Let’s take a look at SMSF loan offset accounts for investment property loans taken out by SMSFs, also known as limited recourse borrowing arrangements.

What is an offset account?

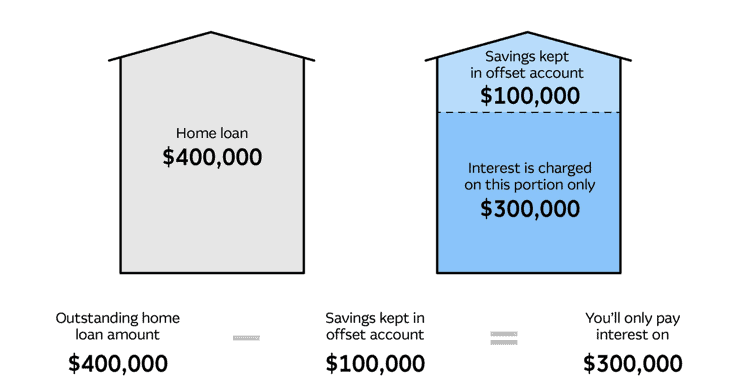

An offset account is a bank account linked to a mortgage. The account doesn’t pay interest, but the balance is subtracted from the amount owing on the mortgage, and interest is only calculated on the remaining balance. For example, if you have a $400,000 mortgage and a $100,000 balance in the offset account, interest is only calculated on $300,000.

How does an offset account impact the loan?

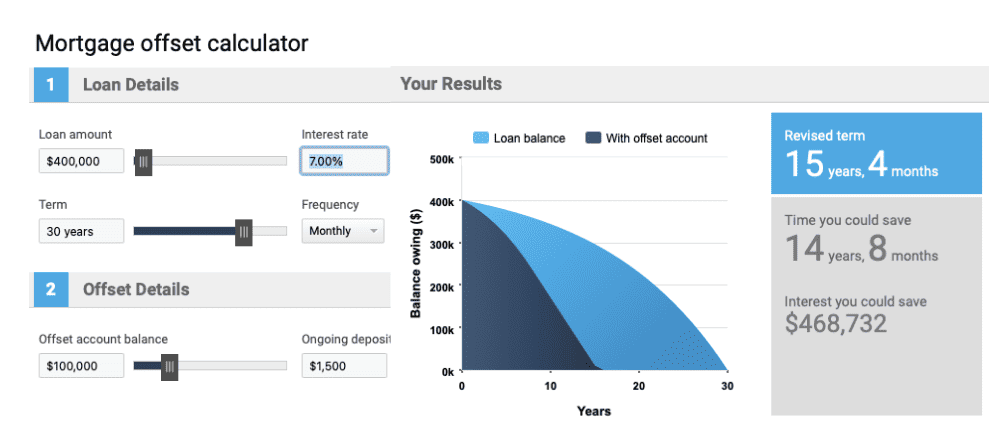

An offset account will reduce the time to pay off the mortgage. This is because, with each repayment, a larger portion of the regular payment is allocated to reduce the loan principal.

Benefits of an SMSF loan offset account

SMSF loans (also known as LRBAs – Limited Recourse Borrowing Arrangements) have many restrictions compared to regular investment loans.

For example, an SMSF loan cannot have a redraw facility (unless only used for repairs and maintenance), and equity that builds up in the SMSF property cannot be accessed as the loan is paid down.

An offset account for an SMSF loan allows surplus funds, such as cash from regular employer and personal contributions, to build up while reducing the interest calculated on the SMSF loan.

Money in the offset account can be withdrawn anytime and used for future investment within the SMSF. This could include investing in any other asset class or funding a deposit for another property under an LRBA structure.

Are SMSF loan offset accounts legal?

Most banks no longer offer SMSF loan products. Many specialist non-bank lenders now service the SMSF loan market but cannot accept customer deposits.

In addition, to comply with superannuation laws, the SMSF loan agreement cannot allow the lender to have security or a charge over the offset account or any claim over the offset account in the event of default. The lender’s recourse must be limited to the property only.

In May 2025, the ATO has updated their website content (QC103937) and provided the following:

A deposit facility offered by an Authorised Deposit-taking Institution (ADI) that is an offset account notionally reduces the loan balance of a mortgage, resulting in a reduction of interest calculated against the loan. Genuine offset accounts offered by an ADI are allowed as it’s not considered a borrowing or charge over the fund’s assets.

Offset accounts offered by non-ADI lenders are not considered bank deposits. Therefore, due diligence should be taken when considering this type of arrangement.

Helpful? Not really. The ATO isn’t saying whether LRBA offset accounts are compliant or not, but it is recommending that the loan agreements be reviewed to ensure there are no compliance issues.

According to legal experts, “It is important to check whether a non-ADI lender has a charge in respect of the amount in an offset account. The term ‘charge’ is defined in reg 13.11 as ‘charge includes a mortgage, lien or other encumbrance’,”

The Australian Taxation Office (ATO) imposes significant penalties for breaches related to charges over SMSF assets, particularly under regulation 13.11 of the Superannuation Industry (Supervision) Regulations 1994 (SISR). This regulation prohibits SMSFs from granting charges over their assets unless it relates to a permitted borrowing arrangement under section 67A of the Superannuation Industry (Supervision) Act 1993 (SISA).

Breaches of borrowing rules (e.g., impermissible charges like an SMSF lender having a charge over an offset account) fall under section 67(1) of SISA, attracting 60 penalty units per trustee. As of November 2024, each penalty unit is $330, meaning a single trustee could face up to $19,800 for a 60-unit penalty.

If you are an SMSF trustee looking at using a lender with an offset account, you should ask the lender in writing whether the offset account they provide complies with section 67A of the Superannuation Industry (Supervision) Act 1993 and also whether the rights they have under the loan agreement are considered a prohibited charge under regulation 13.11 as per the Superannuation Industry (Supervision) Regulations 1994.

Although not lawyers, Grow SMSF has reviewed some loan agreements from popular non-bank SMSF lenders. Some of the agreements have problematic and contradictory clauses. If SMSF trustees are in doubt, they should first ask the lender directly about the offset account’s compliance and also consider obtaining their own separate legal advice.

What lenders currently offer SMSF loan offset accounts?

At the time of writing, the following non-bank lenders have SMSF loan products with an offset account:

- Granite

- GreenHouse

- Better Mortgage Management

- Mortgage Ezy

- WLTH

- Reduce Home Loans

- Homestar Finance

- Yard Home Loans

Please note that the above list is not comprehensive and subject to change, and it cannot be considered a recommendation for a credit product.

How to use an offset account with your SMSF

To get the most benefit from your SMSF loan offset account, consider the following:

- Move all excess cash from your SMSF savings or transactional account into the offset account, ensuring you leave enough money in your transactional account (CMA) to cover regular expenses such as fees, insurance premiums and taxes.

- Instruct your property manager to deposit rental income into the offset account.

- Nominate the offset account to be debited by your SMSF lender for the regular monthly loan repayments.

- Have your employer(s) pay contributions directly into the SMSF offset account or set up a recurring payment from your cash transactional account (CMA) to automatically move employer contributions across.

The overall goal is to maximise the offset account balance while ensuring enough funds are in your transaction account (CMA) to keep the SMSF running smoothly.

Should you choose an SMSF loan with an offset account?

SMSF loan products with offset accounts are popular with borrowers because of their flexibility.

However, a legitimate and complying SMSF loan offset account is not the only aspect of an SMSF loan that should be considered. SMSF borrowers should consider interest rates and other applicable fees when deciding if a loan product suits them.

DISCLAIMER: The information in this article is general only and cannot be considered personal financial advice. For guidance on SMSF lending products, seek advice from a licensed mortgage broker.

One comment

Grow SMSF

June 26, 2025 at 10:22 am

The following commentary is from Shelley Banton, Head of Technical at ASF Audits. Grow SMSF uses the services of ASF Audits.

_____________________________________

“The ATO contribution to this discussion is that the non-ADI offset accounts aren’t bank deposits,” she said.

“We already know that, but we don’t know whether the offset is an asset of the fund and if it’s not, is it a redraw facility which then sets up a new LRBA each time the trustee draws down on it.

“The solution at this point is to put the onus back on those non-ADIs that are offering this structure and the SMSF Association and the ATO recommend they obtain a product ruling or a legal opinion.

“We’re still waiting to hear about those and I think that we will continue to wait.

“So audits will still need to address this through the management letter and if the ATO updates their view with a clearer decision, then we will obviously be able to update our opinion.”

_____________________________________

In summary, no further action is required for most SMSF trustees.

If your SMSF auditor has concerns with the wording in the agreements from the non-bank SMSF lender, they should raise them in the management letter.

Then, as trustee (borrower), you can contact your SMSF lender directly to get a response about how the loan agreements and offset accounts comply with the SIS Act and Regulations.

Don’t be surprised if SMSF lenders start removing their offset accounts. My opinion is that the lenders want it both ways: They want to be able to offer the product, but they also want to have ‘security’ over any SMSF money that sits in the offset account – which they’re not allowed to do.