Superhero has launched a low cost share trading solution in Australia today with share trades at a flat cost of just $5.00 per trade.

This is my review of the Superhero $5 trades service after I signed up for a personal individual account on launch day.

I’ve not been paid to write this review and I have no personal or professional association with Superhero, Superhero Markets Pty Ltd or any individual associated with them.

Superhero Signup

Signing up for Superhero was exceptionally easy. I signed up via my laptop during my lunch break however it could have been done using a mobile web browser just as easily.

I had to enter all the basic details for my Superhero account:

- Name

- Address

- Mobile Number

Superhero used 2-factor authentication via text messages as well as verification of your email address via the sign up process.

One thing that surprised me via the sign up process is that I didn’t have to enter or provide drivers licence details or a tax file number. Apparently the above information is enough to set up a new Superhero trading account under their model.

The Superhero website FAQs Superhero website FAQs don’t mention anything about this.

Superhero Cash Funding

I funded my Superhero share trading platform account with the minimum of $100 to get started.

I used PayID and followed the instructions on their website with the reference number I was provided. I used PayID from a Macquarie Platinum Transaction account and the $100 arrived into the Superhero ‘wallet’ in about 15 minutes. Yay for the New Payments Platform!

Cash Wallet

The cash wallet is interesting. They’ve chosen to work with NAB. The cash wallet is NOT in your name, it’s in the name of Superhero Nominees Pty Ltd ABN 68 642 021 823 AR No. 1282849. This is a separate company to Superhero Markets Pty Ltd which is the ‘business’.

According to the Superhero financial services guide (FSG) the cash is held via a ‘bare trust’ arrangement on your behalf:

“Superhero Nominees will hold on bare trust all financial products acquired by clients and any cash deposited by clients with Superhero through the Superhero Platform. Clients will be able to provide instructions or deal in financial products via the Superhero Platform or by telephone. Superhero Nominees is authorised by Sanlam Private Wealth to provide custodial or depository services (other than investor directed portfolio services) to wholesale and retail clients.”

This might sound unusual, but it’s a common approach. You are the end beneficial owner of the account. You have entitlement to all the monies in your cash wallet, but legally they’re being held by Superhero Nominees Pty Ltd on your behalf.

There are a number of reasons they’ve liken chosen to setup the accounts this way. Firstly, it’s quick and easy as you’re not the one applying to open a bank account (hence a smoother process) and the account is already open in the name of Superhero Nominees. Secondly, it gives them full visibility on your available cash balance therefore it removes the possibility of trades not settling due to lack of funds in the account.

Hopefully they see the irony that their tag line is “Your Money. Your Move” (this is not a criticism, legally it is your money and you are the only person entitled to it!).

Sanlam Private Wealth

Superhero is a authorised representative of Sanlam Private Wealth. Sanlam is also the AFSL (Australian Financial Services Licensee) for other notable FinTech companies such as Stockspot, Stake and Maqro Capital.

Exploring the Platform

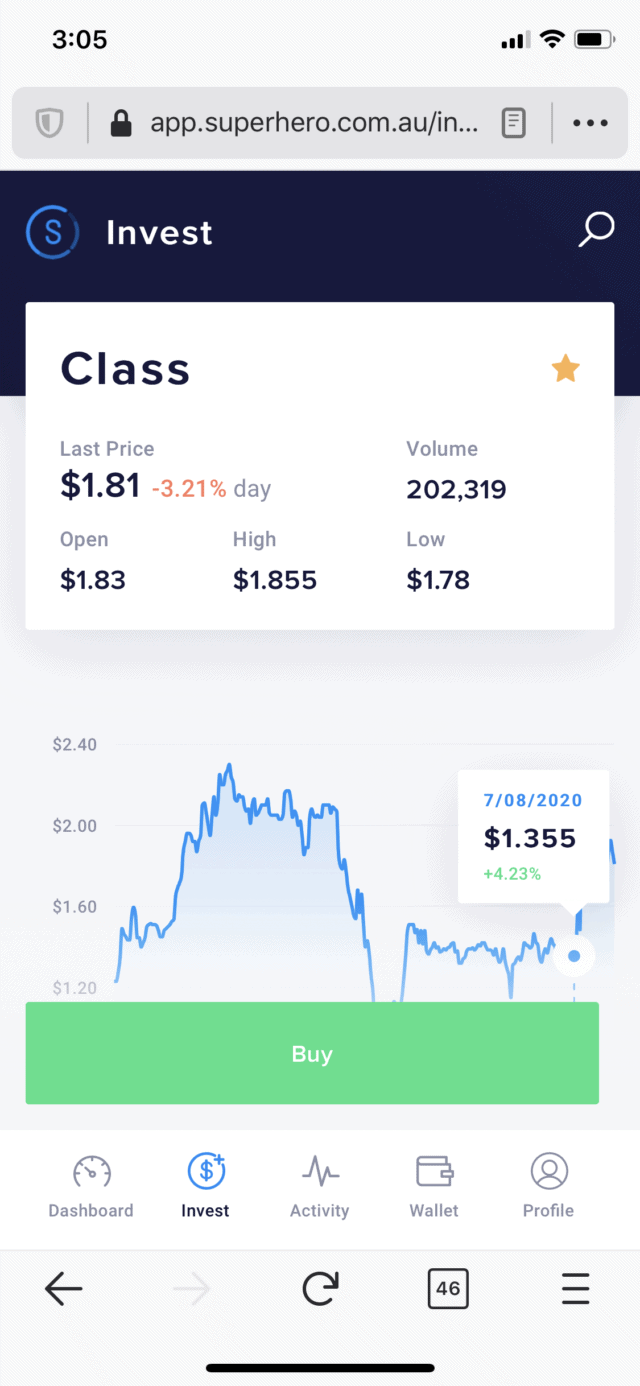

The Superhero platform and ‘trade pad’ is very clean and relatively intuitive.

I found it easy to navigate around and explore key areas including:

- Searching for specific stocks

- Adding ASX stocks and ETFs to a watch list

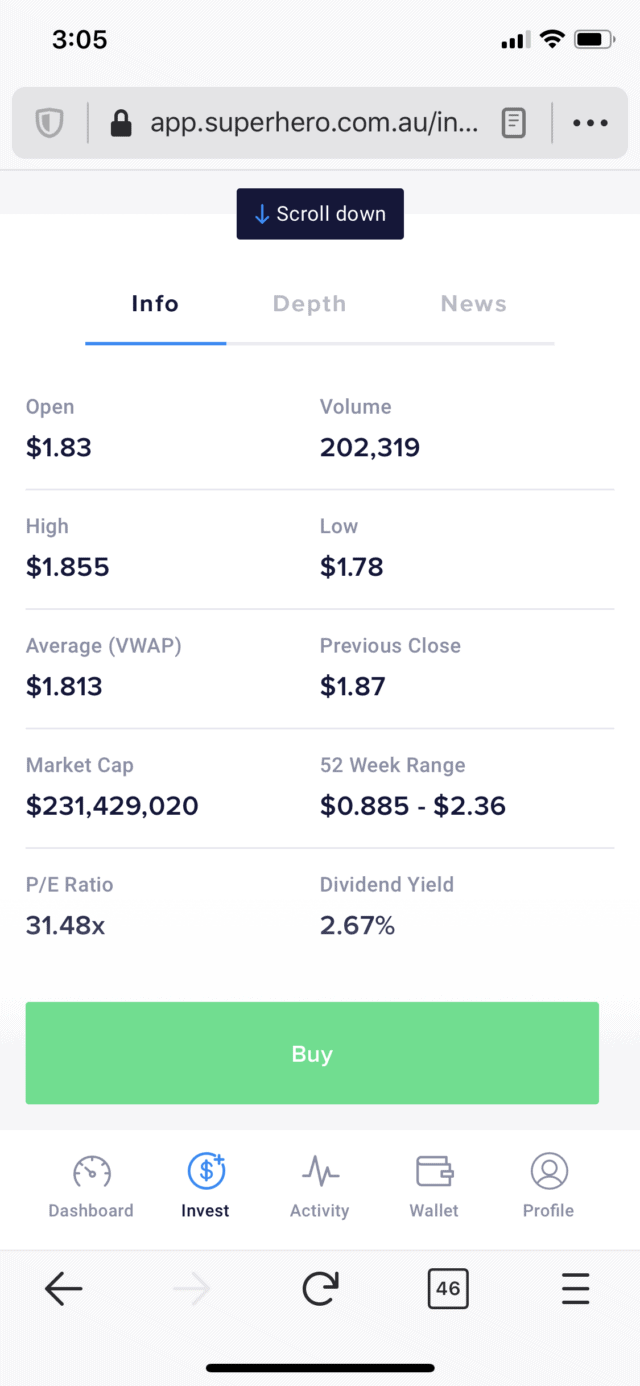

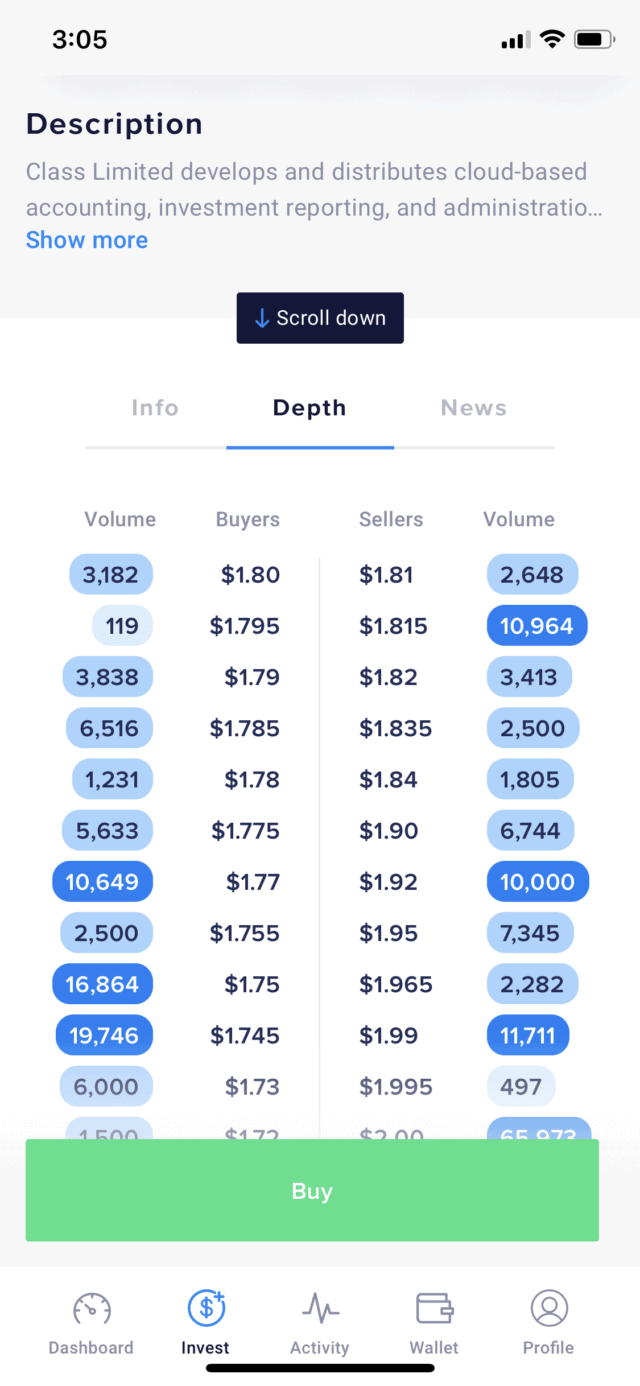

- Checking high level information such as market info (opening / closing prices, market cap etc) as well as market depth and the latest news

- Finding my wallet and adding a linked bank account to enable withdrawals (according to their site, withdrawals can take up to 2 business days which is quite normal with these types of platforms)

- Checking live pricing of particular ASX securities

I felt very comfortable exploring the platform. I used it across both a web browser as well as my mobile phone and it’s very uncluttered. There is no research information or detailed stock analysis on the platform – it’s more of a pure trading solution. I actually found the mobile browser version slightly faster compared to the desktop version as part of my Superhero review.

They’ve not built native iOS or Android apps yet, but no doubt if demand warrants it in the future they will likely build them out.

I think one of the reasons I felt comfortable with the interface was that it contained information that felt very familiar, as they use OpenMarkets as their underlying broker that actually executes the trades on the ASX.

Making a Trade

To make a trade on the platform, the minimum amount it invest must be more than $100.00 (before brokerage). As I mentioned earlier in this review, I only transferred $100 into the cash wallet, so I was unable to buy any stocks without topping up an extra $10.00 dollars.

Typically I wouldn’t make a trade with such a small amount, however I’m happy to drop $5.00 per trade for the purpose of this review of Superhero.

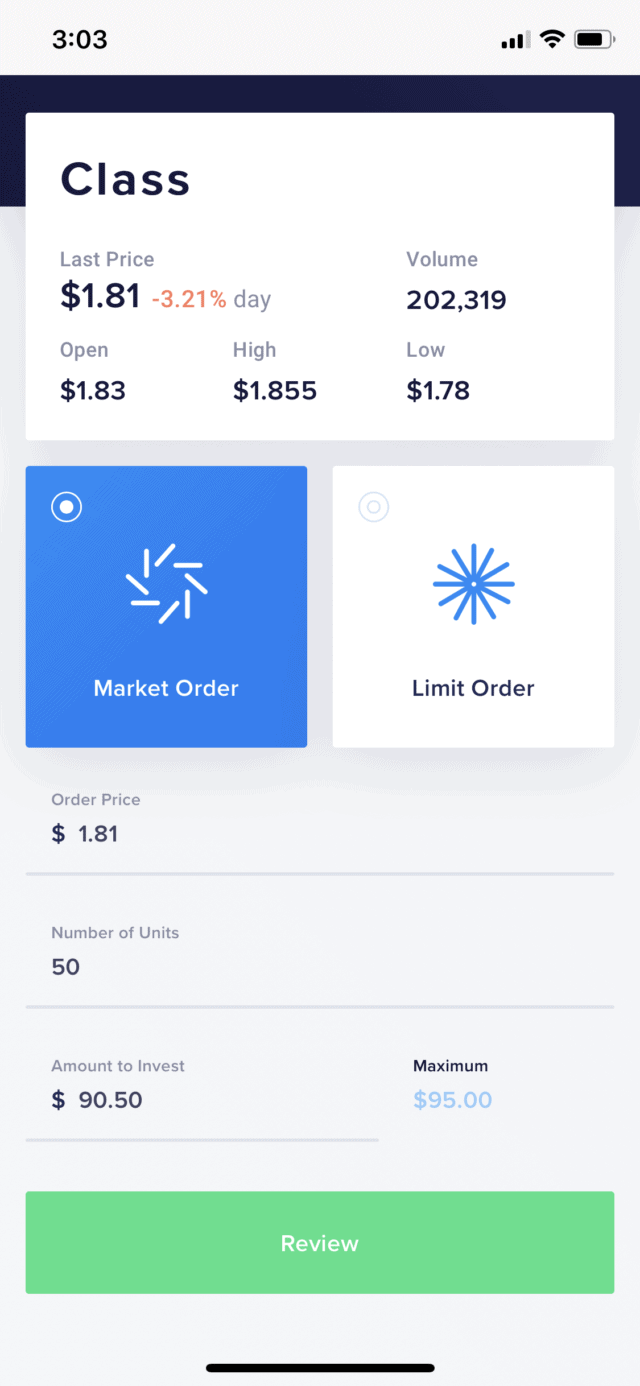

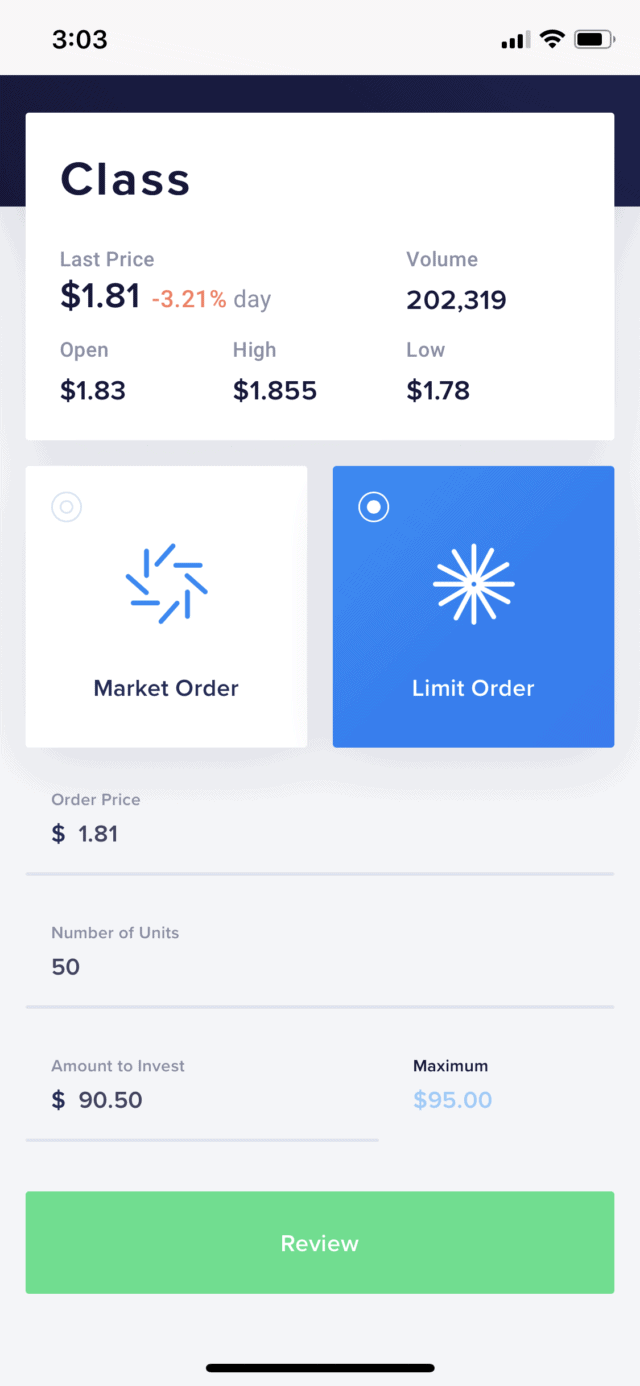

Trading gives you the two key options:

- Market Order (where you basically take the lowest sell price being offered on the market) and;

- Limit Order (where you set the price you want to pay / receive for the stock)

When you review your order, and then confirm to place the order, you get sent a text message with a 6 digit code to enter before the trade is executed. This caught me by surprise and if I was rushing to execute a trade on a fast moving stock, it would likely add valuable seconds. I’m more of a ‘buy and hold’ kinda guy – so an extra few seconds doesn’t concern me.

I attempted to complete a market order for a small number of shares in a company I am familiar with. Unfortunately for me, both orders failed. I received a text message confirming the failure of my order which asked to to login to Superhero for more information, however with the exception of the Pending orders tab showing two failed orders, there was no additional information.

I will forgive this as Monday 7th of September 2020 was the very first day they went live, or it could have been a user error.

Subsequently I placed a limit order at $0.01 above the market price just after 4.00pm when the market closed and it was processed immediately upon market open the next day. I received a confirmation text message and a PDF of the contract note was available via the Supehero dashboard, listing OpenMarkets as the executing broker in the fine print.

Who is OpenMarkets

Superhero uses OpenMarkets as its underling broker to execute its $5 trades on the ASX.

You likely have never hear of OpenMarkets, however they are the fourth largest and fastest growing retail broker in the country and turnover more than $40 billion in trades per year:

- Commsec / Westpac Online

- CMC Markets (ANZ, Suncorp etc)

- WealthHub (aka NABTrade)

- OpenMarkets

- Morgans

- Bell Potter

Although you’ve likely not seen the name OpenMarkets in the retail investing world, you may have heard of some of their clients including SelfWealth, robo-advisors SixPark and Stockspot, micro-investment solution Raiz (formerly Acorns AU) and Clover (automated investing).

OpenMarkets is a technology company that provides white-labelled trading solutions to FinTech companies such as Superhero and the above cohort. OpenMarkets is has a retail broking solution called OpenTrader which has broking fees starting at $5 per trade for amounts up to $5,000.

I’ve personally used OpenMarkets as the broker for my self-managed super fund (SMSF) and family trust broker accounts for a number of years so I am very comfortable with their ability to execute trades cleanly, quickly and at low cost. They’re now more focused on providing the trading infrastructure for the likes of Superhero and SelfWealth to trade through which enables these companies to build there own trading solutions on top of the OpenMarkets technology.

Do you get a HIN with Superhero?

No. According to their website, “your shares are held securely on a special purpose HIN on ASX’s CHESS system to safeguard all of your financial assets.”

Putting this differently, its similar to having a ‘wrap’ account as custodian – i.e. something like a Hub24, Netwealth, Macquarie or BT Wrap etc.

You maintain beneficial ownership, however legally any investments are held in the name of Superhero Nominees on your behalf. For some people this might not be an issue – provided you get all the benefits of direct ownership, does it really matter?

For some people yes, the lack of separate personalised HIN may remove the feeling of control. The Australian CHESS system is old, but its unique and we Aussies love knowing that our shareholdings are in OUR NAME and we have both the legal and beneficial ownership of our investments. Having worked with SMSF trustees for close almost 20 years people with a self-managed super fund typically feel this way.

For comparison, with both SixPark, Stockspot and SelfWealth who both also use OpenMarkets as their executing ASX broker issue investors with their own HINs.

Can Superhero invest your super?

No – not at this stage.

They’ve listed trust accounts as coming soon so with an self-managed super fund (SMSF) being a type of trust, it may be an option down the track.

One key benefit a solution like Superhero may have for SMSF trustees is that compared to an investment wrap account, there are no percentage based administration or investment fees. That said, this can be said for all share portfolios held under a HIN, so although trading costs are super low, the savings only eventuate if people are actually making trades.

To make Superhero suitable for SMSFs the reporting functionality would need to be built out and also integrations with the key SMSF administration platforms such as Class Super and BGL. However I don’t see an alignment between people who want an SMSF and those who are comfortable not having their own unique HIN.

Superhero could obtain the holy grail and link up with an APRA-regulated superannuation trustee to provide transparent, low cost trading for people wanting extra control over their investments and put them in a similar category to the member-direct options of many industry super funds.

Superhero FAQs

Can you trade on unsettled funds?

Yes. You may use Unsettled Funds for trading. Please note your current Available Funds balance already includes the amount in your Unsettled Funds.

Is the pricing live?

Live pricing is available free for the first 30 days. After that you pay $108 ($9/m) for live pricing.

Does the Superhero trading platform provide research and detailed analysis of stocks?

No. It provides basic information in trading volumes, high/low pricing, pricing history and market depth.

Is there are watch list function?

Yes. You can favourite / star stocks you want to follow. In that regard as well as how the ASX shares are categorised and grouped it’s similar to how Stake works for US stocks.

Can you buy overseas or US stocks using Superhero?

No. You have access to the ASX only. Look at something like Stake for access to US stocks.

Can you set up an account for a company, trust or SMSF with Superhero?

No. The platform is currently only available to individual accounts.

Where to dividends get paid?

Good question. Under their beneficial ownership model, your holdings are pooled with other Superhero accounts under their HIN, so it’s likely that you will receive an entitlement to dividends. They should issue you an annual tax statement with details of the dividends and applicable franking credits.

You can view more Frequently Asked Questions here: Superhero/FAQs

What reports and reporting functionality is there?

The following reports can be generated for last month, last financial year, current financial year as well as for custom periods:

- Portfolio Valuation Report

- Shows you all of your current holdings with a summary of the gains or losses on each holdings at the selected date.

- Transaction Statement

- Shows you all transactions on your account between the dates selected.

- Cash Statement

- Shows you all of the cash movements on your account between the dates selected

- Unrealised Gain Report

- Shows you all of the unrealised gains and losses on your current holdings at the selected date.

- Realised Gain Report

- Shows your realised gains between the dates selected.

- Realised Gains Detail Report

- Shows you a detailed breakdown of your realised gains between the dates selected.

- Fees & Expenses

- Shows you all of the fees and expenses charged to your account between the selected dates. This does not include brokerage, which is capitalised and forms part of the cost base of your investments.

All the above reports can be generated in PDF or .csv (excel) format so can also be potentially imported into 3rd party applications.

Are the reports audited?

The above reports are not audited.

Superhero Review Summary

The key attraction obviously with a platform like this is the price. $5 per trade is extremely cheap, however its important to understand that the business is in it’s infancy. Offering $0 commission trades on ETF purchases is also a smart move at that will attract a wider customer base and provide them with more leverage as they expand the product out.

The low-friction and ease of setup was refreshing. I admit it was the first time I’ve actually got to use PayID with my bank to fund the Superhero account.

Although they’re live, it will take them a bit of time to flesh out all the features of the platform, such as different account types. Since Superhero was first launched they’ve improved their reporting functionality which is useful.

Fortunately for Superhero, according to the Financial Review they’ve got the backing of the founders of Zip and Afterpay backing them so hopefully funding will not be an issue as they are in for a marathon – not a sprint.

Currently Superhero is only available to simple personal / individual accounts. There is no ability for companies, trusts or SMSFs to open an account. No doubt they will build out a solution for these types of accounts in the future.

Obviously the pricing is great but it comes with a trade off. The lack of an individual HIN and their beneficial rather than legal ownership model is not my personal preference.

I wish the team behind Superhero the best. Their $5 flat trades will generate interest – it certainly did for me, but competition is tough. SelfWealth‘s popularity has surged recently, as has Stake when it comes to a solution for buying US stocks from Australia.

It’s quite possible Superhero will find it’s niche somewhere between the Raiz micro investing solutions and the more fully functional SelfWealth and Commsec type solutions that are out there. I wish them all the best.

Related Articles

The following articles may also be of interest.

Taking the first step is simple.

You can set up a new SMSF, obtain a fee quote for your existing fund or schedule a time to discuss your needs.