In June 2020 rules were passed which increased the work test age for superannuation contributions from 65 to 67. Further law changes have now been made that also pushes out the bring-forward rule for non-concessional contributions from age 65 to age 67. This change enables people aged 65 and 66 can use the superannuation bring forward rule. The combination of these changes with the superannuation preservation age remaining at age 65 boosts the opportunity to implement a super re-contribution strategy.

UPDATE 24 June 2021: The SMSF Association has confirmed with Treasury that although the new law allowing people age 65 and 66 to use the bring-forward commences 1 July 2021, it applies to any non-concessional contributions made from 1 July 2020. This means someone aged 65 or 66 can make a $300,000 non-concessional contribution before 30 June 2021 and not have an excess contribution!

What is a re-contribution strategy?

A re-contribution strategy involves withdrawing money from superannuation as a pension or lump sum payment and making subsequent non-concessional contributions prior to commencing a new pension with those amounts.

The withdrawal and re-contribution of superannuation benefits changes the underlying tax components of those benefits to ‘tax-free’. Although any withdrawal of superannuation as either a lump sum or pension for a person over the age of 60 is not taxable, upon their death any remaining benefits paid to their beneficiaries incur tax on the taxable component.

In simple terms, a re-contribution strategy reduces tax payable on superannuation death benefits paid to adult children.

Taxation on superannuation death benefits

To understand why a re-contribution strategy may be worthwhile, it’s important to understand how super benefits are taxed when a member of an SMSF dies:

Key Terms:

- Dependent: Under tax law – spouse (including de facto, former spouse and same sex spouses), child under 18, person in an interdependency relationship.

- Non-Dependent: Typically, an adult child is the key person who can receive a super death benefit but will not be considered a dependent for tax purposes.

- Tax Free Component: Generally made up of non-concessional contributions.

- Taxable Component: General made up of concessional contributions and earnings.

- Taxed Element: Tax has previous been paid on these amounts.

- Untaxed Element: Tax as previously not been paid on these amounts.

More information on the above can be found here: Superannuation dependents under tax and super law

When a superannuation death benefit is paid to a deceased estate, the taxable component is taxed as income to the estate at 15%, and when the distribution is made from the estate to the non-dependent beneficiary, no further tax or Medicare Levy is payable.

Re-contribution strategy calculator

To determine the potential value of a re-contribution strategy, the easiest way is to use the following formula:

Amount re-contributed ($) x taxable component (%) x 15%*

*If the superannuation death benefits are likely to be paid direct to a non-tax dependent such as an adult child, rather than to the members estate, use 17% rather than 15% to include the Medicare levy.

Re-contribution strategy calculator example:

Simone is undertaking a re-contribution strategy aver a number of years and will re-contribute a total of $500,000 over that period. The taxable component of Simone’s account is 80% and she has nominated her estate to receive her superannuation death benefits when she dies. The calculated value of a re-contribution for Simone is as follows:

$500,000 x 80% x 15% = $60,000

‘Magic window’ for superannuation re-contribution strategies

The work-test requirement has been pushed out to age 67, and the ability to trigger the two year bring-forward rule for non-concessional contributions has now also been extended to people to age 67.

The change, as part of the Treasury Laws Amendment (More Flexible Superannuation) Bill 2020 applies retrospectively to non-concessional contributions made from 1 July 2020.

Importantly, there have been no corresponding increases to the preservation age which determines when you can make lump sum withdrawal from super.

When a person turns age 65, they’ve triggered a condition of release meaning all their superannuation benefits can be accessed and withdrawn from super. This means we have a ‘magic window’ between the ages of 65 and 67 where a recontribution strategy can easily be implemented.

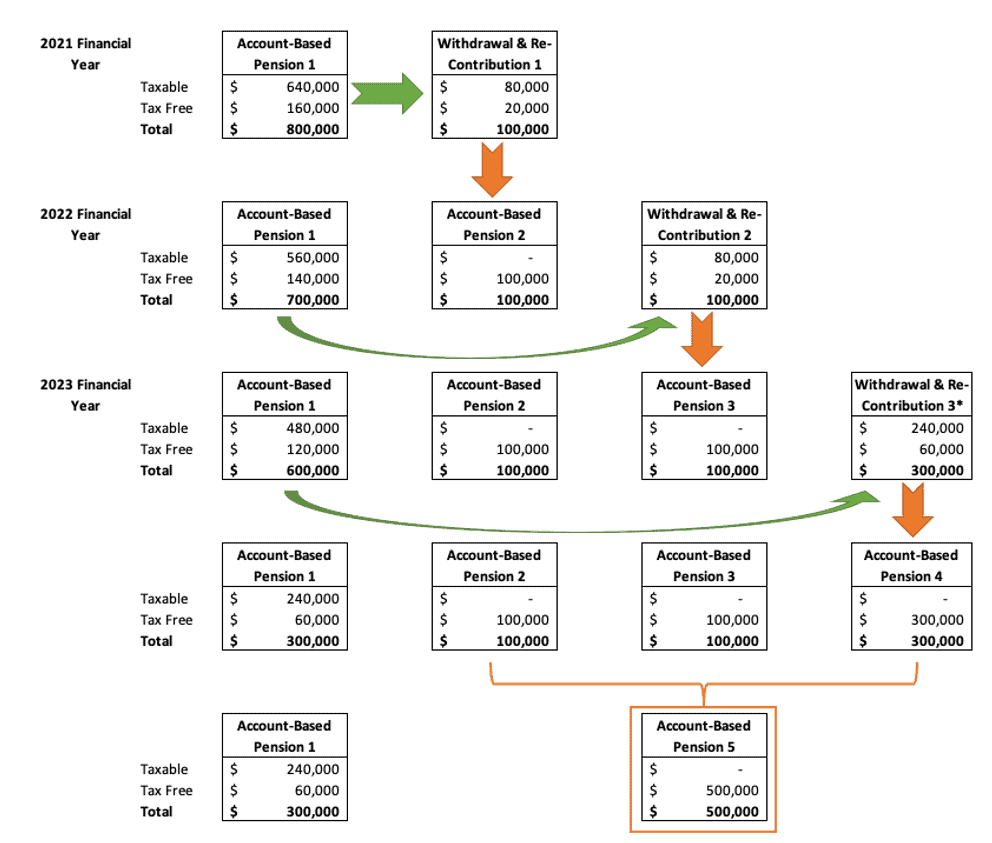

Re-contribution strategy example 2020-21

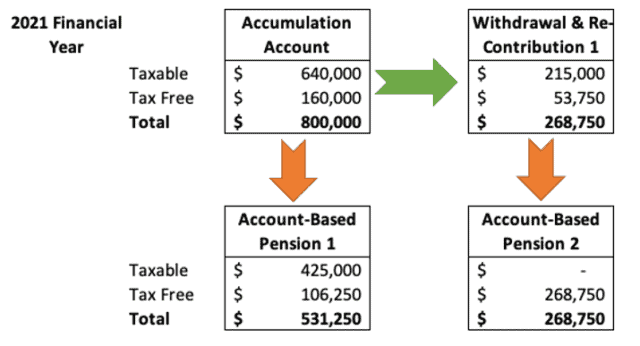

Simone turned 65 on 08/08/2020 and has just retired and commenced an account-based pension valued at $800,000 from her SMSF with the following components:

- Taxable Component – 80% ($640,000)

- Tax-Free Component – 20% ($160,000)

Simone is the sole member of her SMSF and has a binding death benefit in favour of her legal personal representative (estate) for the entirety of her superannuation benefits. Simone has two adjust children who will receive 50% each from her estate as per her recently updated Will.

Simone only expects to withdraw the required minimum pension from her account-based pension, therefore doesn’t expect to eat into capital for at least another 10-15 years.

If Simone passed away and a superannuation death benefit was paid to her estate for $800,000, the tax paid by the estate would be:

- Taxable Component: $640,000 x 15% = $96,000

- Tax-Free Component – $160,000 x 0% = $0

By comparison, if Simone had put in place a binding death benefit nomination to her adult children (50% each again), the total tax payable on the $800,000 in death benefits would be $108,800 (15% + 2% Medicare Levy x $640,000).

Let’s take a look at how a re-contribution strategy would be implemented for Simone:

*Withdrawal & Re-Contribution 3 for $300,000 must occur prior to Simone turning age 67 on 08/08/2022.

Step 1:

In the 2021 financial year, Simone will complete the following transactions:

- Commence Account-Based Pension 1 (e.g. on 1 July 2020) from the full amount of her $800,000 accumulation account

- Withdrawal the required minimum amount (or pro-rata minimum) for the period from 1 July 2020 to the date of the partial commutation

- Make the partial commutation from Account-Based Pension 1 for $100,000 (e.g. in June 2021)

- Re-contribute the $100,000 as a non-concessional contribution in June 2021 and immediately commence Account-Based Pension 2 (no minimum drawdown required prior to 30 June 2021 if pension commenced in June)

Step 2:

In the 2022 financial year, Simone will complete the following transactions:

- Withdrawal the required minimum amount for the period from 1 July 2021 for both Account-Based Pensions 1 & 2

- Make the partial commutation from Account-Based Pension 1 for $100,000 (e.g. in June 2022)

- Re-contribute the $100,000 as a non-concessional contribution in June 2022 and immediately commence Account-Based Pension 3 (no minimum drawdown required prior to 30 June 2023 if pension commenced in June)

Step 3:

In the 2023 financial year, Simone will complete the following transactions:

- Withdrawal the required pro-rata minimum pension for the period 1 July 2022 to the date of the partial commutation of Account-Based Pension 1 (e.g. 31 July 2022)

- Make the partial commutation from Account-Based Pension 1 for $300,000 (e.g. at 31 July 2022)

- Re-contribute the $300,000 as a non-concessional contribution prior to turning age 67 on 08/08/2022 and immediately commence Account-Based Pension 4 (as it’s not expected that Simone will meet the work test in the 2023 financial year)

- Withdrawal the required minimum amount for the period from 1 July 2022 for Account-Based Pensions 2 & 3 as well as the pro-rata minimum amounts for Account-Based Pensions 1 & 4

Step 4:

- Although not essential, for administrative simplicity, the 3 new Account-Based Pensions (2, 3 & 4) can be consolidated into a single Account-Based Pension (5) as at 1 July 2023

Importantly, each financial year the SMSF would need to lodge the relevant partial commutations and pension commencement transactions with the ATO under the transfer-balance cap reporting regime (TBAR).

As Simone’s total superannuation balance is under $1m (and she is the only member of the SMSF) this reporting is annually. If Simone (or any member within her SMSF) had a total superannuation balance above $1m then the TBAR reporting would be required quarterly.

If the legislation extending the age limit for the bring-forward rule is NOT extended from 65 to 67, then the above strategy would need to be modified to reduce the amount of Withdrawal & Re-Contribution #3 (and Account-Based Pension #4) to $100,000 rather than $300,000.

Result of the strategy (first stage)

If the re-contribution strategy is implemented for Simone following the above diagram and steps, she will end up with the following two account-based pensions as at 1 July 2023:

- Account-Based Pension 1 – $300,000 ($240k taxable / $60k tax free)

- Account-Based Pension 5 – $500,000 ($500k tax free)

The actual balances above will be higher or lower depending on the earnings of the SMSF across the three years the re-contribution strategy was implemented.

By withdrawing and re-contributing $500,000 over the three-year period, Simone has reduced the future death benefits tax on her superannuation balance by $60,000 ($500,000 x 80% taxable x 15% tax).

If Simone passed away at this time, her estate would only incur $36,000 in tax on receipt of the $240k taxable component on the death benefit lump sum from Account-Based Pension 1 ($240,000 x 15%). The tax-free components ($60k from Account-Based Pension 1 and $500k from Account-Based Pension 5) are not taxable to the estate.

Moving forward, as Simone draws out more from her SMSF, the most suitable drawdown strategy would be for her to take the minimum (e.g. 5%) pension from Account-Based Pension 5, as well as the minimum from Account-Based Pension 1, with any amounts required above the minimum to also be taken from Account-Based Pension 1 to use up the pension with the highest taxable component first.

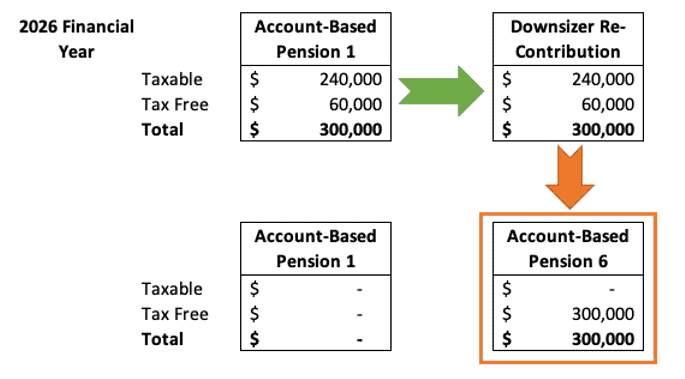

Downsizer re-contribution strategy

Continuing with our previous example, in the 2026 financial year when Simone turns

71, she decides to sell her home and re-locate to a different property. As the house has been her principal residence for more than 10 years, Simone is able to utilise the downsizer contribution to make a one-off $300,000 contribution to her SMSF.

As the new property she is purchasing is approximately the same value of the house she has sold, she still needs the $300,000 from the proceeds of the sale, so withdrawals this amount as a either a full or partial commutation, or a large pension payment from her Account-Based Pension 1.

As shown in the above diagram, Simone commences new Account-Based Pension 6 with the $300,000 downsizer contribution amount. The downsizer contribution a non-concessional contribution and is therefore made up of tax-free component.

Result of the strategy (second stage)

Upon completion of downsizer re-contribution, the final $300,000 remaining in Simone’s original 80% taxable component Account-Based Pension 1 is reduced to $0 and replaced with 100% tax-free Account-Based Pension 6. If required, Account-Based Pensions 5 & 6 could now be combined into a single 100% tax-free component pension.

Simone has reduced the future death benefits tax payable on her original Account-Based Pension 1 from $96,000 down to $0 through implementing a re-contribution strategy. This additional amount will be available to her estate to distribute to her beneficiaries.

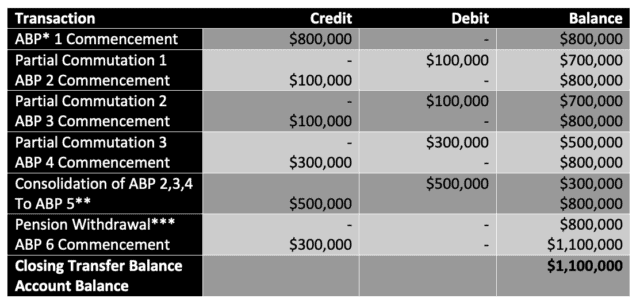

$1.6m transfer balance account implications

The only difference in regard to whether the $300,000 withdrawn from the original Account-Based Pension 1 is treated as a pension or a lump sum comes down to Simone’s pension transfer balance cap.

As Simone is unable to make further contributions to super (work test not met) and she is not going to receive a reversionary pension from a spouse, there is no real need to treat the $300,000 amount as a lump sum commutation as the debit against her $1.6m transfer balance cap is not necessarily needed.

Simone’s transaction balance account would be as follows:

Apologies to any accountants ready this for the debit and credit columns being reversed. This is how the ATO records them as you can’t have a debit prior to a credit!

*ABP = Account-Based Pension.

**The debit and credit amounts for this account consolidation are likely different due to earnings on these accounts, however whatever the figure the commutations and commencement will offset each other.

***A pension withdrawal amount is not counted as a debit amount against a person’s transfer balance account.

Re-contribution strategy rules of thumb

However, if you are in any of the following situations, you would ALWAYS preference a pension commutation (i.e. transfer balance cap debit) over extra pension drawings:

- There is a possibility you will make additional contributions in the future which would be used to fund additional pensions (transfer cap credits);

- It’s possible you will receive either a reversionary pension on the passing of your spouse or a death benefit pension from your spouse;

- You are close to your $1.6m transfer balance cap and are at risk of exceeding the $1.6m amount.

Other re-contribution strategy options

The above case study illustrates the key principals and implementation of a re-contribution strategy for an individual between the ages of 65 and 67.

In reality there are other complexities and opportunities to further adjust the ‘simple’ re-contribution strategy outlined above.

Re-contribution strategy with spouse

With the introduction of the $1.6m transfer balance caps in 2017 couples with uneven superannuation balances may have found themselves in a situation where not all of their benefits are able to be put into pension phase.

By implementing a re-contribution strategy balances between members of a couple could be made more even and therefore enable a higher proportion to be in pension phase and therefore increase the portion of exempt pension income of the SMSF.

The SMSF Association has also proposed a ‘spousal rollover’ to enable couples to more evenly distribute their superannuation balances, however in the absence of such a provision, a re-contribution strategy is likely the best option.

There is also a potential social security benefit to implementing a re-contribution strategy with a spouse where members of a couple are of different ages.

By withdrawing amounts from the older partners account and contributing to the younger spouses account who then retains their balance in accumulation phase (which is not counted for Centrelink purposes if they are under age pension age) the amount of age pension the older spouse may be eligible for can increase significantly depending on the other assets and income of the couple.

Contributions between ages 60 and 65

Although the new ‘magic window’ for a re-contribution strategy is between the ages of 65 and 67, it’s also possible for individuals between ages 60 and 65 to take advantage of a re-contribution strategy.

The key requirement to implement a re-contribution strategy if you are under the age of 65 is for you to trigger an appropriate condition of release. The key conditions of release applicable for persons between ages 60 and 65 are:

- Retirement

- Ceasing an arrangement where gainfully employed

- Permanent incapacity

- Terminal illness

The primary advantage of a re-contribution strategy if you are under age 65 is that you have more years in which you can withdrawal and re-contribute.

For example, if you retire at age 60, you could potentially trigger three $300,00 withdrawal and re-contributions at ages 60, 63 and 66 enabling a significant total of $900,000 of super benefits to be reconfigured from taxable to tax free.

At a rate of 15% tax when paid to non-dependents, these transactions could save your future beneficiaries up to $135,000 in death benefits tax!

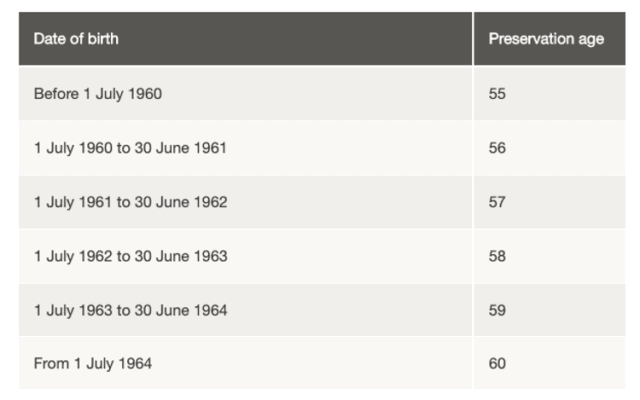

Low rate cap while under age 60 and retired

If you retires, or are forced to retire after reaching your condition of release before hitting age 60, a re-contribution strategy may still provide some benefits, for a handful of years anyway.

As shown by the following table, the preservation age is gradually increasing from 55 to 60:

This means that for anyone born after 1 July 1964, the preservation age of 60 is also the age where superannuation pensions or lump sums become non-assessable non-exempt (NANE) income, therefore this strategy will only be valid prior to the 2025 financial year.

Using our original strategy with Simone, but instead of Simone turning age 65 on 08/08/2020 and retiring, let’s say she only turned 58 (making her date of birth 08/08/1962 and her preservation age 58).

It’s also important to note the condition of release requirement for retirement under age 60 is different compared to someone over age 60. The trustee of a super fund (including an SMSF) needs to be satisfied that the person does not intend to become gainfully employed for 10 hours or more per week at that time.

As Simone, at age 58 requires at least 4% of her $800,000 SMSF balance per year for living expenses (ignoring the 50% reduction in the FY2020-21 minimum drawdown due to COVID-19), she wants to commence a pension to provide $32,000 additional income for the year.

If Simone simply commences an account-based pension (it’s not a TRIS / TTR pension as she is fully retired) and draws down the $32,000, 80% of that is taxable and reportable in her personal return for the 2021 financial year (albeit with a 15% tax offset).

Assuming Simone also received additional employment income (including accrued leave) in the financial year she retired of $20,000, her tax bill (including Medicare Levy) will be approximately $2,700.

Conversely, if Simone took a lump sum of $268,750 from her fund, of which $215,000 (80%) was taxable component up to her condition of release and re-contributed that to commence a second account-based pension, the amount of taxable component within her fund would be reduced and would save Simone approximately $1700 in additional tax for the 2020-21 financial year.

In addition, if Simone takes advantage of the 50% reduction in minimum pension drawdown requirements for 2020-21 due to COVID-19, and also takes a $16,000 lump sum from a partial commutation from her Account-Based Pension 2, she would end up with the same income of $32,000 from her SMSF with close to a nil tax bill for the 2020-21 financial year.

Assuming minimal other income for the next 2021-22 financial year and drawing the minimum 4% required pensions from her account-based pensions and after offsets, Simone would be paying nil tax again.

In the 2022-23 financial year Simone will turn 60 so any and all payments after 08/08/2022 will be NANE.

In addition, as we’ve ensured her SMSF is in 100% pension phase for the period from 08/08/2020 through to 30/06/2022 all income and capital gains are tax exempt for this period, we’ve significantly reduced the SMSF tax bill.

Re-contribution strategy and total superannuation balance

It’s important to understand that your total superannuation balance impacts the amount of non-concessional contributions you can make to your SMSF:

| Total Superannuation Balance on 30/06/2020 | Non-concessional cap available | Bring-forward period |

| Less than $1.4m | $300,000 | 3 years |

| $1.4m to $1.5m | $200,000 | 2 years |

| $1.5 to $1.6m | $100,000 | 1 year only (current) |

| More than $1.6m | $0 | Not available |

It’s also important to understand that the total superannuation balance is determined based on 30 June of the prior financial year, i.e. 30 June 2020 for the SMSF end of financial year 2021.

Using in-specie lump sums and liquidity

To effectively implement a re-contribution strategy, one key aspect that cannot be overlooked is liquidity. Your SMSF must have available cash reserves to enable a decent amount of lump sum to be paid and then re-contributed – preferably $100,000 or more.

For most SMSFs where the members are in the ‘magic window’ period of 65 to 67, this should not be a problem.

Another less appealing option, is to in-specie transfer assets out of your fund as lump sum payment(s) however, in-specie contributions going into your SMSF are limited to listed securities and business real property.

Part IVA tax avoidance with re-contribution strategies

The last known official announcement from the ATO in regard to whether they as regulator consider a super re-contribution strategy Part IVA tax avoidance was made back in August 2004.

In a media release, the ATO confirmed the following two types of re-contribution strategies acceptable:

- a person who withdraws an ETP (lump sum) from their super fund and recontributes the same or similar amount shortly after to the same fund for the purposes of commencing an allocated pension; and

- simple variations on the above strategy where the recontribution is made to a different fund — for example, the recontribution is made to a spouse’s super fund.

These recontribution strategies are legitimate because the purpose of the recontribution is clearly to create an income stream that maximises the available tax concessions but does not use them as an end in themselves.

The ATO also said Part IVA will not apply to a superannuation strategy in which:

- a person makes a large undeducted (non-concessional) contribution to their super fund before they withdraw from the same fund to effectively reduce the amount of tax payable on their subsequent lump sum ETP.

It’s important to note that the above is from a non-binding media release from the ATO and it was issued well before both the 2007 ‘Simpler Super’ changes as well as the 2017 ‘Better Super’ changes – i.e. before the $1.6m transfer balance caps were introduced.

Its recommended any advice provided in regard to re-contribution strategies include appropriate disclaimers in regards to Part IVA.

SMSF accounting and administration aspects

Correctly implementing a re-contribution strategy with your SMSF required pro-active advice as well as an SMSF accountant with the ability to assist with the administration and paperwork aspects.

The examples provided in this article are relatively simple however in the real world with most SMSFs there is more complexity. This is where quality SMSF accounting support is needed to ensure all actions of the trustees are correctly documented with relevant minutes and forms including:

- Commencement of pensions

- Partial commutations of pensions

- Lump-sum payments

- Non-concessional contributions

- Calculation and of minimum pensions

- Transfer balance cap (TBAR) reporting

- Total superannuation balance tracking

Importantly decisions to take lump sums cannot be made retrospectively. The member of the SMSF must make the election and document any lump sums at the time of or prior to the withdrawal. Ideally the trustees of the SMSF would work closely with an adviser and accountant to correctly implement a re-contribution strategy.

Estate planning importance for SMSFs

The primary reason behind a re-contribution strategy is to reduce future tax payable by beneficiaries – typically adult children – who will ultimately receive any residual super benefits when you pass away.

It’s important that you have in place a comprehensive personal estate plan in place to ensure your super ends up with the correct beneficiaries. This means your personal estate plan – including your Wills must align to your SMSFs estate plan.

Importantly your personal Will does not cover or dictate what happens to your superannuation benefits including your SMSF. For your Will to determine what happens to any of your super monies, your SMSF estate plan – typically via non-lapsing binding death benefit nominations – need to direct your super benefits to your estate.

It’s essential you liaise with an specialist estate planning solicitor who can ensure your wishes are carried out correctly when you die.

Implementing this strategy

A re-contribution strategy can be very powerful for SMSF trustees looking to grow their legacy and reduce the amount of tax their beneficiaries will pay when they decease.

If you have any questions regarding this strategy, please get in touch.

Disclaimer

The information and examples in this article are purely factual in nature and do not take into account your personal objectives, situation or needs. The information is objectively ascertainable and, therefore, does not constitute financial product advice. If you require personal advice you should consult an appropriately licensed or authorised financial adviser.