The SMSF Association has retained Rice Warner to update its report prepared for the Australian Securities and Investments Commission (ASIC) in May 2013, Costs of Operating self managed super funds (SMSFs). The updated Rice Warner ‘Costs of Operating SMSFs 2020’ report has been released to the public on Monday 23rd of November 2020.

The research is based on both published fee structures and actual data from more than 100,000 SMSFs. It establishes the size at which an SMSF becomes viable based on a number of assumptions.

This version of the Rice Warner SMSF report is an updated version of the original ‘Costs of Operating SMSFs‘ report commissioned by ASIC in 2013.

Costs of Operating SMSFs 2020 – Key Findings

The Rice Warner SMSF report found that SMSFs with $200,000 or more are cost competitive with both Industry and Retail funds. The $200,000 figure was for a long time used as a benchmark by most financial professionals to determine the level at which an SMSF was appropriate and cost effective to be setup.

Other key finding from the Rice Warner SMSF report include:

- SMSFs with between $100,000 and $200,000 are competitive with APRA regulated funds provided the Trustees use a lower cost service providers (or undertake some of the administration themselves);

- SMSFs with $200,000 or more are fee competitive with both industry and retail funds even when a full service SMSF administration provider is used;

- SMSFs with $250,000 or more actually become the CHEAPEST ALTERNATIVE where either a low cost provider is used OR the trustees undertake some of the SMSF administration themselves;

- SMSFs with $500,000 or more are generally cheaper than BOTH industry and retail super funds regardless of whether a basic, low cost SMSF service is used or a higher cost provider

The above findings echo what many advisers who work with SMSF trustees have said for many years.

Are SMSF fees falling?

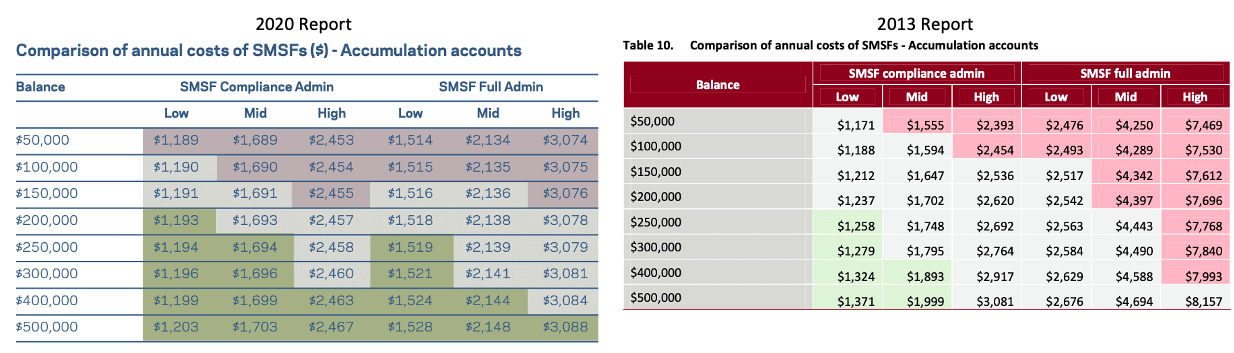

According to the Rice Warner SMSF report, yes the fees relating to running an SMSF have fallen over the last seven years between 2013 and 2020.

However, the greatest reductions in SMSF fees are at the higher end – i.e. full service SMSF administration fees have fallen significantly whereas low-end basic SMSF fees have remained relatively stable.

Compared to the average SMSF fees, the costs in the table are actually quite low. This is because of a different methodology used in the Rice Warner SMSF report compared to other statistic data from the ATO and software providers such as Class Ltd and BGL.

Another interesting difference between the the 2013 and 2020 SMSF reports is that for a self-managed super fund with a $50,000 balance, a low cost SMSF administration fee ($1,171 in 2013 versus $1,189 in 2020) is no longer ‘within range’ of retail and industry funds. Although this fee has increased by $17 dollars over the 7 years, it’s also likely that the fees applicable to industry and retail super accounts have also decreased over this time.

Other findings from Rice Warner

The Rice Warner SMSF report (Costs of Operating SMSFs 2020) also found the following:

- SMSFs with less than $50,000 are more expensive than all alternatives;

- SMSFs with between $50,000 and $100,000 can be cheaper than the most expensive APRA funds;

- SMSFs of between $50,000 and $100,000 would only be appropriate if they are expected to grow to a competitive size within a reasonable time. The analysis of these small funds over time shows that the majority of these funds do, in fact, grow.

- The majority of SMSFs with low balances either grow to competitive size or are closed. Those that remain are generally remnant funds on low fees.

- SMSFs with $100,000 to $150,000 are competitive with APRA regulated funds provided the Trustees use one of the cheaper service providers or undertake some of the administration themselves

- The SMSF sector has delivered equivalent returns to those of the APRA sector since 2005 in both good years and bad years.

- SMSFs holding direct property are more expensive

Low / Mid / High SMSF annual compliance fees

-

Financial Statements & Tax Return – $525

-

Audit – $350

-

Total – $875 + $259 ATO SMSF Levy & $55 ASIC fee for company trustee

-

Financial Statements & Tax Return – $880

-

Audit – $495

-

Total – $1375 + $259 ATO SMSF Levy & $55 ASIC fee for company trustee

-

Financial Statements & Tax Return – $1500

-

Audit – $639

-

Total – $2139 + $259 ATO SMSF Levy & $55 ASIC fee for company trustee

It’s important to note that the above are for the bare-bones statutory requirements for an SMSF – i.e. the annual financial statements, tax return and audit. It does not including online up to date investment reporting, tracking on contributions or monitoring or management of pension accounts within the SMSF.

Where to obtain the Costs of Operating SMSFs 2020 report

The full report can be downloaded from Rice Warner here: https://www.ricewarner.com/cost-of-operating-smsfs-2020/

Members of the SMSF Association can download the report here: SMSF Week 2020 – Costs of Operating SMSFs 2020 – Your Industry Takeaways

If you’re an SMSF trustee or not a member of the SMSF Association, you can join the free community here (report will be made available): SMSF Connect

One comment

Pingback: How much super do you need to set up an SMSF?