We have significant expertise when it comes to the applicable superannuation rules and regulations, and our independent SMSF auditors have a regular dialogue with the ATO which helps ensure we know what the regulator is looking at when it comes to SMSFs investing in gold and silver bullion.

Depending on HOW you invest your SMSF into gold, silver or other precious metals can have a significant impact on your SMSF administration and audit fees.

If you believe global financial markets are about to implode and the only means to protect your SMSF portfolio from this doomsday scenario is to invest 99% of your fund into physical gold and silver bullion, Grow SMSF is probably not the best specialist SMSF business for you.

If however you have (or are looking to) incorporate physical gold and silver bullion investments of physical precious metal backed ETFs as part of your SMSF portfolio for one of the following three reasons:

- As a diversifier

- As an insurance policy / hedge

- As a safe haven

…then we may be able to assist you.

To learn more about our SMSF administration and advice services, please contact us to find out more or to obtain a fee quote.

Interested in setting up an SMSF?

The following pages provides more information on how you can establish an SMSF: How to set up an SMSF

If you have any questions please contact Grow SMSF.

28 comments

mathew brown

January 21, 2022 at 9:56 am

I am interested in investing in gold and silver for my SMSF / Super

Kris Kitto

January 21, 2022 at 10:00 am

There are lots of options including buying direct from provider or buying an ETF.

I always lean towards the ETFs because they give direct exposure to the asset class without the costs involved in the purchase, storage, insurance and additional compliance cost and time burden.

Bob Loblaw

April 5, 2023 at 2:48 pm

Yes, but with ETFs you also assume counterparty risk vs holding at home. Some of these ETFs aren’t holding physical on your behalf, instead they are selling a right to buy… And if no one is selling or the ETF Issuer can’t obtain the physical, what’s that right to buy actually worth?

Kris Kitto

April 5, 2023 at 2:55 pm

This is why all investors should do their research. The following article by Stockspot has a good summary of these issues: Best Gold ETFs

Specifically:

Luke Searles

July 16, 2022 at 6:53 pm

What are the storage requirements for holding physical gold/silver in smsf?

Kris Kitto

July 17, 2022 at 8:57 am

Assuming the physical bullion is not considered a collectable, it can be stored with a bullion provider such as Perth Mint, Ainslie, ABC Bullion etc, at a secure vaulting facility, or even at home.

Storing physical gold/silver bullion at the personal residence of an SMSF trustee is troublesome. Firstly, it will not be able to be insured, whereas if stored at a vaulting facility it will be covered by their insurance.

Secondly, most vaulting and gold bullion storage providers that cater to SMSFs provide annual audit reports to make the administration of your SMSF easier. When stored at home the onus of providing the audit evidence is on the trustee – i.e. photographic evidence, count sheets, and declarations each 30 June. Some SMSF auditors may also insist a third party (auditor/accountant) inspect the bullion before signing off on the audit report which adds extra fees and costs.

Thirdly, if an SMSF trustee wants to store gold/silver bullion at home, they will need to pay for a safe (yes the SMSF can pay for it) and ensure it is correctly installed. The safe can ONLY be used by the SMSF – the trustees cannot obtain personal benefit from it (i.e. cannot store personal valuables).

Interestingly, precious metals held by Perth Mint are covered by a Government guarantee from the Government of Western Australia.

As an easy alternative to physical metals, an SMSF can purchase gold backed ETFs via their broker. Something like GOLD.ASX is backed by physical gold held in your name by JPMorgan Chase Bank, N.A. (the Custodian) in London.

Sharon Donoghue

November 22, 2022 at 3:22 pm

Great article! I am in pension phase and wanting to close my SMSF. How do I “sell” the physical metal to myself? It is currently held with Perth Mint.

Kris Kitto

November 22, 2022 at 3:31 pm

Very good question!

Doing this incorrectly can cause trouble, so best to seek advice specific to your situation.

Importantly, any pension payments can only be made in cash. You can’t in species assets as pension payments, only lump sums.

You have a few options. You can pay the SMSF cash for the market value of the physical metals. It will need to be minuted with details of the specific assets and their market values at the time of sale. You can commute or partially commute pension accounts and make an in-specie lump sum payment. Once again, documentation is essential.

Again, I MUST say you should speak specific advice for your situation. Although you may have decided to wind up the SMSF, there may be value in keeping money in the super system depending on your age and situation. (THIS IS NOT ADVICE)

Kim

February 23, 2023 at 7:21 am

Hi, should we be concerned about gold and silver confiscation and should we change our bullion bars and coins to collectables? Thanks

Kris Kitto

February 27, 2023 at 11:04 am

That is entirely dependent on your level of paranoia.

Although an SMSF can own collectibles, there are VERY STRICT rules. Learn more: SMSF Collectibles

Gillian

April 14, 2023 at 7:56 am

If you have gold in a SMSF , can you sell some of it and give a pay out to the members if they are not on pension yet.. I.e lets say i am 30 and i use my super to buy gold. In 10 years, i keep on earning super in the fund and I also add more of my own savings to the SMSF to buy more gold. At 40 years old I decide I want to buy a new car, can I take out money from the SMSF? How much can you take out and how is the allowable amount calculated?

Kris Kitto

April 14, 2023 at 8:15 am

No. You cannot do this. It’s illegal early access.

You can’t pull out additional contributions you make to super – whether it’s an SMSF or industry/retail super fund. The only exception is the First Home Saver Super Scheme which has very rigid controls handled by the ATO.

The administrative penalty for illegal early access is 60 penalty units (@ $275/unit = $16,500). Also you’re taxed on the amount you illegally remove, and you will also likely be disqualified as an SMSF trustee and have your name published in both the Commonwealth Government Notices Gazette and the ATO trustee disqualification register. This means your disqualification will be on public record. This can hurt you professionally, personally or financially – i.e. it will come up on future employment checks and when anyone Googles your name.

Anne

December 12, 2023 at 1:11 pm

Hi, Can I buy my bullion (that I own personally) with cash from my SMSF?

Kris Kitto

December 18, 2023 at 12:20 pm

No.

Definitely not. An SMSF is not able to acquire assets from related parties, with a few exceptions (gold is NOT one of them).

There is nothing stopping an individual from selling a personally owned asset, contributing the cash proceeds to their SMSF, then investing via the SMSF as per their investment strategy.

None of the above should be considered personal financial advice.

Darren

March 7, 2024 at 4:05 pm

So I can store my SMSF bullion at home, in a safe dedicated to the SMSF only, insurance is not mandatory, and the responsibility to prove it is currently in my possession is upon me each year? Thanks

Kris Kitto

March 7, 2024 at 4:22 pm

I’ve given up trying to convince people who invest heavily in precious metals to be logical and prudent when it comes to the compliance aspects of their SMSF precious metals investments.

Therefore I see no point in responding and tell you what you should or shouldn’t do because it’s unlikely you will listen.

What I will say is that you need to consider the following trustee duties anyone with an SMSF signs off that they will comply with in the ATO Trustee Declaration including:

– act honestly in all matters concerning the fund

– exercise skill, care and diligence in managing the fund

– ensure that my money and other assets are kept separate from the money and other assets of the fund

– take appropriate action to protect the fund’s assets

Darren

March 11, 2024 at 4:59 pm

Hi Kris, thanks for your response. In fact I will listen, that is why I ask the question.

All of the ATO Trustee Declaration points I will meet, being relatively new to a SMSF I want to get it right.

Mark

October 26, 2024 at 11:45 am

Hi, I already own gold and silver bullion which is stored in 2 overseas locations (BullionVault). I bought this early 2021 and I would like to create an SMSF and place this bullion in it as a way of reducing my tax exposure when I retire in 3 years. Is this possible, and will I incur any tax on the difference between the cost of the gold in 2021 and the current gold price when I move it into the SMSF?

Kris Kitto

October 27, 2024 at 2:47 pm

Your SMSF cannot acquire this bullion that you own personally.

You would need to sell it, contribute cash to your SMSF (subject to contribution caps) and then re-purchase your chosen investments. These are the rules.

Simon

January 27, 2025 at 9:01 pm

Hi Kris,

What if the bullion held personally is transferred to my SMSF via an in-specie transfer as part of a downsizer contribution?

I purchased the bullion some time ago and it has increased in value significantly. I am about to turn 60 and retire.

The SMSF could then sell the bullion once in pension mode tax-free?

Many thanks

Kris Kitto

January 28, 2025 at 7:40 am

You cannot in-specie transfer physical bullion to an SMSF. You can only transfer listed securities, business real property or units in widely held unit trusts. Physical bullion is not one of the exceptions under section 66 of the Superannuation Industry (Supervision) Act 1993 (SIS Act) – so it cannot be acquired from a related party.

So you’d need to go to a bullion dealer, personally sell for cash, deposit the cash into the SMSF bank account, then if bullion is part of your SMSF investment strategy, repurchase under the SMSF.

You may be unhappy that you would incur the transaction fees with a bullion dealer, but it’s a lot better than the alternative: Administrative fines and potential non-compliance of your SMSF.

Any sale of personally owned bullion will also be a capital gain event for you as the seller, so you should seek your own taxation advice on that aspect.

Richard V

July 7, 2025 at 12:23 pm

Hi Grow,

I have purchased both Gold & Silver bullion cast bars for my SMSF from Perth Mint & ABC Bullion am awaiting delivery & intend for it to be held at my residence of which the address is the same listed on the SMSF.

My question refers to what EXACTLY is classed as a ‘Collectable’ in terms of metal bullion?

I am quite frustrated at the moment because none of the distributors can give me an answer, I have gone the cast bar route just to be safe because I know for a fact that cast bars are not classed as collectable however I would much prefer to be holding smaller denominations of the metal such as coins e.g. American Eagle, Canadian Maple, Perth Mint Kangaroo or ABC Bullion Eureka Round.

These may be in coin form however I believe they are investment grade (+999.5% pure) assets that have been a staple of precious metal investors for decades so are these forms also okay to held at the trustee residence in the same way as cast bars are?

Very much appreciated,

Richard.

Kris Kitto

July 7, 2025 at 12:46 pm

For coins specifically, the regulation clarifies that a coin is considered a collectible if its value is derived from factors such as rarity, historical significance, or numismatic value (i.e., value beyond the intrinsic metal content).

Coins held primarily for their investment value (based on metal content) are treated as bullion or investment-grade assets, not collectibles.

The distributors correctly didn’t provide advice on this. They’re not experts on the SIS Act/Regulations.

But you have another item to consider: Are you meeting your trustee duties?

When you signed your ATO Trustee Declaration, you agreed to:

I understand that by law I must at all times:

– act honestly in all matters concerning the fund

– exercise skill, care and diligence in managing the fund

– act in the best financial interests of all the members of the fund

– ensure that my money and other assets are kept separate from the money and other assets of the fund

– take appropriate action to protect the fund’s assets (for example, have sufficient evidence of the ownership of fund assets)

I don’t want a response to the above – it’s a rhetorical question and an item between you and the auditor of your fund.

Max

January 10, 2026 at 4:10 pm

Hi Kris,

I have some bullion purchased by my SMSF. I wish to sell some and reinvest in a different metal in my SMSF.

If I sell some bullion, must the proceeds be deposited into my SMSF bank account, even if I will use the funds to purchase the new bullion, from the same dealer on the same day? They would provide a purchase order invoice and a sale invoice. Any difference (if the new purchase is less than the value of the bullion my SMSF sold would be paid to my SMSF bank account) or additional payment be made from my SMSF ( if the new purchase is for an amount greater than the bullion my SMSF sold?)

The paper trail would clearly show the details of what was sold and its price, while a separate purchase invoice would show the new bullion details and price and could be quickly reconciled by both the accountant and/or auditor.

Regards

Max

Kris Kitto

January 12, 2026 at 9:15 am

Provided you have the invoices/receipts for the paper trail, having cash deposited and then withdrawn is not necessary.

No different to share sales and purchases offsetting each other via a brokerage account.

Hass Herbert

January 12, 2026 at 9:08 am

Hi,

Is it possible to take custody of the physical gold in New Zealand?

Kris Kitto

January 12, 2026 at 9:14 am

I would say no.

Reason is that if you’re a trustee of an SMSF, you need to ensure your SMSF meets the residency rules. If you’re physically living in another country, this will be difficult to show.

Physically holding gold overseas is simply going to open a can of compliance worms you likely don’t want to deal with!

Hass Herbert

January 13, 2026 at 8:14 am

I am an Australian citizen, but it all hinges on residency?