The ATO has launched a new text message alert service from February 2020 for SMSF trustees. These messages are legitimate and real and are not scams. If you are unsure please check with the accountant/administrator who lodges your SMSF return.

The most common reason the text message or email has been triggered is due to a change of details as part of the lodgement of the SMSFs annual return. If you know your SMSF return has recently been lodged with the ATO, this is likely the cause of the ATO SMS alert.

Known Issue with ESA ‘changes’ – 13 February 2020

Due to changes made by the ATO in regards to how a funds ESA (Electronic Service Address for SuperStream) are recorded in SMSF annual returns (free text field versus drop-down) there have been some errant ‘non-change’ change messages triggered when an SMSF lodged an annual return.

ATO Assistant Commissioner – SMSF Segment – Dana Fleming addressed this in a LinkedIn post here.

The ESA issue reported is being investigated as a priority and we are working on a fix to be deployed shortly to correct the error. In the interim, we have stopped the alerts incorrectly triggering to impacted funds. We will provide an update as soon as the fix has been deployed. SMSF trustees can be assured that any alerts received are being correctly triggered.

ATO messages will never ask you to reply by text or email or to provide personal information, such as your tax file number (TFN) or your personal bank account number or BSB.

Details of the ATO SMSF Change of Details Text Message

The service will issue text message alerts to trustees of a self-managed fund when any changes are made to key details relating to that fund.

This includes changes to the SMSF’s:

- financial account details

- authorised contacts

- members

- electronic service address (ESA) for Superstream (more below)

These messages are legitimate and more information can be found here:

https://www.ato.gov.au/Super/Self-managed-super-funds/In-detail/SMSF-resources/Alerts-for-changes-made-to-SMSF-information/

What does the SMSF change of details text message say?

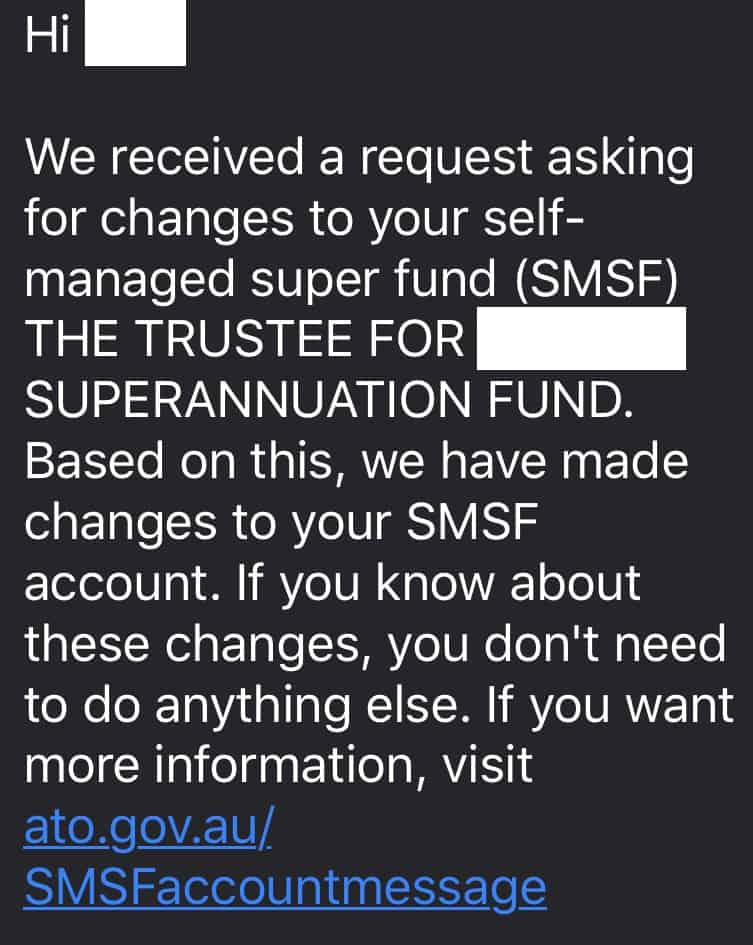

The ATO SMSF text message/SMS/email reads:

“Hi Trustee

We received a request asking for changes to your self-managed super fund (SMSF) THE TRUSTEE FOR YOUR SUPERANNUATION FUND.

Based on this, we have made changes to your SMSF account. If you know about these changes, you don’t need to do anything else. If you want more information, visit ato.gov.au/SMSFaccountmessage “

Why has the SMSF ATO SMS text message been sent?

The ATO legitimately sends these messages when the following details have been updated by an authorised contact person:

- financial account details

- authorised contacts

- members

- electronic service address (ESA) for Superstream (more below)

Importantly, any of the above details could have been updated when the most recent SMSF return has been lodged with the ATO or when a change of details has been submitted by a tax agent / accountant / administrator such as Grow SMSF.

For example, if you’ve changed the nominated bank account to receive income tax refunds from one financial year to the next (as per the SMSF annual return) this change will trigger a text message or email from the ATO when the SMSF return is lodged.

Changes to the SMSF’s electronic service address (ESA)

One common change we’ve observed with the lodgement of SMSF returns in February 2020 is that it’s triggering a change to the SMSFs nominated electronic service address, specifically for clients using Intello (and any other accountant / SMSF administrator using Class) – the SMSF Data Flow ESA with the ATO is now ‘smsfdataflow’ not ‘SMSFDATAFLOW’

This very minor change is triggering the ATO SMS and email alerts, however there is no ‘real’ change of details trustees need to be aware of.

Related articles:

Interested in setting up an SMSF?

The following pages provides more information on how you can establish an SMSF: How to set up an SMSF

If you have any questions please contact Grow SMSF.

3 comments

Julia Quill

December 20, 2022 at 7:39 am

These ATO messages are an essential check. As trustees of our SMSF, we recently received a message that helped prevent fraud from occurring!

On 8 November, the ATO processed a request to establish a self-managed super fund for my husband or make changes to our existing SMSF. The reported request was fraudulent as the trustees (my husband and myself) were appointed when the fund was set up, and there has been no change.

(Note: Original comment edited to remove any personally identifiable information)

Kris Kitto

January 13, 2023 at 1:18 pm

Thank you for sharing your experience Julia.

Everyone must keep their email and mobile number up to date with the ATO.

This enables the ATO to notify you of any changes and alert you to potentially fraudulent actions, which they did in your case.

Julia Quill

December 20, 2022 at 7:44 am

It is appreciated that the ATO screens messages and consequently can stop fraud.