Effective from the 1st of February 2012, the Australian Government deposit guarantee on bank deposits reduces from $1 million to $250,000 per customer per institution. This will have a large impact on a number of SMSF trustees who have been holding a large portion of their portfolios in cash and term deposits in the face of continued market volatility over the last few years.

How much money is covered by the FCS?

All deposits are currently guaranteed to a maximum of $1 million per customer per ADI until 1 February 2012. From 1 February 2012 the Commonwealth Government will reduce the guarantee cap to a maximum of $250,000 per customer per institution.

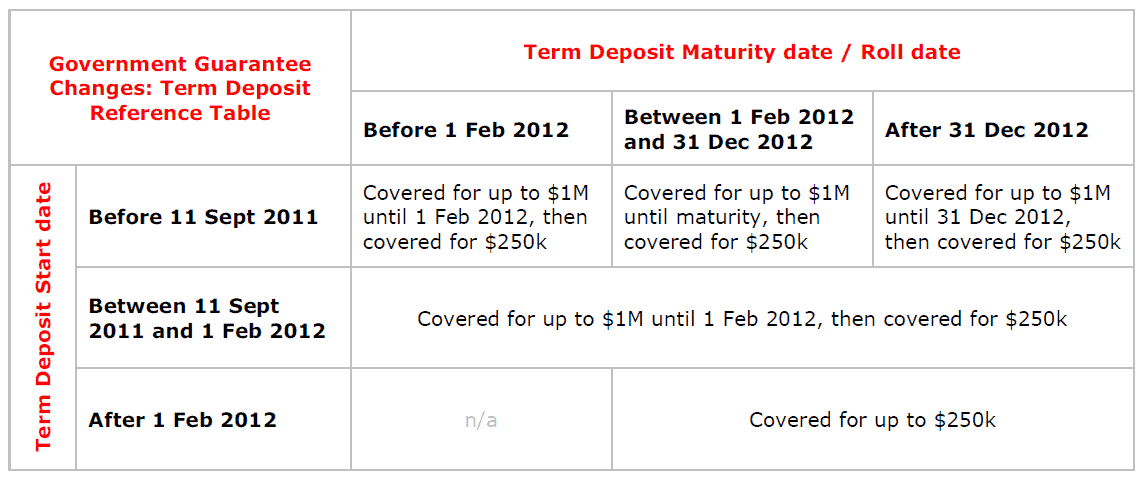

For term deposits that were opened on or before 10 September 2011, the $1 million guarantee cap will apply until 31 December 2012 or until the deposit matures, whichever occurs sooner, however if a term deposit matures and is rolled over in this period, then the new $250,000 guarantee cap will apply from the rollover date.

Transitional Arrangements

There are transitional arrangements with this change to the Government deposit guarantee depending on the commencement date and maturity date of your term deposit. They fall into three categories:

- Term deposits already in existence on 10 September 2011

- Term deposits that mature and roll over between 10 September 2011 and 1 February 2012

- Term deposits that mature and roll over after 1 February 2012

The following table confirms that applicable level of Government guarantee for these deposits:

Why has the cap been reduced from $1 million to $250,000?

The original guarantee cap, set at $1 million in October 2008, was intended as a temporary measure to assist the financial system through a particularly turbulent period. At that time, the Australian Government committed to review the settings of the FCS after three years. The new guarantee cap reflects the soundness of the Australian financial system and brings the scheme more into line with its counterparts in other countries.

How long will the new scheme guaranteeing deposits to $250,000 be in place? Will there be another revision of the guarantee cap?

The $250,000 guarantee is designed to be a permanent guarantee scheme. There is no expiry date for the new guarantee cap.

I have more than $250,000 that I want to invest in term deposits. What should I do?

You have a few options. Firstly, you could look at investing anything over and above the amount of $250,000 into an alternative asset class such as listed shares. Many blue chip Australian companies are currently paying attractive dividends, that when you take into account the franking credits, are above a 10% yield. The downside is that you need to be able to ride out any continued market volatility.

If you still desire the security and safety (and likely reduced returns) of term deposits, you are going to have to split your SMSF funds across different institutions. This is definitely not an ideal situation – you shouldn’t have to run around to multiple banks chasing the best interest rates.

In addition, investing in multiple term deposits across different banks, credit unions and building societies is going to be extremely time-consuming as any most cases you may not be an existing customer of the particular institution, meaning you will need to complete the required applications and proof of identity procedures time and time again. Another thing to consider is the increased paperwork and administration that will be required to complete your SMSF accounts.

Any questions please contact us.