If you’ve ever typed ‘SMSF’ into a search engine, there is a very strong likelihood you’ve come across a business called esuperfund. Esuperfund is a Melbourne-based online low-cost SMSF provider. Their yearly fees are $1499, but people’s experience with this provider is mixed. As a specialist accountant with over 20 years of SMSF experience, I thought I would share my esuperfund review.

Esuperfund, like any business, exists for one reason and one reason only: To make a profit and provide a return to the owners. It’s important to understand how they make money, so some of this esuperfund review looks at their business model and how it generates revenue.

My esuperfund review

Four main things esuperfund does as part of its business model to ensure profitability:

- Channel you into default accounts and products;

- Generate revenue on accounts and products in the form of commissions;

- Outsource work back to you;

- Lower service levels;

Please understand that I don’t have a problem with esuperfund, its owners or any of the above four things. As an online SMSF provider, they’ve built a very successful business through the low-cost / low-touch model that has removed barriers to people who want to take control of their wealth via a self-managed super fund but are put off by the seemingly high fees of traditional SMSF accounting services.

What challenges me professionally is the combination of all four together. This esuperfund review provides the facts surrounding the service and some context and perspective. This review does not intend to discredit the business in any way.

To put it another way, this esuperfund review is not really about esuperfund at all. It is about enlightening current or potential SMSF trustees about the practicalities of running an SMSF and working with your service providers.

Channel you into default products

Controlling accounts that can be used makes good business sense. By controlling and restricting the inputs, you can streamline processes for efficiency, enabling cheaper service delivery. However, this is contradictory when you consider one of the major reasons people establish an SMSF in the first place is choice.

Choice is critical with SMSFs. This is not just about the choice of investments (e.g. property, shares, managed funds etc.) but of bank accounts, brokers, platforms and service providers.

I originally wrote an esuperfund review in 2015, and at the time, your choice was limited regarding bank and broker accounts. At the time of writing, esuperfund, by default, will provide you with an ANZ V2 Plus Account application as part of the SMSF establishment process. Although this account is not the worst for an SMSF, it’s also not the best SMSF bank account.

As trustee of your SMSF, you can choose any bank transaction account you like, but there is a catch. Where you choose to use a different bank account (or broker account), esuperfund cannot receive the transaction information through their system, meaning you have to provide the data and statements to esuperfund, which creates more work for you and them.

By comparison, Grow (and many other SMSF administrators) can obtain automatic direct daily data for over 20 popular SMSF bank accounts and transaction data from 50 other building societies, credit unions and banks. I’ve read comments from several esuperfund clients saying that they like the fact the transactions are fed into the esuperfund accounting system, and don’t get me wrong, it’s an important feature, but in 2023 it’s very common functionality that has been around for well over a decade.

What potential SMSF trustees need to research is whether the providers they may be forced to use suit them. Over the last 15 years since I’ve been running my own SMSF, I’ve trialled many banks, brokers and other investment providers – so I personally have a very good idea of what providers work extremely well with SMSFs.

Whether you’ve already established an SMSF or not, the challenge for many people is determining what accounts have the features and usability you need. You don’t know what you don’t know.

I recommend potential trustees speak to an experienced SMSF service provider and get their opinions. They will know what accounts will work well for their clients, and with new providers entering the market all the time (think fintech companies and neo banks), there are always more options available.

Commissions on recommended accounts

There is more than one way to catch a rabbit. Traditionally most SMSF work has been done by accountants, who either charge an hourly rate based on the time it takes to complete the work or a fixed fee basis. This is changing as more SMSF trustees utilise specialist SMSF administration providers who only offer fixed-fee packages (like we do at Grow).

Esuperfund works on a hybrid model – they charge an annual fixed fee ($1399, which is sometimes discounted for a year*) and receive commissions on some of the products their clients use. This is all disclosed in their FSG. The esuperfund FSG (November 2022 version) can be found here: Financial Services Guide. Please note that you should check the esuperfund website for the most up-to-date version, as these documents and their content change regularly.

*EXIT FEE APPLIES The following is from the July 2024 esuperfund Terms and Conditions document:

If you terminate the services of ESUPERFUND prior to having paid at least one (1) years annual compliance fee of $1,399, then an exit fee of $1399 will apply. If you terminate the services of ESUPERFUND and have paid at least one (1) years annual compliance fee of $1399 then NO exit fee will apply.

Paying commissions on financial products has been common practice across the Australian financial services industry for a long time. Large financial institutions have previously been accused of restricting the products their financial advisers can recommend to products owned by the financial institution, compromising the quality of advice provided. This was all exposed in the Banking Royal Commission. Although before and after the Royal Commission laws have been changed to reduce or eliminate commissions on financial products, legacy commission arrangements and other forms of revenue sharing are still in place with many businesses.

As part of my esuperfund review and reading their FSG document, esuperfund collects a commission on the following types of products and transactions:

- Share trades

- Bank accounts

- Term deposits

- Insurance products

- Options and other derivatives trades

The following information is taken from the “How we are Paid” section of the November 2022 Financial Services Guide (FSG) on the esuperfund website. ASIC recommends reading the FSG of any potential service provider when considering using their product or service. Understanding the additional revenue streams the business earns is a vital part of this esuperfund review.

CommSec Shares

- Commission is payable at a flat rate of 10% of the Gross Brokerage value per trade.

When you trade with Commsec under esuperfund and settle the trades into the ANZ V2 account, you pay a minimum brokerage fee of $29.95 or 0.12% for any trades over $25,000.

It’s also worth noting that although CommSec is one of Australia’s most popular online stockbroking platforms, it is also relatively expensive compared to new entrants such as Stake and SelfWealth. In some cases, by using CommSec and esuperfund, you may pay double or almost triple the brokerage fees compared to other providers.

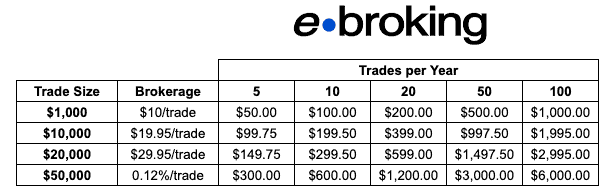

EBROKING Shares

- For Share Trades under $30,000 a commission of up to $15.23 per trade is payable to ESUPERFUND by EBROKING.

- For Share Trades over $30,000, a commission of up to 0.068% per trade is payable to ESUPERFUND by EBROKING.

The brokerage rates payable by your SMSF on share trades with EBROKING are detailed on the esuperfund website here and also shown in the table below. The commission paid to esuperfund on share trades with EBROKING is not in addition to the published brokerage rates on their website.

Depending on your investing strategy or approach, the total you pay in brokerage fees can add a significant cost to the operation of your SMSF. Even if you’re an occasional trader with a few share trades per month, you will be paying many hundreds of dollars per year in brokerage fees if you use esuperfund’s default ebroking broker.

By comparison, using a low-cost flat-fee broker like Stake or SelfWealth can save hundreds or even thousands of dollars per year in brokerage fees.

Please note although esuperfund says on their website it’s not compulsory to use their default ebroking account if you choose to use an alternative broker they make you provide the data to them and also make you code and categorise all transactions manually.

Esuperfund review – other commissions

The following is a summary of other commissions potentially received by esuperfund as part of my review of their financial services guide:

- EBROKING options: For Option Trades under $8,000, a commission of up to $9.04per trade is payable to ESUPERFUND. For Option Trades over $8,000 a commission of up to 0.103% per trade is payable to ESUPERFUND by EBROKING.

- CMC Markets CFDs: Refer to page 3 of the esuperfund FSG.

- FP Markets: Refer to page 3 of the esuperfund FSG.

- ANZ V2 Plus Bank Transaction Account: Commission is payable up to 0.60% per annum of the cash balance.

- ING Direct Bank: Commission is payable up to 0.20% per annum of the cash balance.

- AMP Term Deposits: Commission is payable up to 0.20% per annum of the cash balance.

- Zurich Australia Limited: Commission is payable up to 20% per annum of the Insurance Premium

- AIA Insurance: Commission is payable up to 27.5% per annum of the Insurance Premium.

It may be argued that the SMSF client is no worse off as the brokerage they are paying or the interest they can earn via esuperfund is not different from what they would pay or receive if they went directly to the provider. It’s also possible the actual commissions received by esuperfund are lower than the above. However, they must still disclose the above commission rates due to legacy arrangements.

One interesting point is my original esuperfund review from 2015 had the annual fees at $699. The annual fee with esuperfund is now $1399 (when not discounted). This equates to a $700 or 100% increase over these nine years. Incidentally, law changes have significantly reduced the commissions that can be paid on financial products. It’s my educated guess that esuperfund has had to adapt its fee model to ensure continued viability as its commission revenue has decreased. Once again – there is nothing wrong with this – it’s a commercial reality, and SMSF administration is a low-margin, high-volume business.

However, it is important to compare apples with apples and understand where and how esuperfund generates revenue. In some cases, the overall fees would be lower for the SMSF if they paid a higher annual SMSF administration fee to access a wider range of data-fed brokers (especially the newer, low-cost entrants such as Stake, SelfWealth and others). This is because the lower transaction fees on trading would offset the higher fixed SMSF administration fees.

I’m not the only person to shine a light on these commissions. Back in 2015, James Frost from the Financial Review penned an article entitled: How discount SMSF players are clipping your ticket

You’re the accountant with esuperfund

I’ve had many clients and colleagues use the esuperfund service, and they’ve relayed some interesting information about how it works. One comment that sticks in my mind was that “using esuperfund is like using the self-service check out at Woolies – you’re buying from them, but it’s you doing all the work”. It’s an appropriate analogy.

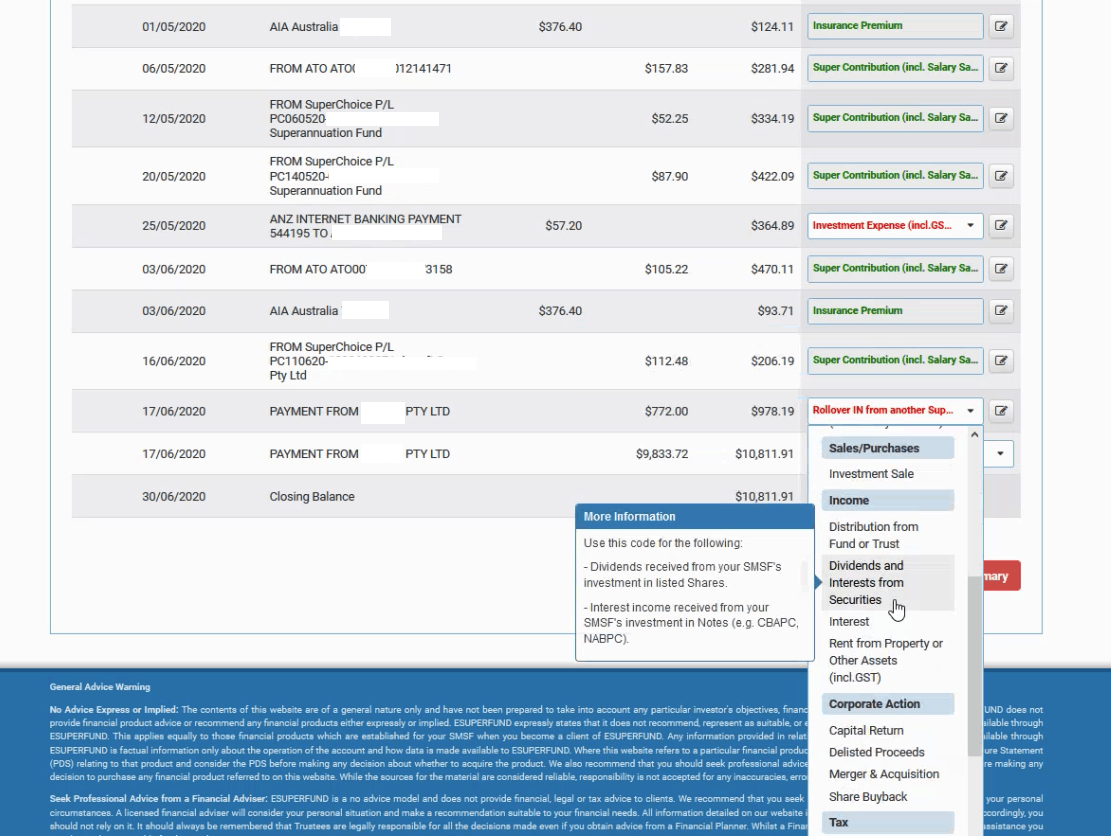

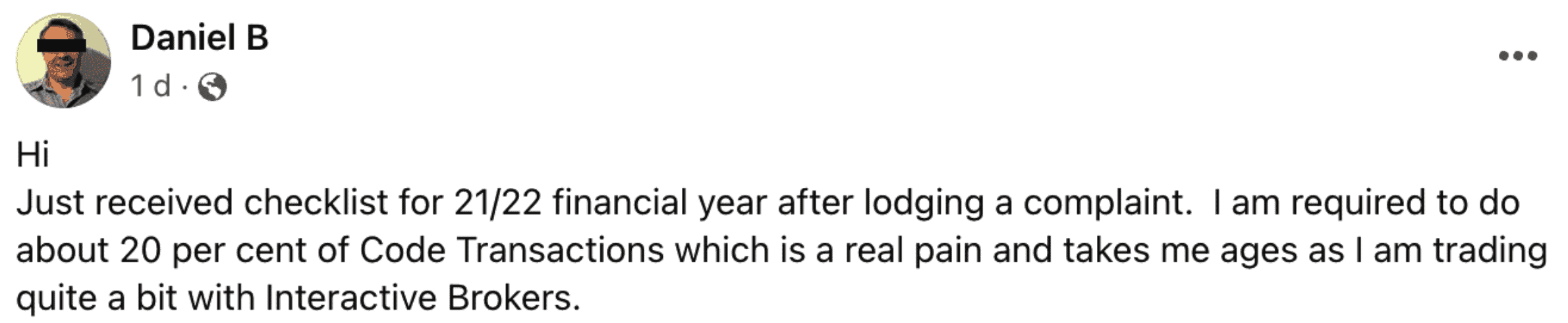

As the SMSF trustee, the esuperfund client portal requires you to categorise and code specific transactions and upload supporting documents for the auditor. This can be dangerous if significant items are incorrectly categorised, and there could be negative tax or compliance impacts if their quality control systems miss something important.

Once again, this is something that by itself is not a problem. The more work you do as a client or customer, the quicker and easier it becomes for the service provider, reducing the cost of providing the service—a fairly simple concept.

What I don’t like about it is the lack of incentive to make things easier on the SMSF trustee – it’s all about making it easier on them as a business. Although the fees paid to any accountant or administration business that looks after SMSFs are for completing annual accounts and tax returns, you are paying for the administrative burden being lifted from you onto someone else.

When conducting my esuperfund review, it became apparent that esuperfund does not lift any administrative burdens from clients. Some people like the hands-on “DIY” approach. However, most people running an SMSF for several years understand that the less time spent paper chasing on behalf of your service provider, the better. There are more important things SMSF trustees should spend their time on, such as ensuring their investment strategy is suitable and implementing it to ensure the best outcome for their situation.

I’ve been looking after hundreds of SMSF clients for over 20 years. I am happy to say that many of my clients’ ongoing compliance obligations can be looked after with virtually no paperwork or effort. This is because of the work done around automation and opening up 3rd party access to reporting and information. Their time is spent managing their SMSF investment portfolio or just living their lives – not jumping through hoops for their SMSF service provider.

While conducting this updated esuperfund review, I looked at their service differently. I no longer view esuperfund as an SMSF administration provider like Grow SMSF. I believe esuperfund can best be considered an online SMSF administration platform with audit and tax lodgement functionality attached.

So they provide more than an online SMSF accounting package but less than a full-service SMSF administration provider. It’s a unique model, and although not perfect, it’s been and is a successful and profitable business, so from an entrepreneurial perspective, I tip my hat to them.

When considering a service provider, determine the paperwork you need to organise. My opinion is that “less is more” when it comes to SMSF administration.

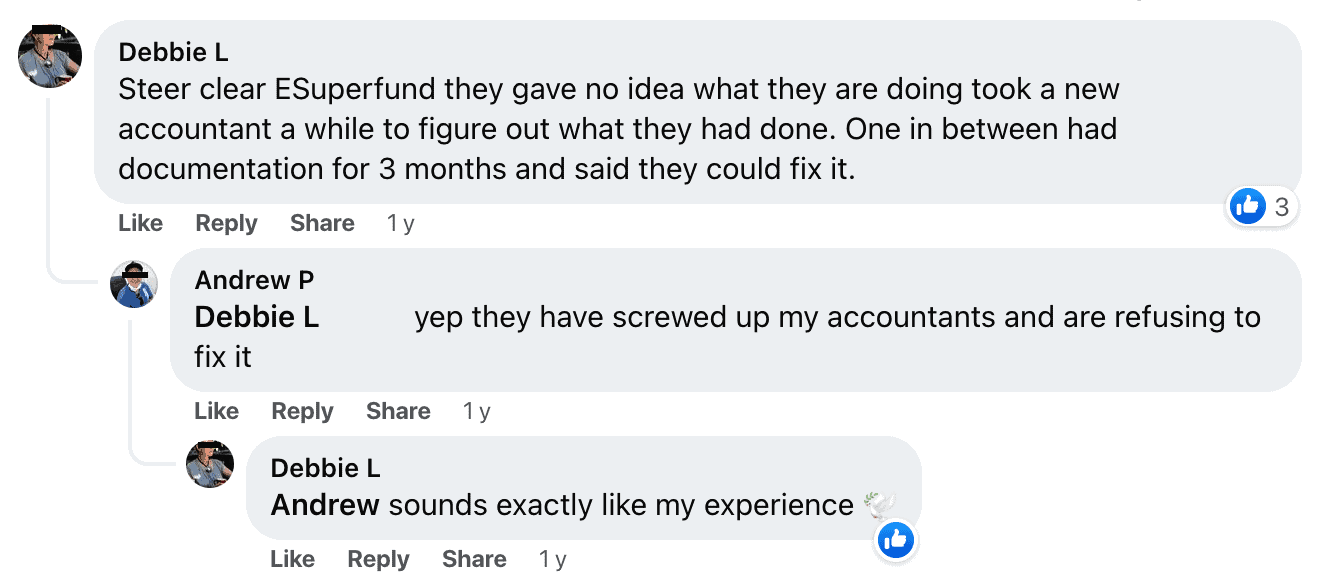

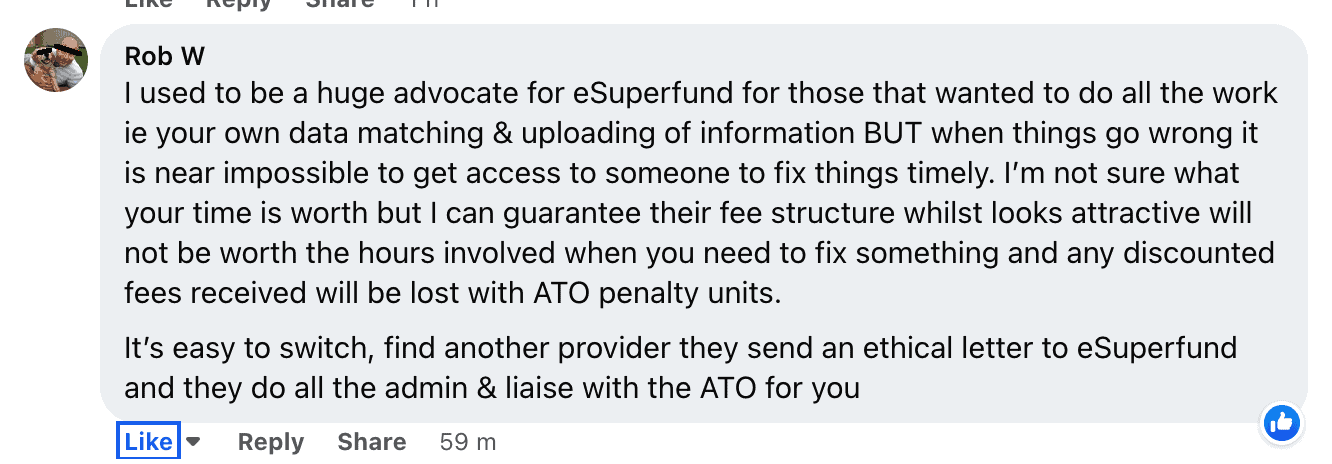

Comparatively lower service levels

A great quote from the last few years from Bryan Kramer that sticks with me is:

Can you pick up the phone and speak to someone who knows you, knows your SMSF and can provide you with the info and advice you need when you want it? Or are you forced to crawl through pages and pages of web content and FAQs?

Personalised service should be becoming easier with technology. However, many companies are guilty of letting it make their service cold and impersonal – similar to the struggles of large industry and retail superannuation funds where you are known by your member account number and balance, not as an individual. Take a minute and try to find the esuperfund phone number on their website. Take 10 minutes even. If you find it, please let me know.

SMSF trustees need to think about the difference between price (what you pay) and value (what you get). In the case of my esuperfund review experience, it’s both low price and, in my opinion, low service by design.

Once again, the esuperfund solution is designed to be self-serve. Their client portal makes you code and classify transactions and upload supporting documents for the auditor (where things are not automated). The esuperfund website has a plethora of helpful information, most of which is well-written and accurate (not 100% accurate – but this reflects the constant rule changes impacting super and SMSFs rather than esuperfund). For their service to be delivered under $1400 per year, they must make it as low-touch (for them) as possible.

A low-touch / low-service model with self-managed super funds is dangerous. It may work OK when the SMSF is relatively simple. For example, for someone, or a couple, that are in accumulation mode and want to invest in direct shares and ETFs and are not doing more than a handful of share trades per year. People who fit this category – historically, many SMSFs that use esuperfund do – have relatively simple needs. The esuperfund platform seems to cater for them quite well: bank and share trading data is automated, insurance is available via Zurich and AIA, employer contributions via Superstream etc.

esuperfund problems

In my experience, esuperfund becomes less suitable when an SMSF begins to go outside the ‘simple’ and dive into the more complex investments and strategies. I need to acknowledge my own bias at this stage. In my work, I’ve often taken on SMSF trustees who started with esuperfund but needed to move away from the esuperfund service due to experiencing either compliance issues with the ATO (normally from their own actions or inaction) or a need for specialist advice that esuperfund is not designed to provide.

Due to this, my perspective is skewed because if someone were happy with esuperfund, they would likely not have sought advice or support from me or Grow SMSF.

Here are a couple of recent examples of SMSF clients I’ve assisted who’ve had problems with esuperfund:

- SMSF had invested in a 50/50 unrelated private unit trust, which had invested in a start-up company. The auditor used by esuperfund issued an auditor contravention report (ACR) to the ATO because the trustee didn’t provide appropriate information to the auditor regarding the (legitimate) investment. We happened to look after the SMSF that owned the other 50% of the unrelated unit trust and that SMSF had no issues with the independent auditor (who happens to be one of the largest and most reputable SMSF auditors in the country). We worked with the trustee and our auditors to get the non-issue resolved. The issues could have been avoided if the trustee had spoken to someone at esuperfund or even the auditor directly to understand better what was required in terms of evidence to satisfy the auditor.

- An SMSF had a mother and son as the members and individual trustees. The mother was in the pension phase and retired and needed to access increased cash from the SMSF until a property settlement occurred. Due to the investments of the SMSF dropping during the 2020 financial year, the pension member overdrew her balance (i.e. it went under $0) and effectively chewed into her son’s member balance and became a loan to her as a member, which is a serious breach. She had contacted esuperfund to determine how much she was allowed to withdraw during the year, and they referred her to the 30 June 2019 closing balance. The auditors reported the breach (which they had to do), and the fund is now on the ATO radar for further compliance action and potentially a significant admin penalty (fine).

- A doctor and his wife used esuperfund to set up an SMSF to use a limited-recourse loan (LRBA) to purchase an investment property. They set up the SMSF, organised all the bare trust documentation, signed a contract, and paid a deposit for a property. The contract fell through, and the significant deposit was refunded into a solicitor’s trust account. The doctor decided to use the refunded deposit for a deposit on another property; however, as he couldn’t obtain any guidance from esuperfund, he ended up signing a contract in the wrong name (his own) rather than in the name of the bare trustee. The purchase was settled, and the deposit effectively became a loan to the member. The only way to unwind everything now is to sell the residential property and repay the money back to the SMSF. It’s a very expensive mistake that the trustee made, which could have easily been avoided if he could pick up the phone and speak to an SMSF specialist for guidance.

The above three are just a recent number of dozens of SMSF scenarios I’ve encountered in the last 10 years.

I’ve noticed in the last few years that the independent auditors used by esuperfund are becoming increasingly ‘trigger happy’ when lodging Auditor Contravention Reports (ACRs) to the ATO. This is not unique to esuperfund as the ATO, as the regulator is putting more pressure on auditors as they are the gatekeepers regarding SMSF compliance. This trend – which is not likely to change anytime soon – potentially puts SMSF trustees in danger where they don’t have the specialist support and guidance with their SMSF. This is especially so if the SMSF is not ‘vanilla’ regarding its investments and strategies.

Known Limitations

Like most businesses – including Grow SMSF – esuperfund is not designed to cater for all types of SMSF customers.

Some of the limitations we’ve encountered with esuperfund include:

- Inability to work with SMSF trustees where an enduring power of attorney (EPoA) is in place, for example, where someone wants to move overseas indefinitely and appoint an Australian-resident friend or family member to act as trustee/director on their behalf.

- Segregation of SMSF investment across different member ‘pools’ or separate investment strategies. Although rare, most SMSFs can accommodate the segregation of assets within an SMSF.

Please note that the above list of examples is not exclusive, and Grow SMSF, as a specialist administrator, is equipped to deal with all of the above.

Summary: esuperfund – good for some

Some people may read this article and disagree with me on my opinions. Hopefully, it will enlighten others about the practicalities of running an SMSF and what to look for with a potential service provider, which is the purpose of this unbiased esuperfund review.

Many people use esuperfund as their first provider when setting up an SMSF. This is both good and bad. It’s good as esuperfund is low cost and might enable access to an SMSF for people with lower balances. However, the downside is that when people first start an SMSF, it’s the time they need the most support.

For example, most SMSFs I take over from esuperfund have individual trustees. For many reasons not covered in this review, the best practice is to use a special purpose trustee company, and individual trustees should be by exception. Similarly, esuperfund sets the expectation that an SMSF is Do-it-Yourself – where the best outcome is always where you can tap into the specialist expertise and guidance from an SMSF specialist.

In the case of esuperfund, it is my personal opinion that for most people, there are too many compromises for the offering to be attractive to anyone but a small niche of SMSF trustees who employ a very simple, vanilla investment strategy and don’t have much need for support. This is also probably the biggest compliment I can provide in this esuperfund review: They’ve determined their niche and are successfully working it.

My esuperfund review

As part of my esuperfund review, I give them the following ratings:

- Price – 3/5

- Quality of Service – 2/5

- Communication – 2/5

- Online Functionality – 4/5

- Technical Expertise – 3/5

- Overall Rating – 3/5

My core recommendation for people considering using esuperfund for their SMSF would be to research and go in with ‘eyes wide open’. Understand what they’re paying and what’s NOT available via the esuperfund solution. Understand the esuperfund business model and how they derive their income. If in doubt, speak to an SMSF specialist adviser like me and the team at Grow.

More questions on my esuperfund review?

If you have any questions or feedback on this esuperfund review, please get in touch.

If you believe any information in this article is inaccurate and requires updating, don’t hesitate to contact Grow.